Federal Reserve Economic Data: Your trusted data source since 1991

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

NOTES

Source: Coinbase

Release: Coinbase Cryptocurrencies

Units: U.S. Dollars, Not Seasonally Adjusted

Frequency: Daily, 7-Day

Notes:

All data is as of 5 PM PST.

Copyright, 2018, Coinbase.

Reproduction of Coinbase data in any form is prohibited except with the prior written permission of Coinbase.

Suggested Citation:

Coinbase, Coinbase Bitcoin [CBBTCUSD], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CBBTCUSD, May 14, 2024.

Source: Coinbase

Release: Coinbase Cryptocurrencies

Units: U.S. Dollars, Not Seasonally Adjusted

Frequency: Daily, 7-Day

Notes:

All data is as of 5 PM PST.

Copyright, 2018, Coinbase.

Reproduction of Coinbase data in any form is prohibited except with the prior written permission of Coinbase.

Suggested Citation:

Coinbase, Coinbase Ethereum [CBETHUSD], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CBETHUSD, May 14, 2024.

Source: Coinbase

Release: Coinbase Cryptocurrencies

Units: U.S. Dollars, Not Seasonally Adjusted

Frequency: Daily, 7-Day

Notes:

All data is as of 5 PM PST.

Copyright, 2018, Coinbase.

Reproduction of Coinbase data in any form is prohibited except with the prior written permission of Coinbase.

Suggested Citation:

Coinbase, Coinbase Litecoin [CBLTCUSD], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CBLTCUSD, May 14, 2024.

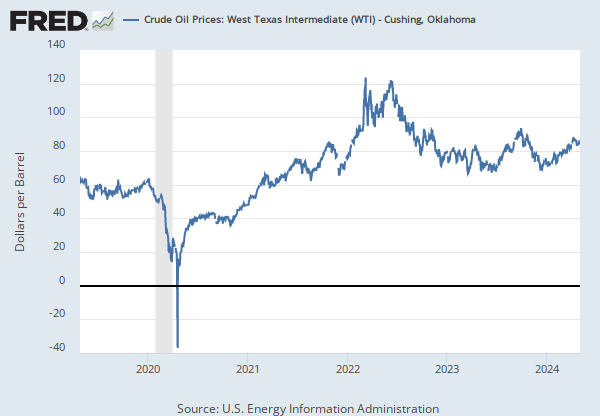

Source: U.S. Energy Information Administration

Release: Spot Prices

Units: Dollars per Barrel, Not Seasonally Adjusted

Frequency: Daily

Notes:

Definitions, Sources and Explanatory Notes

Suggested Citation:

U.S. Energy Information Administration, Crude Oil Prices: Brent - Europe [DCOILBRENTEU], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DCOILBRENTEU, May 14, 2024.

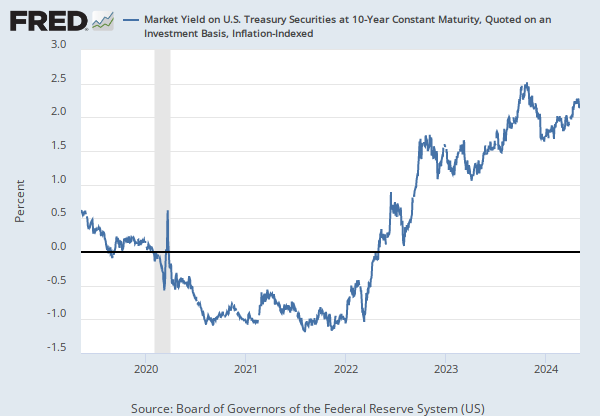

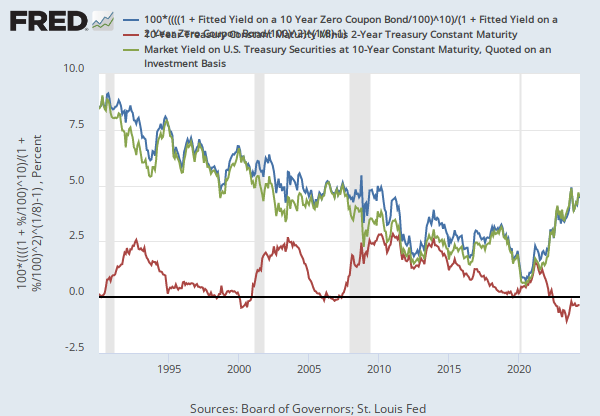

Source: Board of Governors of the Federal Reserve System (US)

Release: H.15 Selected Interest Rates

Units: Percent, Not Seasonally Adjusted

Frequency: Daily

Notes:

For further information regarding treasury constant maturity data, please refer to the H.15 Statistical Release notes and Treasury Yield Curve Methodology.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity, Quoted on an Investment Basis [DGS10], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DGS10, May 14, 2024.

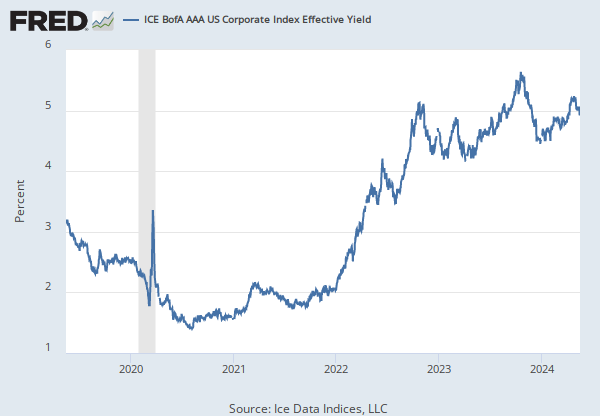

Source: Ice Data Indices, LLC

Release: ICE BofA Indices

Units: Percent, Not Seasonally Adjusted

Frequency: Daily, Close

Notes:

This data represents the effective yield of the ICE BofA US Corporate Index, which tracks the performance of US dollar denominated investment grade rated corporate debt publicly issued in the US domestic market. To qualify for inclusion in the index, securities must have an investment grade rating (based on an average of Moody's, S&P, and Fitch) and an investment grade rated country of risk (based on an average of Moody's, S&P, and Fitch foreign currency long term sovereign debt ratings). Each security must have greater than 1 year of remaining maturity, a fixed coupon schedule, and a minimum amount outstanding of $250 million. Original issue zero coupon bonds, "global" securities (debt issued simultaneously in the eurobond and US domestic bond markets), 144a securities and pay-in-kind securities, including toggle notes, qualify for inclusion in the Index. Callable perpetual securities qualify provided they are at least one year from the first call date. Fixed-to-floating rate securities also qualify provided they are callable within the fixed rate period and are at least one year from the last call prior to the date the bond transitions from a fixed to a floating rate security. DRD-eligible and defaulted securities are excluded from the Index.

ICE BofA Explains the Construction Methodology of this series as:

Index constituents are capitalization-weighted based on their current amount outstanding. With the exception of U.S. mortgage pass-throughs and U.S. structured products (ABS, CMBS and CMOs), accrued interest is calculated assuming next-day settlement. Accrued interest for U.S. mortgage pass-through and U.S. structured products is calculated assuming same-day settlement. Cash flows from bond payments that are received during the month are retained in the index until the end of the month and then are removed as part of the rebalancing. Cash does not earn any reinvestment income while it is held in the Index. The Index is rebalanced on the last calendar day of the month, based on information available up to and including the third business day before the last business day of the month. Issues that meet the qualifying criteria are included in the Index for the following month. Issues that no longer meet the criteria during the course of the month remain in the Index until the next month-end rebalancing at which point they are removed from the Index.

When the last calendar day of the month takes place on the weekend, weekend observations will occur as a result of month ending accrued interest adjustments.

Certain indices and index data included in FRED are the property of ICE Data Indices, LLC (“ICE DATA”) and used under license. ICE® IS A REGISTERED TRADEMARK OF ICE DATA OR ITS AFFILIATES AND BOFA® IS A REGISTERED TRADEMARK OF BANK OF AMERICA CORPORATION LICENSED BY BANK OF AMERICA CORPORATION AND ITS AFFILIATES (“BOFA”) AND MAY NOT BE USED WITHOUT BOFA’S PRIOR WRITTEN APPROVAL. ICE DATA, ITS AFFILIATES AND THEIR RESPECTIVE THIRD PARTY SUPPLIERS DISCLAIM ANY AND ALL WARRANTIES AND REPRESENTATIONS, EXPRESS AND/OR IMPLIED, INCLUDING ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, INCLUDING WITH REGARD TO THE INDICES, INDEX DATA AND ANY DATA INCLUDED IN, RELATED TO, OR DERIVED THEREFROM. NEITHER ICE DATA, NOR ITS AFFILIATES OR THEIR RESPECTIVE THIRD PARTY PROVIDERS SHALL BE SUBJECT TO ANY DAMAGES OR LIABILITY WITH RESPECT TO THE ADEQUACY, ACCURACY, TIMELINESS OR COMPLETENESS OF THE INDICES OR THE INDEX DATA OR ANY COMPONENT THEREOF. THE INDICES AND INDEX DATA AND ALL COMPONENTS THEREOF ARE PROVIDED ON AN “AS IS” BASIS AND YOUR USE IS AT YOUR OWN RISK. ICE DATA, ITS AFFILIATES AND THEIR RESPECTIVE THIRD PARTY SUPPLIERS DO NOT SPONSOR, ENDORSE, OR RECOMMEND FRED, OR ANY OF ITS PRODUCTS OR SERVICES.

Copyright, 2023, ICE Data Indices. Reproduction of this data in any form is prohibited except with the prior written permission of ICE Data Indices.

The end of day Index values, Index returns, and Index statistics (“Top Level Data”) are being provided for your internal use only and you are not authorized or permitted to publish, distribute or otherwise furnish Top Level Data to any third-party without prior written approval of ICE Data.

Neither ICE Data, its affiliates nor any of its third party suppliers shall have any liability for the accuracy or completeness of the Top Level Data furnished through FRED, or for delays, interruptions or omissions therein nor for any lost profits, direct, indirect, special or consequential damages.

The Top Level Data is not investment advice and a reference to a particular investment or security, a credit rating or any observation concerning a security or investment provided in the Top Level Data is not a recommendation to buy, sell or hold such investment or security or make any other investment decisions.

You shall not use any Indices as a reference index for the purpose of creating financial products (including but not limited to any exchange-traded fund or other passive index-tracking fund, or any other financial instrument whose objective or return is linked in any way to any Index) without prior written approval of ICE Data.

ICE Data, their affiliates or their third party suppliers have exclusive proprietary rights in the Top Level Data and any information and software received in connection therewith.

You shall not use or permit anyone to use the Top Level Data for any unlawful or unauthorized purpose.

Access to the Top Level Data is subject to termination in the event that any agreement between FRED and ICE Data terminates for any reason.

ICE Data may enforce its rights against you as the third-party beneficiary of the FRED Services Terms of Use, even though ICE Data is not a party to the FRED Services Terms of Use.

The FRED Services Terms of Use, including but limited to the limitation of liability, indemnity and disclaimer provisions, shall extend to third party suppliers.

Suggested Citation:

Ice Data Indices, LLC, ICE BofA US Corporate Index Effective Yield [BAMLC0A0CMEY], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/BAMLC0A0CMEY, May 14, 2024.

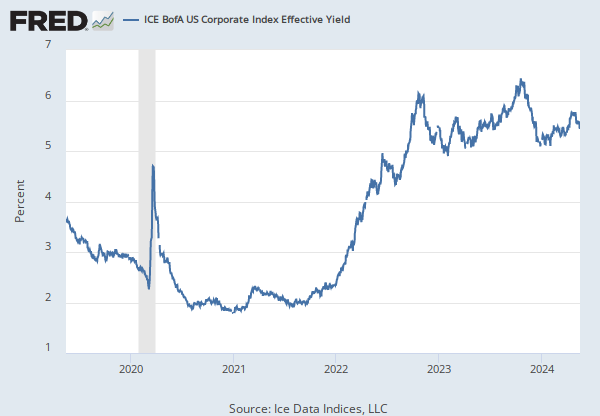

Source: Ice Data Indices, LLC

Release: ICE BofA Indices

Units: Percent, Not Seasonally Adjusted

Frequency: Daily, Close

Notes:

This data represents the effective yield of the ICE BofA US High Yield Index, which tracks the performance of US dollar denominated below investment grade rated corporate debt publicly issued in the US domestic market. To qualify for inclusion in the index, securities must have a below investment grade rating (based on an average of Moody's, S&P, and Fitch) and an investment grade rated country of risk (based on an average of Moody's, S&P, and Fitch foreign currency long term sovereign debt ratings). Each security must have greater than 1 year of remaining maturity, a fixed coupon schedule, and a minimum amount outstanding of $100 million. Original issue zero coupon bonds, "global" securities (debt issued simultaneously in the eurobond and US domestic bond markets), 144a securities and pay-in-kind securities, including toggle notes, qualify for inclusion in the Index. Callable perpetual securities qualify provided they are at least one year from the first call date. Fixed-to-floating rate securities also qualify provided they are callable within the fixed rate period and are at least one year from the last call prior to the date the bond transitions from a fixed to a floating rate security. DRD-eligible and defaulted securities are excluded from the Index.

ICE BofA Explains the Construction Methodology of this series as:

Index constituents are capitalization-weighted based on their current amount outstanding. With the exception of U.S. mortgage pass-throughs and U.S. structured products (ABS, CMBS and CMOs), accrued interest is calculated assuming next-day settlement. Accrued interest for U.S. mortgage pass-through and U.S. structured products is calculated assuming same-day settlement. Cash flows from bond payments that are received during the month are retained in the index until the end of the month and then are removed as part of the rebalancing. Cash does not earn any reinvestment income while it is held in the Index. The Index is rebalanced on the last calendar day of the month, based on information available up to and including the third business day before the last business day of the month. Issues that meet the qualifying criteria are included in the Index for the following month. Issues that no longer meet the criteria during the course of the month remain in the Index until the next month-end rebalancing at which point they are removed from the Index.

When the last calendar day of the month takes place on the weekend, weekend observations will occur as a result of month ending accrued interest adjustments.

Certain indices and index data included in FRED are the property of ICE Data Indices, LLC (“ICE DATA”) and used under license. ICE® IS A REGISTERED TRADEMARK OF ICE DATA OR ITS AFFILIATES AND BOFA® IS A REGISTERED TRADEMARK OF BANK OF AMERICA CORPORATION LICENSED BY BANK OF AMERICA CORPORATION AND ITS AFFILIATES (“BOFA”) AND MAY NOT BE USED WITHOUT BOFA’S PRIOR WRITTEN APPROVAL. ICE DATA, ITS AFFILIATES AND THEIR RESPECTIVE THIRD PARTY SUPPLIERS DISCLAIM ANY AND ALL WARRANTIES AND REPRESENTATIONS, EXPRESS AND/OR IMPLIED, INCLUDING ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, INCLUDING WITH REGARD TO THE INDICES, INDEX DATA AND ANY DATA INCLUDED IN, RELATED TO, OR DERIVED THEREFROM. NEITHER ICE DATA, NOR ITS AFFILIATES OR THEIR RESPECTIVE THIRD PARTY PROVIDERS SHALL BE SUBJECT TO ANY DAMAGES OR LIABILITY WITH RESPECT TO THE ADEQUACY, ACCURACY, TIMELINESS OR COMPLETENESS OF THE INDICES OR THE INDEX DATA OR ANY COMPONENT THEREOF. THE INDICES AND INDEX DATA AND ALL COMPONENTS THEREOF ARE PROVIDED ON AN “AS IS” BASIS AND YOUR USE IS AT YOUR OWN RISK. ICE DATA, ITS AFFILIATES AND THEIR RESPECTIVE THIRD PARTY SUPPLIERS DO NOT SPONSOR, ENDORSE, OR RECOMMEND FRED, OR ANY OF ITS PRODUCTS OR SERVICES.

Copyright, 2023, ICE Data Indices. Reproduction of this data in any form is prohibited except with the prior written permission of ICE Data Indices.

The end of day Index values, Index returns, and Index statistics (“Top Level Data”) are being provided for your internal use only and you are not authorized or permitted to publish, distribute or otherwise furnish Top Level Data to any third-party without prior written approval of ICE Data.

Neither ICE Data, its affiliates nor any of its third party suppliers shall have any liability for the accuracy or completeness of the Top Level Data furnished through FRED, or for delays, interruptions or omissions therein nor for any lost profits, direct, indirect, special or consequential damages.

The Top Level Data is not investment advice and a reference to a particular investment or security, a credit rating or any observation concerning a security or investment provided in the Top Level Data is not a recommendation to buy, sell or hold such investment or security or make any other investment decisions.

You shall not use any Indices as a reference index for the purpose of creating financial products (including but not limited to any exchange-traded fund or other passive index-tracking fund, or any other financial instrument whose objective or return is linked in any way to any Index) without prior written approval of ICE Data.

ICE Data, their affiliates or their third party suppliers have exclusive proprietary rights in the Top Level Data and any information and software received in connection therewith.

You shall not use or permit anyone to use the Top Level Data for any unlawful or unauthorized purpose.

Access to the Top Level Data is subject to termination in the event that any agreement between FRED and ICE Data terminates for any reason.

ICE Data may enforce its rights against you as the third-party beneficiary of the FRED Services Terms of Use, even though ICE Data is not a party to the FRED Services Terms of Use.

The FRED Services Terms of Use, including but limited to the limitation of liability, indemnity and disclaimer provisions, shall extend to third party suppliers.

Suggested Citation:

Ice Data Indices, LLC, ICE BofA US High Yield Index Effective Yield [BAMLH0A0HYM2EY], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/BAMLH0A0HYM2EY, May 14, 2024.

Source: Ice Data Indices, LLC

Release: ICE BofA Indices

Units: Percent, Not Seasonally Adjusted

Frequency: Daily

Notes:

This data represents the effective yield of the ICE BofA Emerging Markets Corporate Plus Index, which tracks the performance of US dollar (USD) and Euro denominated emerging markets non-sovereign debt publicly issued within the major domestic and Eurobond markets. To qualify for inclusion in the index, the issuer of debt must have risk exposure to countries other than members of the FX G10 (US, Japan, New Zealand, Australia, Canada, Sweden, UK, Switzerland, Norway, and Euro Currency Members), all Western European countries, and territories of the US and Western European countries. Each security must also be denominated in USD or Euro with a time to maturity greater than 1 year and have a fixed coupon. For inclusion in the index, investment grade rated bonds of qualifying issuers must have at least 250 million (Euro or USD) in outstanding face value, and below investment grade rated bonds must have at least 100 million (Euro or USD) in outstanding face value. The index includes corporate and quasi-government debt of qualifying countries, but excludes sovereign and supranational debt. Other types of securities acceptable for inclusion in this index are: original issue zero coupon bonds, "global" securities (debt issued in the US domestic bond markets as well the Eurobond Market simultaneously), 144a securities, pay-in-kind securities (includes toggle notes), callable perpetual securities (qualify if they are at least one year from the first call date), fixed-to-floating rate securities (qualify if the securities are callable within the fixed rate period and are at least one year from the last call prior to the date the bond transitions from a fixed to a floating rate security). Defaulted securities are excluded from the Index.

ICE BofA Explains the Construction Methodology of this series as:

Index constituents are capitalization-weighted based on their current amount outstanding. With the exception of US mortgage pass-throughs and US structured products (ABS, CMBS and CMOs), accrued interest is calculated assuming next-day settlement. Accrued interest for US mortgage pass-through and US structured products is calculated assuming same-day settlement. Cash flows from bond payments that are received during the month are retained in the index until the end of the month and then are removed as part of the rebalancing. Cash does not earn any reinvestment income while it is held in the Index. The Index is rebalanced on the last calendar day of the month, based on information available up to and including the third business day before the last business day of the month. Issues that meet the qualifying criteria are included in the Index for the following month. Issues that no longer meet the criteria during the course of the month remain in the Index until the next month-end rebalancing at which point they are removed from the Index.

When the last calendar day of the month takes place on the weekend, weekend observations will occur as a result of month ending accrued interest adjustments.

Certain indices and index data included in FRED are the property of ICE Data Indices, LLC (“ICE DATA”) and used under license. ICE® IS A REGISTERED TRADEMARK OF ICE DATA OR ITS AFFILIATES AND BOFA® IS A REGISTERED TRADEMARK OF BANK OF AMERICA CORPORATION LICENSED BY BANK OF AMERICA CORPORATION AND ITS AFFILIATES (“BOFA”) AND MAY NOT BE USED WITHOUT BOFA’S PRIOR WRITTEN APPROVAL. ICE DATA, ITS AFFILIATES AND THEIR RESPECTIVE THIRD PARTY SUPPLIERS DISCLAIM ANY AND ALL WARRANTIES AND REPRESENTATIONS, EXPRESS AND/OR IMPLIED, INCLUDING ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, INCLUDING WITH REGARD TO THE INDICES, INDEX DATA AND ANY DATA INCLUDED IN, RELATED TO, OR DERIVED THEREFROM. NEITHER ICE DATA, NOR ITS AFFILIATES OR THEIR RESPECTIVE THIRD PARTY PROVIDERS SHALL BE SUBJECT TO ANY DAMAGES OR LIABILITY WITH RESPECT TO THE ADEQUACY, ACCURACY, TIMELINESS OR COMPLETENESS OF THE INDICES OR THE INDEX DATA OR ANY COMPONENT THEREOF. THE INDICES AND INDEX DATA AND ALL COMPONENTS THEREOF ARE PROVIDED ON AN “AS IS” BASIS AND YOUR USE IS AT YOUR OWN RISK. ICE DATA, ITS AFFILIATES AND THEIR RESPECTIVE THIRD PARTY SUPPLIERS DO NOT SPONSOR, ENDORSE, OR RECOMMEND FRED, OR ANY OF ITS PRODUCTS OR SERVICES.

Copyright, 2023, ICE Data Indices. Reproduction of this data in any form is prohibited except with the prior written permission of ICE Data Indices.

The end of day Index values, Index returns, and Index statistics (“Top Level Data”) are being provided for your internal use only and you are not authorized or permitted to publish, distribute or otherwise furnish Top Level Data to any third-party without prior written approval of ICE Data.

Neither ICE Data, its affiliates nor any of its third party suppliers shall have any liability for the accuracy or completeness of the Top Level Data furnished through FRED, or for delays, interruptions or omissions therein nor for any lost profits, direct, indirect, special or consequential damages.

The Top Level Data is not investment advice and a reference to a particular investment or security, a credit rating or any observation concerning a security or investment provided in the Top Level Data is not a recommendation to buy, sell or hold such investment or security or make any other investment decisions.

You shall not use any Indices as a reference index for the purpose of creating financial products (including but not limited to any exchange-traded fund or other passive index-tracking fund, or any other financial instrument whose objective or return is linked in any way to any Index) without prior written approval of ICE Data.

ICE Data, their affiliates or their third party suppliers have exclusive proprietary rights in the Top Level Data and any information and software received in connection therewith.

You shall not use or permit anyone to use the Top Level Data for any unlawful or unauthorized purpose.

Access to the Top Level Data is subject to termination in the event that any agreement between FRED and ICE Data terminates for any reason.

ICE Data may enforce its rights against you as the third-party beneficiary of the FRED Services Terms of Use, even though ICE Data is not a party to the FRED Services Terms of Use.

The FRED Services Terms of Use, including but limited to the limitation of liability, indemnity and disclaimer provisions, shall extend to third party suppliers.

Suggested Citation:

Ice Data Indices, LLC, ICE BofA Emerging Markets Corporate Plus Index Effective Yield [BAMLEMCBPIEY], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/BAMLEMCBPIEY, May 14, 2024.

Source: S&P Dow Jones Indices LLC

Release: Standard & Poors

Units: Index, Not Seasonally Adjusted

Frequency: Daily, Close

Notes:

The observations for the S&P 500 represent the daily index value at market close. The market typically closes at 4 PM ET, except for holidays when it sometimes closes early.

The Federal Reserve Bank of St. Louis and S&P Dow Jones Indices LLC have reached a new agreement on the use of Standard & Poors and Dow Jones Averages series in FRED. FRED and its associated services will include 10 years of daily history for Standard & Poors and Dow Jones Averages series.

The S&P 500 is regarded as a gauge of the large cap U.S. equities market. The index includes 500 leading companies in leading industries of the U.S. economy, which are publicly held on either the NYSE or NASDAQ, and covers 75% of U.S. equities. Since this is a price index and not a total return index, the S&P 500 index here does not contain dividends.

Copyright © 2016, S&P Dow Jones Indices LLC. All rights reserved. Reproduction of S&P 500 in any form is prohibited except with the prior written permission of S&P Dow Jones Indices LLC ("S&P"). S&P does not guarantee the accuracy, adequacy, completeness or availability of any information and is not responsible for any errors or omissions, regardless of the cause or for the results obtained from the use of such information. S&P DISCLAIMS ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE. In no event shall S&P be liable for any direct, indirect, special or consequential damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with subscriber's or others' use of S&P 500.

Permission to reproduce S&P 500 can be requested from index_services@spdji.com. More contact details are available here, including phone numbers for all regional offices.

Suggested Citation:

S&P Dow Jones Indices LLC, S&P 500 [SP500], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/SP500, May 14, 2024.

Source: Board of Governors of the Federal Reserve System (US)

Release: H.10 Foreign Exchange Rates

Units: Index Jan 2006=100, Not Seasonally Adjusted

Frequency: Daily

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Nominal Advanced Foreign Economies U.S. Dollar Index [DTWEXAFEGS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DTWEXAFEGS, May 14, 2024.

Source: Chicago Board Options Exchange

Release: CBOE Market Statistics

Units: Index, Not Seasonally Adjusted

Frequency: Daily, Close

Notes:

VIX measures market expectation of near term volatility conveyed by stock index option prices. Copyright, 2016, Chicago Board Options Exchange, Inc. Reprinted with permission.

Suggested Citation:

Chicago Board Options Exchange, CBOE Volatility Index: VIX [VIXCLS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/VIXCLS, May 14, 2024.

RELEASE TABLES

RELATED DATA AND CONTENT

Data Suggestions Based On Your Search

Content Suggestions

Other Formats

Crude Oil Prices: Brent - Europe

Annual, Not Seasonally Adjusted Monthly, Not Seasonally Adjusted Weekly, Not Seasonally AdjustedMarket Yield on U.S. Treasury Securities at 10-Year Constant Maturity, Quoted on an Investment Basis

Annual, Not Seasonally Adjusted Monthly, Not Seasonally Adjusted Weekly, Not Seasonally AdjustedNominal Advanced Foreign Economies U.S. Dollar Index

Index 2006=100, Annual, Not Seasonally Adjusted Monthly, Not Seasonally Adjusted