Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Notes

Source: Board of Governors of the Federal Reserve System (US)

Release: Interest Rate on Reserve Balances

Units: Percent, Not Seasonally Adjusted

Frequency: Daily, 7-Day

Notes:

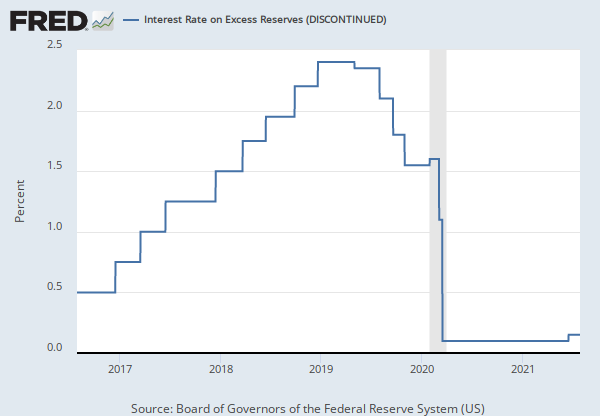

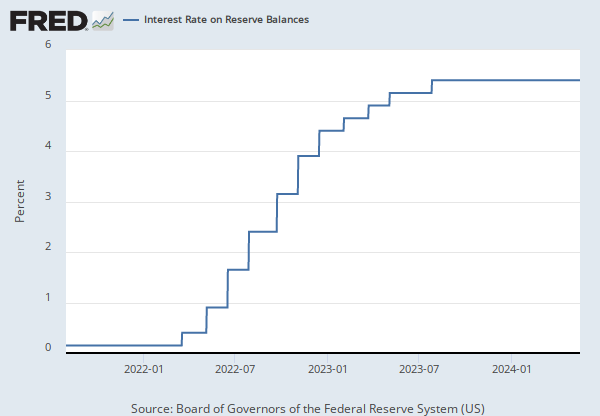

Starting July 29, 2021, the interest rate on excess reserves (IOER) and the interest rate on required reserves (IORR) were replaced with a single rate, the interest rate on reserve balances (IORB). See the source's announcement for more details.

The interest rate on reserve balances (IORB rate) is the rate of interest that the Federal Reserve pays on balances maintained by or on behalf of eligible institutions in master accounts at Federal Reserve Banks. The interest rate is set by the Board of Governors, and it is an important tool of monetary policy.

See Policy Tools and the IORB FAQs for more information.

For questions on FRED functionality, please contact us here.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Interest Rate on Reserve Balances (IORB Rate) [IORB], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/IORB, .

Source: Federal Reserve Bank of New York

Release: Federal Funds Data

Units: Percent, Not Seasonally Adjusted

Frequency: Daily

Notes:

For additional historical federal funds rate data, please see Daily Federal Funds Rate from 1928-1954.

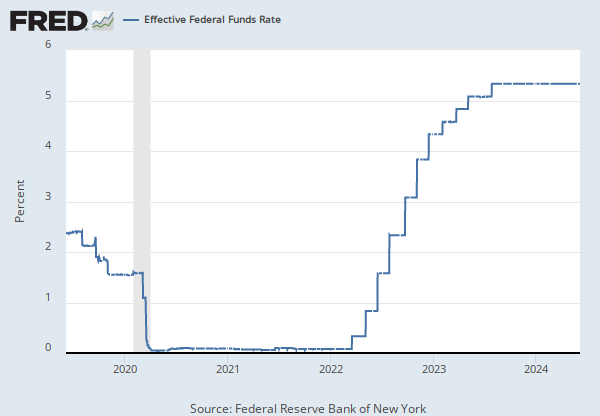

The federal funds market consists of domestic unsecured borrowings in U.S. dollars by depository institutions from other depository institutions and certain other entities, primarily government-sponsored enterprises.

The effective federal funds rate (EFFR) is calculated as a volume-weighted median of overnight federal funds transactions reported in the FR 2420 Report of Selected Money Market Rates.

For more information, visit the Federal Reserve Bank of New York.

Suggested Citation:

Federal Reserve Bank of New York, Effective Federal Funds Rate [EFFR], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/EFFR, .

Source: Federal Reserve Bank of New York

Release: Temporary Open Market Operations

Units: Percent, Not Seasonally Adjusted

Frequency: Daily

Notes:

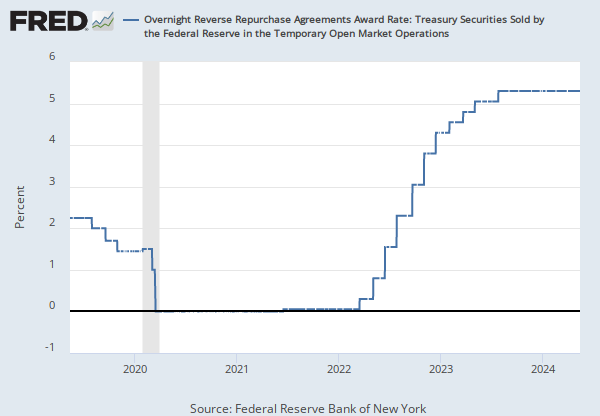

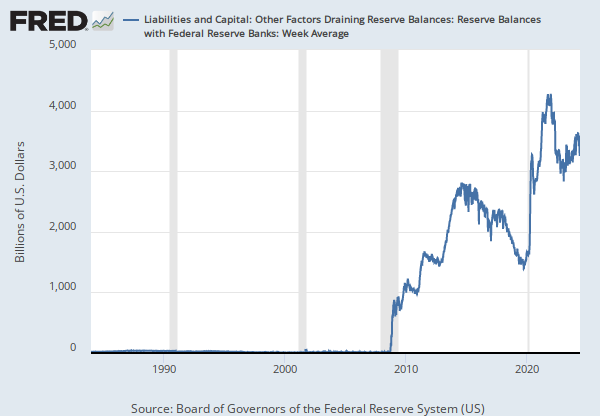

The award rate is the rate given to all accepted propositions for the collateral type reported by the New York Fed as part of the Temporary Open Market Operations.

Temporary open market operations involve short-term repurchase and reverse repurchase agreements that are designed to temporarily add or drain reserves available to the banking system and influence day-to-day trading in the federal funds market.

A reverse repurchase agreement (known as reverse repo or RRP) is a transaction in which the New York Fed under the authorization and direction of the Federal Open Market Committee sells a security to an eligible counterparty with an agreement to repurchase that same security at a specified price at a specific time in the future. For these transactions, eligible securities are U.S. Treasury instruments.

See FAQs for more information.

Suggested Citation:

Federal Reserve Bank of New York, Overnight Reverse Repurchase Agreements Award Rate [RRPONTSYAWARD], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/RRPONTSYAWARD, .

Source: Board of Governors of the Federal Reserve System (US)

Release: H.15 Selected Interest Rates

Units: Percent, Not Seasonally Adjusted

Frequency: Daily

Notes:

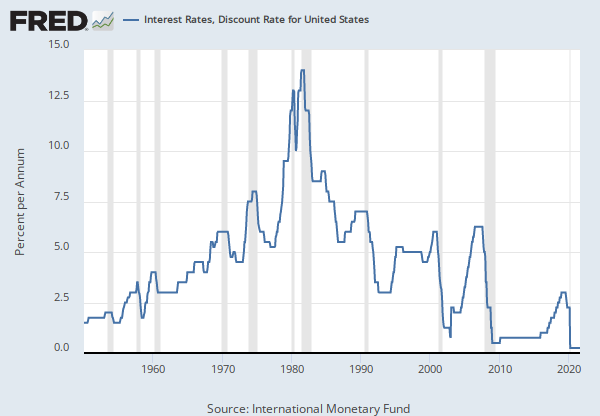

This data represent rate charged for discounts made and advances extended under the Federal Reserve's primary credit discount window program, which became effective January 9, 2003.

Primary credit is available to generally sound depository institutions at a rate set relative to the Federal Open Market Committee's (FOMC) target range for the federal funds rate. Depository institutions are not required to seek alternative sources of funds before requesting advances of primary credit. Primary credit may be used for any purpose, including financing the sale of federal funds. By making funds readily available at the primary credit rate the primary credit program complements open market operations in the implementation of monetary policy.

Reserve Banks ordinarily do not require depository institutions to provide reasons for requesting very short-term primary credit. Rather, borrowers are asked to provide only the minimum information necessary to process a loan, usually the amount and term of the loan.

This rate replaces that for adjustment credit, which was discontinued after January 8, 2003. For further information, see Board of Governor's announcement. The rate reported is that for the Federal Reserve Bank of New York.

For questions on the data, please contact the data source. For questions on FRED functionality, please contact us here.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Discount Window Primary Credit Rate [DPCREDIT], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DPCREDIT, .

Release Tables

Related Data and Content

Data Suggestions Based On Your Search

Content Suggestions

Other Formats

Related Categories

Releases

Tags

Permalink/Embed

modal open, choose link customization options

Select automatic updates to the data or a static time frame. All data are subject to revision.