Federal Reserve Economic Data

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Notes

Source: Nasdaq, Inc.

Release: Nasdaq Daily Index Data

Units: Index Feb 5, 1971=100, Not Seasonally Adjusted

Frequency: Daily, Close

Notes:

The observations for the NASDAQ Composite Index represent the daily index value at market close. The market typically closes at 4 PM ET, except for holidays when it sometimes closes early.

The NASDAQ Composite Index is a market capitalization weighted index with more than 3000 common equities listed on the NASDAQ Stock Market. The types of securities in the index include American depositary receipts (ADRs), common stocks, real estate investment trusts (REITs), and tracking stocks. The index includes all NASDAQ listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds (ETFs) or debentures.

Copyright © 2016, NASDAQ OMX Group, Inc.

Suggested Citation:

Nasdaq, Inc., NASDAQ Composite Index [NASDAQCOM], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/NASDAQCOM, .

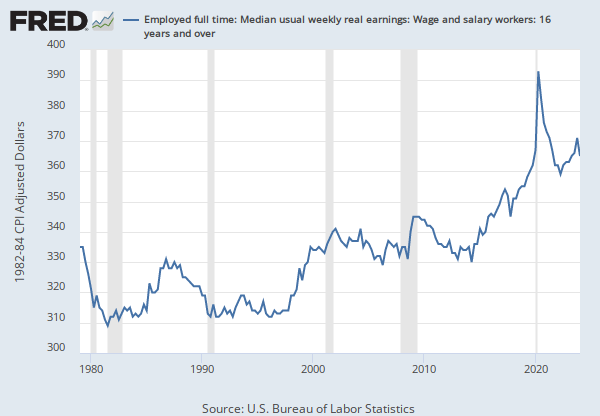

Source: U.S. Bureau of Labor Statistics

Release: Employment Situation

Units: Dollars per Hour, Seasonally Adjusted

Frequency: Monthly

Notes:

The series comes from the 'Current Employment Statistics (Establishment Survey).'

The source code is: CES0500000003

The Average Hourly Earnings of All Private Employees is a measure of the average hourly earnings of all private employees on a “gross” basis, including premium pay for overtime and late-shift work. These differ from wage rates in that average hourly earnings measure the actual return to a worker for a set period of time, rather than the amount contracted for a unit of work, the wage rate. This measure excludes benefits, irregular bonuses, retroactive pay, and payroll taxes paid by the employer.

Average Hourly Earnings are collected in the Current Employment Statistics (CES) program and published by the BLS. It is provided on a monthly basis, so this data is used in part by macroeconomists as an initial economic indicator of current trends. Progressions in earnings specifically help policy makers understand some of the pressures driving inflation.

It is important to note that this series measures the average hourly earnings of the pool of workers in each period. Thus, changes in average hourly earnings can be due to either changes in the set of workers observed in a given period, or due to changes in earnings. For instance, in recessions that lead to the disproportionate increase of unemployment in lower-wage jobs, average hourly earnings can increase due to changes in the pool of workers rather than due to the widespread increase of hourly earnings at the worker-level.

For more information, see:

U.S. Bureau of Labor Statistics, CES Overview

U.S. Bureau of Labor Statistics, BLS Handbook of Methods: Chapter 2. Employment, Hours, and Earnings from the Establishment Survey

Suggested Citation:

U.S. Bureau of Labor Statistics, Average Hourly Earnings of All Employees, Total Private [CES0500000003], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CES0500000003, .

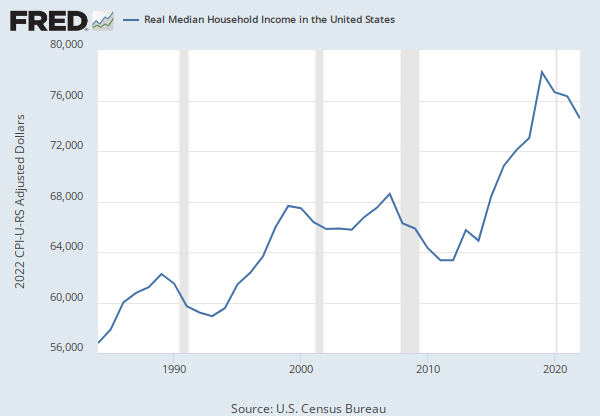

Source: U.S. Census Bureau

Release: Income and Poverty in the United States

Units: Current Dollars, Not Seasonally Adjusted

Frequency: Annual

Notes:

Household data are collected as of March.

As stated in the Census's "Source and Accuracy of Estimates for Income, Poverty, and Health Insurance Coverage in the United States: 2011" (http://www.census.gov/hhes/www/p60_243sa.pdf):

Estimation of Median Incomes. The Census Bureau has changed the methodology for computing median income over time. The Census Bureau has computed medians using either Pareto interpolation or linear interpolation. Currently, we are using linear interpolation to estimate all medians. Pareto interpolation assumes a decreasing density of population within an income interval, whereas linear interpolation assumes a constant density of population within an income interval. The Census Bureau calculated estimates of median income and associated standard errors for 1979 through 1987 using Pareto interpolation if the estimate was larger than $20,000 for people or $40,000 for families and households. This is because the width of the income interval containing the estimate is greater than $2,500.

We calculated estimates of median income and associated standard errors for 1976, 1977, and 1978 using Pareto interpolation if the estimate was larger than $12,000 for people or $18,000 for families and households. This is because the width of the income interval containing the estimate is greater than $1,000. All other estimates of median income and associated standard errors for 1976 through 2011 (2012 ASEC) and almost all of the estimates of median income and associated standard errors for 1975 and earlier were calculated using linear interpolation.

Thus, use caution when comparing median incomes above $12,000 for people or $18,000 for families and households for different years. Median incomes below those levels are more comparable from year to year since they have always been calculated using linear interpolation. For an indication of the comparability of medians calculated using Pareto interpolation with medians calculated using linear interpolation, see Series P-60, Number 114, Money Income in 1976 of Families and Persons in the United States (www2.census.gov/prod2/popscan/p60-114.pdf).

Suggested Citation:

U.S. Census Bureau, Median Household Income in the United States [MEHOINUSA646N], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/MEHOINUSA646N, .

Release Tables

Related Data and Content

Data Suggestions Based On Your Search

Content Suggestions

Other Formats

Related Categories

Releases

Tags

Permalink/Embed

modal open, choose link customization options

Select automatic updates to the data or a static time frame. All data are subject to revision.