Federal Reserve Economic Data

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Notes

Source: Board of Governors of the Federal Reserve System (US)

Release: H.6 Money Stock Measures

Units: Billions of Dollars, Not Seasonally Adjusted

Frequency: Monthly

Notes:

The Board of Governors consolidated this series onto the H.6 statistical release, "Money Stock Measures", after the H.3 statistical release was discontinued. For more information on the consolidated H.6 release, see the H.6 Technical Q&As posted on August 20, 2020.

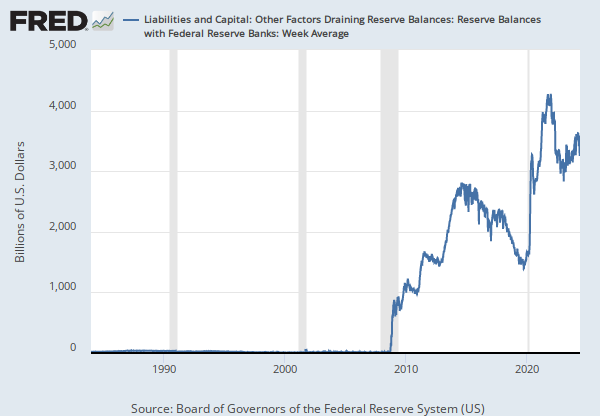

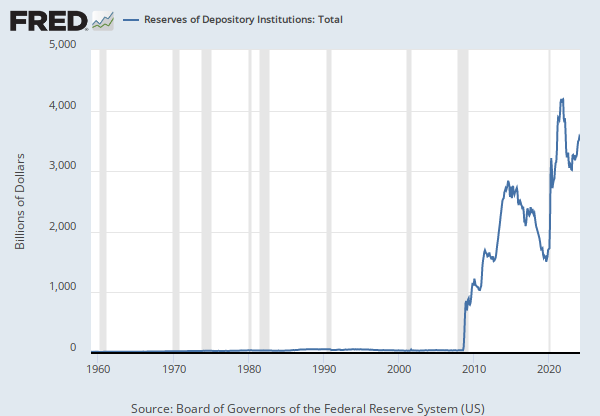

Total reserves equal reserve balances plus, before April 2020, vault cash used to satisfy reserve requirements.

For questions on the data, please contact the data source. For questions on FRED functionality, please contact us here.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Reserves of Depository Institutions: Total [TOTRESNS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/TOTRESNS, .

Source: Board of Governors of the Federal Reserve System (US)

Release: H.6 Money Stock Measures

Units: Billions of Dollars, Not Seasonally Adjusted

Frequency: Monthly

Notes:

The Board of Governors consolidated this series onto the H.6 statistical release, "Money Stock Measures", after the H.3 statistical release was discontinued. For more information on the consolidated H.6 release, see the H.6 Technical Q&As posted on August 20, 2020.

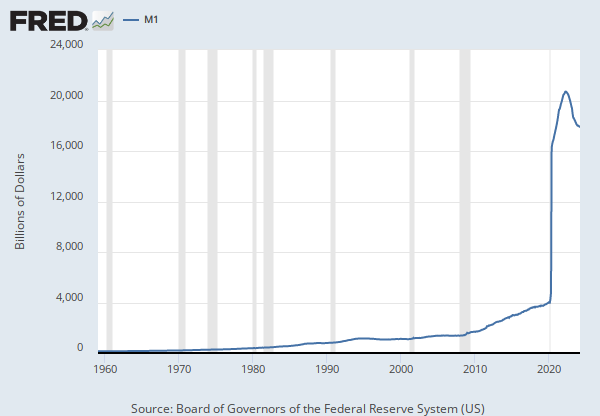

The monetary base equals currency in circulation plus reserve balances.

For questions on the data, please contact the data source. For questions on FRED functionality, please contact us here.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Monetary Base: Total [BOGMBASE], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/BOGMBASE, .

Source: Board of Governors of the Federal Reserve System (US)

Release: H.6 Money Stock Measures

Units: Billions of Dollars, Not Seasonally Adjusted

Frequency: Monthly

Notes:

The Board of Governors consolidated this series onto the H.6 statistical release, "Money Stock Measures", after the H.3 statistical release was discontinued. For more information on the consolidated H.6 release, see the H.6 Technical Q&As posted on August 20, 2020.

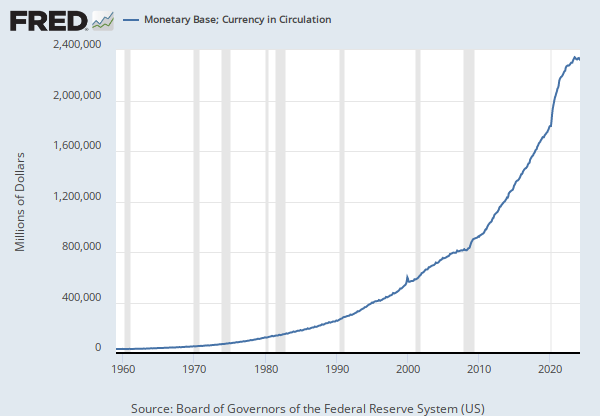

Currency in circulation includes Federal Reserve notes and coin outside the U.S. Treasury and Federal Reserve Banks. The total includes Treasury estimates of coins outstanding and Treasury paper currency outstanding. This definition of currency in circulation differs from the currency component of the money stock (CURRENCY), which excludes currency held in vaults of depository institutions.

For questions on the data, please contact the data source. For questions on FRED functionality, please contact us here.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Monetary Base: Currency in Circulation [MBCURRCIR], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/MBCURRCIR, .

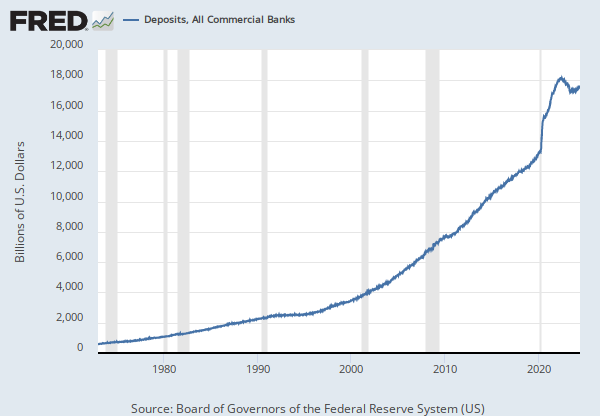

Source: Board of Governors of the Federal Reserve System (US)

Release: H.8 Assets and Liabilities of Commercial Banks in the United States

Units: Billions of U.S. Dollars, Seasonally Adjusted

Frequency: Monthly

Notes:

For questions on the data, please contact the data source. For questions on FRED functionality, please contact us here.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Consumer Loans, All Commercial Banks [CONSUMER], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CONSUMER, .

Source: Board of Governors of the Federal Reserve System (US)

Release: Z.1 Financial Accounts of the United States

Units: Millions of U.S. Dollars, Not Seasonally Adjusted

Frequency: Quarterly, End of Period

Notes:

For more information about the Flow of Funds tables, see the Financial Accounts Guide.

With each quarterly release, the source may make major data and structural revisions to the series and tables. These changes are available in the Release Highlights.

In the Financial Accounts, the source identifies each series by a string of patterned letters and numbers. For a detailed description, including how this series is constructed, see the series analyzer provided by the source.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Federal Government; Paycheck Protection Program Payables; Liability, Level [BOGZ1FL313170103Q], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/BOGZ1FL313170103Q, .

Source: Board of Governors of the Federal Reserve System (US)

Release: Z.1 Financial Accounts of the United States

Units: Millions of U.S. Dollars, Seasonally Adjusted Annual Rate

Frequency: Quarterly, End of Period

Notes:

For more information about the Flow of Funds tables, see the Financial Accounts Guide.

With each quarterly release, the source may make major data and structural revisions to the series and tables. These changes are available in the Release Highlights.

In the Financial Accounts, the source identifies each series by a string of patterned letters and numbers. For a detailed description, including how this series is constructed, see the series analyzer provided by the source.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Federal Government; Paycheck Protection Program Payables; Liability, Transactions [BOGZ1FA313170103Q], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/BOGZ1FA313170103Q, .

Release Tables

Related Data and Content

Data Suggestions Based On Your Search

Content Suggestions

Other Formats

Consumer Loans, All Commercial Banks

Monthly, Not Seasonally Adjusted Weekly, Not Seasonally Adjusted Weekly, Seasonally Adjusted Millions of Dollars, Quarterly, Not Seasonally Adjusted Percent Change at Annual Rate, Annual, Seasonally Adjusted Percent Change at Annual Rate, Monthly, Seasonally Adjusted Percent Change at Annual Rate, Quarterly, Seasonally AdjustedFederal Government; Paycheck Protection Program Payables; Liability, Level

Annual, Not Seasonally AdjustedFederal Government; Paycheck Protection Program Payables; Liability, Transactions

Annual, Not Seasonally Adjusted Annual, Seasonally Adjusted Annual Rate Quarterly, Not Seasonally AdjustedRelated Categories

Releases

Tags

Permalink/Embed

modal open, choose link customization options

Select automatic updates to the data or a static time frame. All data are subject to revision.