Federal Reserve Economic Data

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Notes

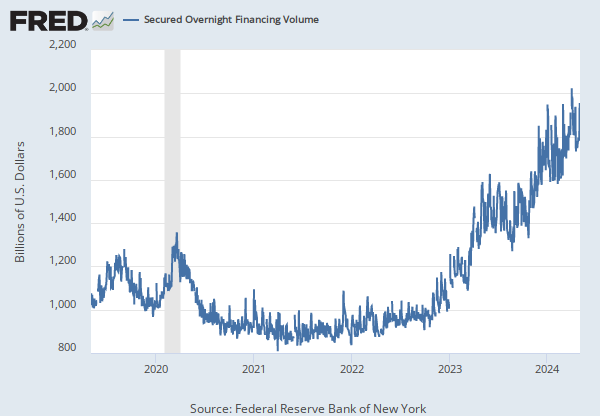

Source: Federal Reserve Bank of New York

Release: Overnight Bank Funding Rate Data

Units: Percent, Not Seasonally Adjusted

Frequency: Daily

Notes:

The overnight bank funding rate is calculated using federal funds transactions and certain Eurodollar transactions. The federal funds market consists of domestic unsecured borrowings in U.S. dollars by depository institutions from other depository institutions and certain other entities, primarily government-sponsored enterprises, while the Eurodollar market consists of unsecured U.S. dollar deposits held at banks or bank branches outside of the United States. U.S.-based banks can also take Eurodollar deposits domestically through international banking facilities (IBFs). The overnight bank funding rate (OBFR) is calculated as a volume-weighted median of overnight federal funds transactions and Eurodollar transactions reported in the FR 2420 Report of Selected Money Market Rates.

Volume-weighted median is the rate associated with transactions at the 50th percentile of transaction volume. Specifically, the volume-weighted median rate is calculated by ordering the transactions from lowest to highest rate, taking the cumulative sum of volumes of these transactions, and identifying the rate associated with the trades at the 50th percentile of dollar volume. The published rates are the volume-weighted median transacted rate, rounded to the nearest basis point.

For more information, see https://www.newyorkfed.org/markets/obfrinfo

Suggested Citation:

Federal Reserve Bank of New York, Overnight Bank Funding Rate [OBFR], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/OBFR, .

Source: Federal Reserve Bank of New York

Release: Federal Funds Data

Units: Percent, Not Seasonally Adjusted

Frequency: Daily

Notes:

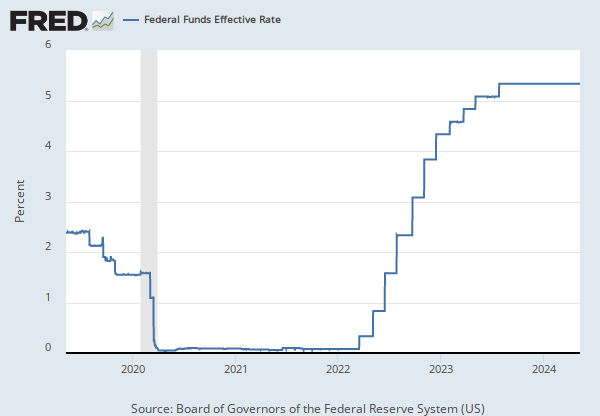

For additional historical federal funds rate data, please see Daily Federal Funds Rate from 1928-1954.

The federal funds market consists of domestic unsecured borrowings in U.S. dollars by depository institutions from other depository institutions and certain other entities, primarily government-sponsored enterprises.

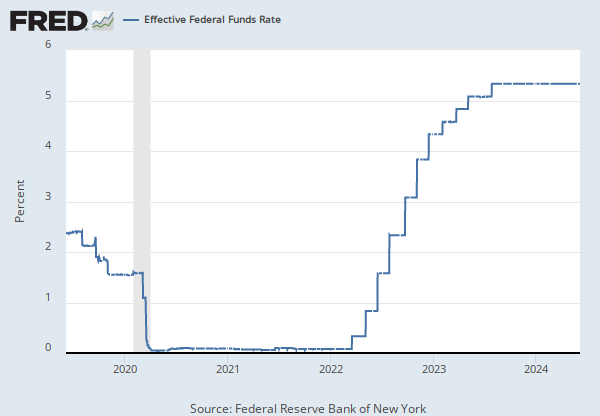

The effective federal funds rate (EFFR) is calculated as a volume-weighted median of overnight federal funds transactions reported in the FR 2420 Report of Selected Money Market Rates.

For more information, visit the Federal Reserve Bank of New York.

Suggested Citation:

Federal Reserve Bank of New York, Effective Federal Funds Rate [EFFR], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/EFFR, .

Source: Board of Governors of the Federal Reserve System (US)

Release: H.15 Selected Interest Rates

Units: Percent, Not Seasonally Adjusted

Frequency: Daily

Notes:

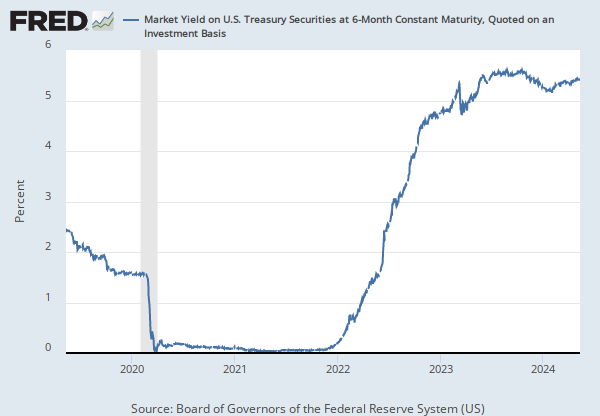

For further information regarding treasury constant maturity data, please refer to the H.15 Statistical Release notes and the Treasury Yield Curve Methodology.

For questions on the data, please contact the data source. For questions on FRED functionality, please contact us here.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Market Yield on U.S. Treasury Securities at 1-Month Constant Maturity, Quoted on an Investment Basis [DGS1MO], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DGS1MO, .

Release Tables

Related Data and Content

Data Suggestions Based On Your Search

Content Suggestions

Other Formats

Related Categories

Releases

Tags

Permalink/Embed

modal open, choose link customization options

Select automatic updates to the data or a static time frame. All data are subject to revision.