Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Notes

Source: Board of Governors of the Federal Reserve System (US)

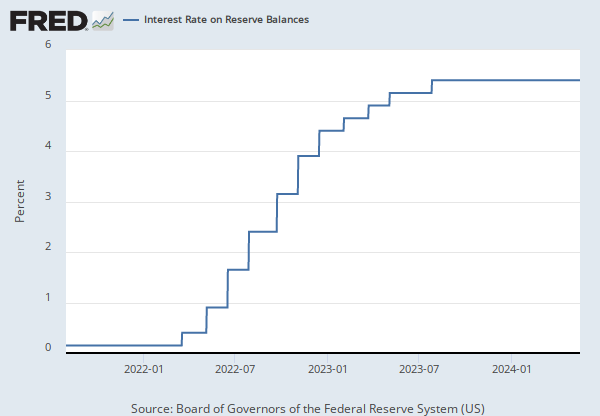

Release: Interest Rate on Reserve Balances

Units: Percent, Not Seasonally Adjusted

Frequency: Daily, 7-Day

Notes:

Starting July 29, 2021, the interest rate on excess reserves (IOER) and the interest rate on required reserves (IORR) were replaced with a single rate, the interest rate on reserve balances (IORB). See the source's announcement for more details.

The interest rate on excess reserves (IOER rate) is determined by the Board of Governors and gives the Federal Reserve an additional tool to conduct monetary policy.

See Policy Tools for more information.

For questions on FRED functionality, please contact us here.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Interest Rate on Excess Reserves (IOER Rate) (DISCONTINUED) [IOER], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/IOER, .

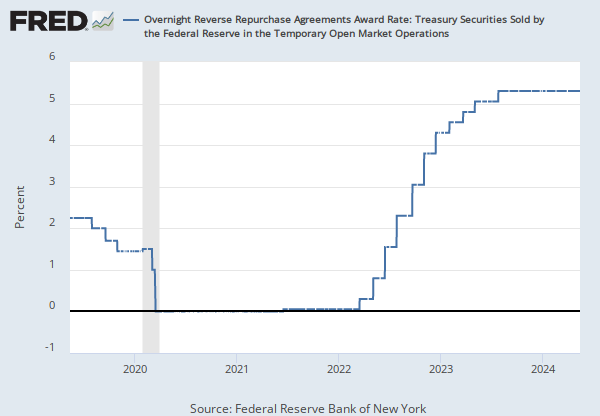

Source: Federal Reserve Bank of New York

Release: Federal Funds Data

Units: Percent, Not Seasonally Adjusted

Frequency: Daily

Notes:

For additional historical federal funds rate data, please see Daily Federal Funds Rate from 1928-1954.

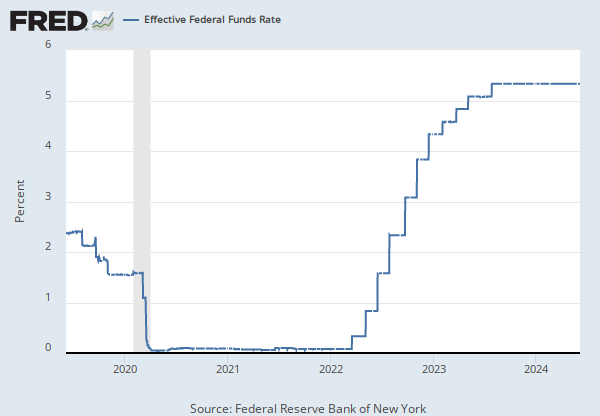

The federal funds market consists of domestic unsecured borrowings in U.S. dollars by depository institutions from other depository institutions and certain other entities, primarily government-sponsored enterprises.

The effective federal funds rate (EFFR) is calculated as a volume-weighted median of overnight federal funds transactions reported in the FR 2420 Report of Selected Money Market Rates.

For more information, visit the Federal Reserve Bank of New York.

Suggested Citation:

Federal Reserve Bank of New York, Effective Federal Funds Rate [EFFR], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/EFFR, .

Release Tables

Permalink/Embed

modal open, choose link customization options

Select automatic updates to the data or a static time frame. All data are subject to revision.