Observations

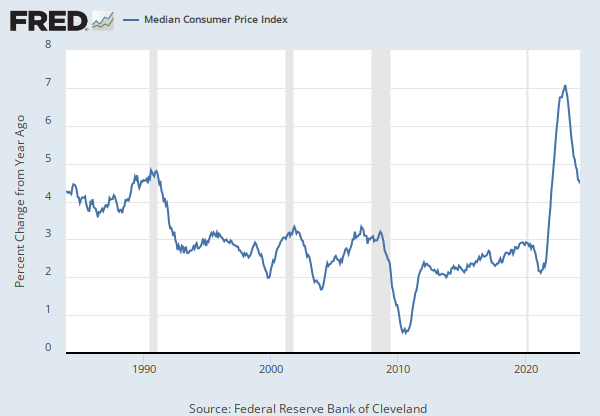

Jan 2026: 0.67209 | Percent Change from Year Ago, Seasonally Adjusted | Monthly

Updated: Feb 13, 2026 5:35 PM CST

Observations

Jan 2026:

0.67209

Updated:

Feb 13, 2026

5:35 PM CST

| Jan 2026: | 0.67209 | |

| Dec 2025: | 1.56479 | |

| Nov 2025: | 1.99412 | |

| Oct 2025: | 2.29741 | |

| Sep 2025: | 2.27544 | |

| View All | ||

Units:

Percent Change from Year Ago,

Seasonally Adjusted

Frequency:

Monthly

Fullscreen