Observations

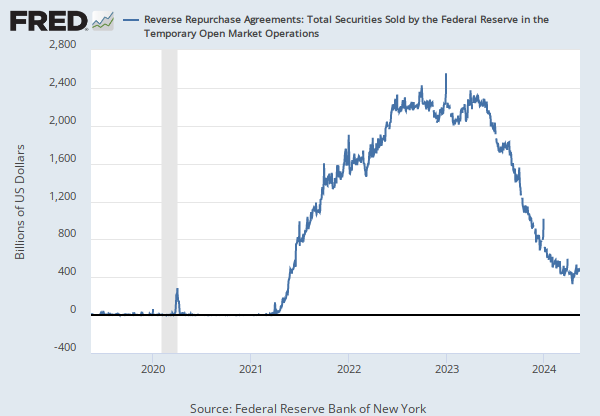

2026-02-26: 0.000 | Billions of US Dollars, Not Seasonally Adjusted | Daily

Updated: Feb 26, 2026 1:02 PM CST

Observations

2026-02-26:

0.000

Updated:

Feb 26, 2026

1:02 PM CST

| 2026-02-26: | 0.000 | |

| 2026-02-25: | 0.000 | |

| 2026-02-24: | 0.000 | |

| 2026-02-23: | 0.001 | |

| 2026-02-20: | 0.000 | |

| View All | ||

Units:

Billions of US Dollars,

Not Seasonally Adjusted

Frequency:

Daily

Fullscreen