Federal Reserve Economic Data

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Notes

Source: Federal Reserve Bank of Chicago

Release: Chicago Fed National Financial Conditions Index

Units: Index, Not Seasonally Adjusted

Frequency: Weekly, Ending Friday

Notes:

The Chicago Fed’s National Financial Conditions Index (NFCI) provides a comprehensive weekly update on U.S. financial conditions in money markets, debt and equity markets, and the traditional and “shadow” banking systems. Source: http://www.chicagofed.org/webpages/publications/nfci/index.cfm.

"Positive values of the NFCI indicate financial conditions that are tighter than average, while negative values indicate financial conditions that are looser than average."

"The three subindexes of the NFCI (risk, credit and leverage) allow for a more detailed examination of the movements in the NFCI. Like the NFCI, each is constructed to have an average value of zero and a standard deviation of one over a sample period extending back to 1971. The risk subindex captures volatility and funding risk in the financial sector; the credit subindex is composed of measures of credit conditions; and the leverage subindex consists of debt and equity measures. Increasing risk, tighter credit conditions and declining leverage are consistent with tightening financial conditions. Thus, a positive value for an individual subindex indicates that the corresponding aspect of financial conditions is tighter than on average, while negative values indicate the opposite." Source: http://www.chicagofed.org/webpages/research/data/nfci/background.cfm.

For further information, please visit the Federal Reserve Bank of Chicago's NFCI website at http://www.chicagofed.org/webpages/publications/nfci/index.cfm.

Suggested Citation:

Federal Reserve Bank of Chicago, Chicago Fed National Financial Conditions Leverage Subindex [NFCILEVERAGE], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/NFCILEVERAGE, .

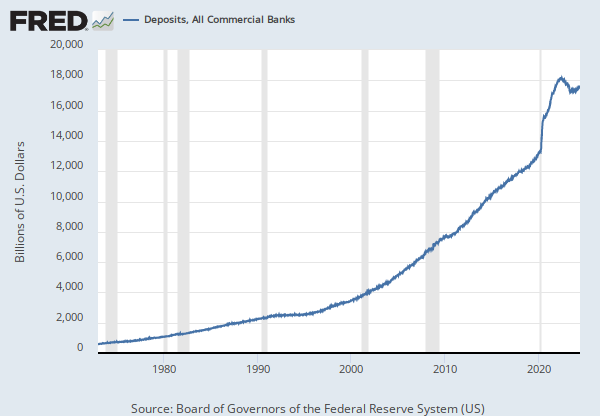

Source: Board of Governors of the Federal Reserve System (US)

Release: H.8 Assets and Liabilities of Commercial Banks in the United States

Units: Billions of U.S. Dollars, Seasonally Adjusted

Frequency: Weekly, Ending Wednesday

Notes:

For questions on the data, please contact the data source. For questions on FRED functionality, please contact us here.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Bank Credit, All Commercial Banks [TOTBKCR], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/TOTBKCR, .

Release Tables

Related Data and Content

Data Suggestions Based On Your Search

Content Suggestions

Other Formats

Related Categories

Releases

Tags

Permalink/Embed

modal open, choose link customization options

Select automatic updates to the data or a static time frame. All data are subject to revision.