Federal Reserve Economic Data

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Notes

Source: National Bureau of Economic Research

Release: NBER Macrohistory Database

Units: Percent, Not Seasonally Adjusted

Frequency: Monthly

Notes:

Data Represent 60-90 Day Prime Endorsed Bills For 1858-1859; Prime 60-90 Day Double Name For 1860-1923; Prime Four-Six Months, Double And Single Names Thereafter. Data For 1857 Are From Rates Given In A Treasury Report In Bankers' Magazine; Rates For 1858 Are From The New York Chamber Of Commerce Report, 1858, P. 9; Rates For 1859-June 1862 Are Arithmetic Averages Between The Monthly Averages Of Hunt'S Merchants Magazine And Of Bankers'; Rates For July 1862-1865 Are Estimated From A Table Of Daily Rates From Different New York Newspapers. Data For 1942-1971 Are Averages Of Daily Offering Rates Of Dealers 60-90 Day Prime Bills. Source: Data For 1857-January 1937: F.R. Macaulay, The Movement Of Interest Rates, Bond Yields, And Stock Prices In The U.S. Since 1856 (NBER No. 33, 1938), Pp. A142-161. Data For February 1937-1942: Computed By NBER From Weekly Data In Bank And Quotation Record, Commercial And Financial Chronicle. Data For 1943-1971: Federal Reserve Board.

This NBER data series m13002 appears on the NBER website in Chapter 13 at http://www.nber.org/databases/macrohistory/contents/chapter13.html.

NBER Indicator: m13002

Suggested Citation:

National Bureau of Economic Research, Commercial Paper Rates for New York, NY [M13002US35620M156NNBR], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/M13002US35620M156NNBR, .

Source: Board of Governors of the Federal Reserve System (US)

Release: G.13 Selected Interest Rates

Units: Percent, Not Seasonally Adjusted

Frequency: Monthly

Notes:

Unweighted average on all outstanding bonds neither due nor callable in less than 10 years.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Long-Term U.S. Government Securities (DISCONTINUED) [LTGOVTBD], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/LTGOVTBD, .

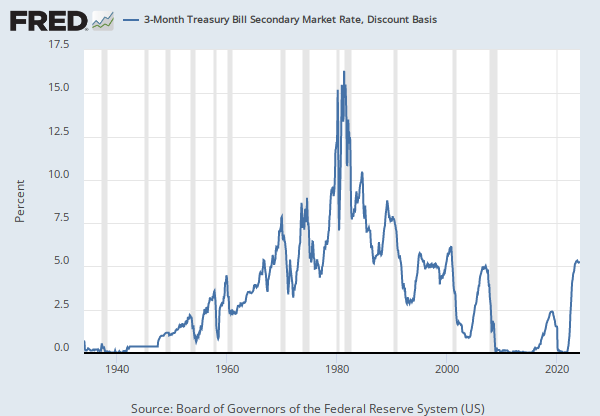

Source: Board of Governors of the Federal Reserve System (US)

Release: H.15 Selected Interest Rates

Units: Percent, Not Seasonally Adjusted

Frequency: Monthly

Notes:

Averages of business days. For further information regarding treasury constant maturity data, please refer to the H.15 Statistical Release notes and the Treasury Yield Curve Methodology.

For questions on the data, please contact the data source. For questions on FRED functionality, please contact us here.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Market Yield on U.S. Treasury Securities at 3-Year Constant Maturity, Quoted on an Investment Basis [GS3], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/GS3, .

Source: Board of Governors of the Federal Reserve System (US)

Release: H.15 Selected Interest Rates

Units: Percent, Not Seasonally Adjusted

Frequency: Monthly

Notes:

Averages of business days. For further information regarding treasury constant maturity data, please refer to the H.15 Statistical Release notes and the Treasury Yield Curve Methodology.

For questions on the data, please contact the data source. For questions on FRED functionality, please contact us here.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity, Quoted on an Investment Basis [GS10], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/GS10, .

Source: National Bureau of Economic Research

Release: NBER Macrohistory Database

Units: Percent, Not Seasonally Adjusted

Frequency: Monthly

Notes:

Data Are Computed By NBER By Taking Simple Averages Of Rates For Commercial, Agricultural, And Livestock Paper, And Weighting Them By The Number Of Days Each Rate Was In Force. Data Are For All Classes And Maturities Of Discount Bills. Source: Federal Reserve Board, Data For 1914-1922: "Discount Rates Of Federal Reserve Banks, 1914-1921", 1922. Data For 1922-1969: Annual Reports For 1931-1942; Federal Reserve Bulletin, Successive Issues.

This NBER data series m13009 appears on the NBER website in Chapter 13 at http://www.nber.org/databases/macrohistory/contents/chapter13.html.

NBER Indicator: m13009

Suggested Citation:

National Bureau of Economic Research, Discount Rates, Federal Reserve Bank of New York for United States [M13009USM156NNBR], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/M13009USM156NNBR, .

Release Tables

Related Data and Content

Data Suggestions Based On Your Search

Content Suggestions

Other Formats

Market Yield on U.S. Treasury Securities at 3-Year Constant Maturity, Quoted on an Investment Basis

Annual, Not Seasonally Adjusted Daily, Not Seasonally Adjusted Weekly, Not Seasonally AdjustedMarket Yield on U.S. Treasury Securities at 10-Year Constant Maturity, Quoted on an Investment Basis

Annual, Not Seasonally Adjusted Daily, Not Seasonally Adjusted Weekly, Not Seasonally AdjustedRelated Categories

Releases

Tags

Permalink/Embed

modal open, choose link customization options

Select automatic updates to the data or a static time frame. All data are subject to revision.