FRED Graph

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Notes

Source: U.S. Bureau of Labor Statistics

Release: Consumer Expenditure Surveys

Units: U.S. Dollars, Not Seasonally Adjusted

Frequency: Annual

Notes:

For each time period represented in the tables, complete income reporters are ranked in ascending order, according to the level of total before-tax income reported by the consumer unit. The ranking is then divided into five equal groups. Incomplete income reporters are not ranked and are shown separately.

For more details about the data or the survey, visit the FAQs.

Suggested Citation:

U.S. Bureau of Labor Statistics, Income Before Taxes: Wages and Salaries by Quintiles of Income Before Taxes: Highest 20 Percent (81st to 100th Percentile) [CXU900000LB0106M], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CXU900000LB0106M, April 2, 2025.

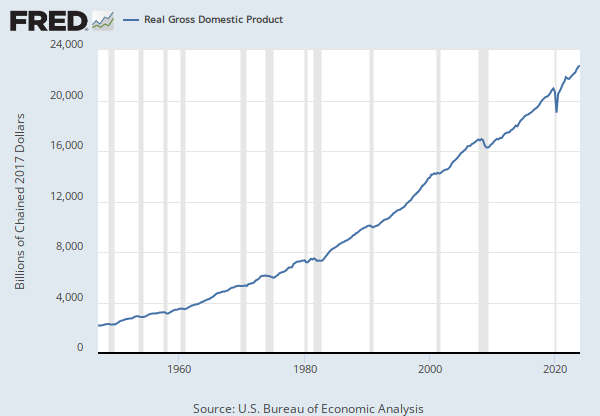

Source: U.S. Bureau of Economic Analysis

Release: Gross Domestic Product

Units: Index 2017=100, Seasonally Adjusted

Frequency: Quarterly

Notes:

BEA Account Code: A191RD

The number of decimal places reported varies over time. A Guide to the National Income and Product Accounts of the United States (NIPA).

Suggested Citation:

U.S. Bureau of Economic Analysis, Gross Domestic Product: Implicit Price Deflator [GDPDEF], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/GDPDEF, April 2, 2025.

Source: U.S. Bureau of Labor Statistics

Release: Consumer Expenditure Surveys

Units: U.S. Dollars, Not Seasonally Adjusted

Frequency: Annual

Notes:

For each time period represented in the tables, complete income reporters are ranked in ascending order, according to the level of total before-tax income reported by the consumer unit. The ranking is then divided into five equal groups. Incomplete income reporters are not ranked and are shown separately.

For more details about the data or the survey, visit the FAQs.

Suggested Citation:

U.S. Bureau of Labor Statistics, Income Before Taxes: Wages and Salaries by Quintiles of Income Before Taxes: Fourth 20 Percent (61st to 80th Percentile) [CXU900000LB0105M], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CXU900000LB0105M, April 2, 2025.

Source: U.S. Bureau of Labor Statistics

Release: Consumer Expenditure Surveys

Units: U.S. Dollars, Not Seasonally Adjusted

Frequency: Annual

Notes:

For each time period represented in the tables, complete income reporters are ranked in ascending order, according to the level of total before-tax income reported by the consumer unit. The ranking is then divided into five equal groups. Incomplete income reporters are not ranked and are shown separately.

For more details about the data or the survey, visit the FAQs.

Suggested Citation:

U.S. Bureau of Labor Statistics, Income Before Taxes: Wages and Salaries by Quintiles of Income Before Taxes: Third 20 Percent (41st to 60th Percentile) [CXU900000LB0104M], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CXU900000LB0104M, April 2, 2025.

Source: U.S. Bureau of Labor Statistics

Release: Consumer Expenditure Surveys

Units: U.S. Dollars, Not Seasonally Adjusted

Frequency: Annual

Notes:

For each time period represented in the tables, complete income reporters are ranked in ascending order, according to the level of total before-tax income reported by the consumer unit. The ranking is then divided into five equal groups. Incomplete income reporters are not ranked and are shown separately.

For more details about the data or the survey, visit the FAQs.

Suggested Citation:

U.S. Bureau of Labor Statistics, Income Before Taxes: Wages and Salaries by Quintiles of Income Before Taxes: Second 20 Percent (21st to 40th Percentile) [CXU900000LB0103M], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CXU900000LB0103M, April 2, 2025.

Source: U.S. Bureau of Labor Statistics

Release: Consumer Expenditure Surveys

Units: U.S. Dollars, Not Seasonally Adjusted

Frequency: Annual

Notes:

For each time period represented in the tables, complete income reporters are ranked in ascending order, according to the level of total before-tax income reported by the consumer unit. The ranking is then divided into five equal groups. Incomplete income reporters are not ranked and are shown separately.

For more details about the data or the survey, visit the FAQs.

Suggested Citation:

U.S. Bureau of Labor Statistics, Income Before Taxes: Wages and Salaries by Quintiles of Income Before Taxes: Lowest 20 Percent (1st to 20th Percentile) [CXU900000LB0102M], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CXU900000LB0102M, April 2, 2025.

Release Tables

- Lowest 20 Percent (1st to 20th Percentile): Income and Taxes

- Second 20 Percent (21st to 40th Percentile): Income and Taxes

- Third 20 Percent (41st to 60th Percentile): Income and Taxes

- Fourth 20 Percent (61st to 80th Percentile): Income and Taxes

- Highest 20 Percent (81st to 100th Percentile): Income and Taxes

Related Data and Content

Data Suggestions Based On Your Search

Content Suggestions

Other Formats

Related Categories

Releases

Tags

Permalink/Embed

modal open, choose link customization options

Select automatic updates to the data or a static time frame. All data are subject to revision.