Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Notes

Source: Board of Governors of the Federal Reserve System (US)

Units: Percent, Not Seasonally Adjusted

Frequency: Daily

Notes:

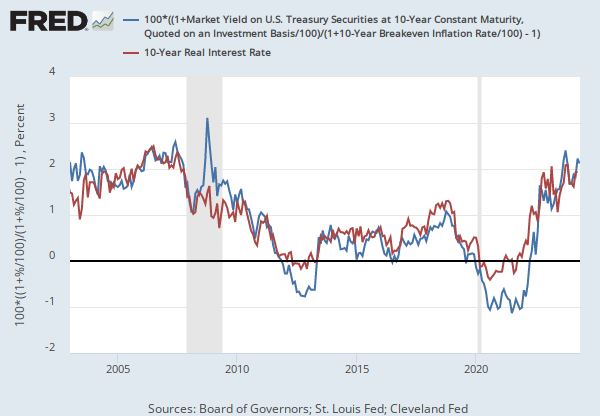

Kim and Wright (2005) produced this data by fitting a simple three-factor arbitrage-free term structure model to U.S. Treasury yields since 1990, in order to evaluate the behavior of long-term yields, distant-horizon forward rates, and term premiums. For the full paper, please go to http://www.federalreserve.gov/pubs/feds/2005/200533/200533abs.html

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Term Premium on a 10 Year Zero Coupon Bond [THREEFYTP10], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/THREEFYTP10, .

Source: Federal Reserve Bank of St. Louis

Release: Interest Rate Spreads

Units: Percent, Not Seasonally Adjusted

Frequency: Daily

Notes:

The breakeven inflation rate represents a measure of expected inflation derived from 10-Year Treasury Constant Maturity Securities (DGS10) and 10-Year Treasury Inflation-Indexed Constant Maturity Securities (DFII10). The latest value implies what market participants expect inflation to be in the next 10 years, on average.

Starting with the update on June 21, 2019, the Treasury bond data used in calculating interest rate spreads is obtained directly from the U.S. Treasury Department.

Suggested Citation:

Federal Reserve Bank of St. Louis, 10-Year Breakeven Inflation Rate [T10YIE], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/T10YIE, .

Release Tables

Related Data and Content

Data Suggestions Based On Your Search

Content Suggestions

Other Formats

Related Categories

Releases

Tags

Permalink/Embed

modal open, choose link customization options

Select automatic updates to the data or a static time frame. All data are subject to revision.