Observations

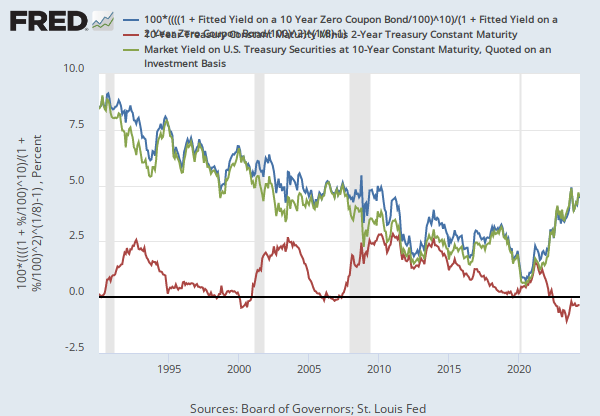

2026-02-13: 4.1581 | Percent, Not Seasonally Adjusted | Daily

Updated: Feb 17, 2026 2:03 PM CST

Next Release Date: Not Available

Observations

2026-02-13:

4.1581

Updated:

Feb 17, 2026

2:03 PM CST

Next Release Date:

Not Available

| 2026-02-13: | 4.1581 | |

| 2026-02-12: | 4.2185 | |

| 2026-02-11: | 4.2780 | |

| 2026-02-10: | 4.2571 | |

| 2026-02-09: | 4.2982 | |

| View All | ||

Units:

Percent,

Not Seasonally Adjusted

Frequency:

Daily

Fullscreen