Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Notes

Source: U.S. Census Bureau

Release: Monthly State Retail Sales

Units: Percent Change from Year Ago, Not Seasonally Adjusted

Frequency: Monthly

Notes:

The Monthly State Retail Sales (MSRS) report is a blended data product combining Monthly Retail Trade Survey data, administrative data, and third-party data. Data are available for year-over-year percent changes for Total Retail Sales excluding Nonstore Retailers as well as 11 North American Industry Classification System (NAICS) retail subsectors.

For more information on the MSRS view the methodology. This is the first version of these experimental data.

This series measures retail sales for all retailers except nonstore retailers. The listed retailers correspond to 44-45 in the 2017 NAICS manual.

Suggested Citation:

U.S. Census Bureau, Monthly State Retail Sales: Total Retail Sales Excluding Nonstore Retailers in California [MSRSCATOTAL], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/MSRSCATOTAL, .

Source: Federal Reserve Bank of Cleveland

Release: Current Median CPI

Units: Percent Change at Annual Rate, Seasonally Adjusted

Frequency: Monthly

Notes:

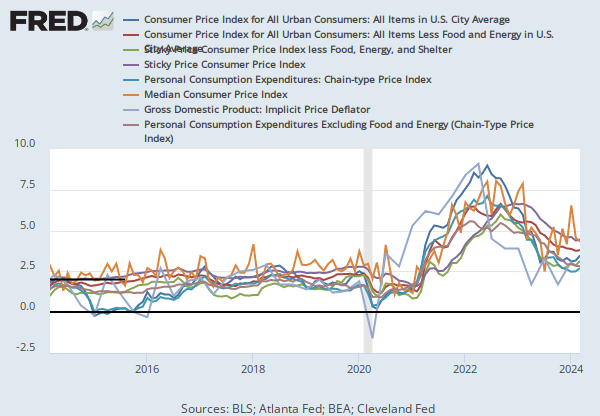

Median Consumer Price Index (CPI) is a measure of core inflation calculated the Federal Reserve Bank of Cleveland and the Ohio State University. Median CPI was created as a different way to get a 'Core CPI' measure, or a better measure of underlying inflation trends. To calculate the Median CPI, the Cleveland Fed analyzes the median price change of the goods and services published by the BLS. The median price change is the price change that's right in the middle of the long list of all of the price changes. This series excludes 49.5% of the CPI components with the highest and lowest one-month price changes from each tail of the price-change distribution resulting in a Median CPI Inflation Estimate.

According to research from the Cleveland Fed, the Median CPI provides a better signal of the inflation trend than either the all-items CPI or the CPI excluding food and energy. According to newer research done at the Cleveland Fed, the Median CPI is even better at PCE inflation in the near and longer term than the core PCE.

For further information, visit The Federal Reserve Bank of Cleveland.

Suggested Citation:

Federal Reserve Bank of Cleveland, Median Consumer Price Index [MEDCPIM158SFRBCLE], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/MEDCPIM158SFRBCLE, .

Release Tables

Related Data and Content

Data Suggestions Based On Your Search

Content Suggestions

Other Formats

Related Categories

Releases

Tags

Permalink/Embed

modal open, choose link customization options

Select automatic updates to the data or a static time frame. All data are subject to revision.