Federal Reserve Economic Data

- Release Calendar

- FRED Tools

- FRED News

- FRED Blog

- About FRED

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

NOTES

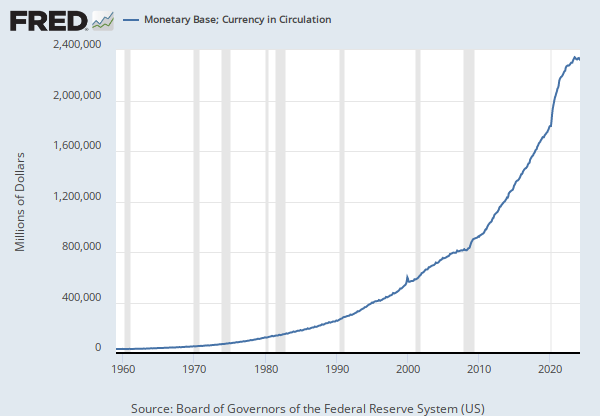

Source: Board of Governors of the Federal Reserve System (US)

Release: H.6 Money Stock Measures

Units: Billions of Dollars, Not Seasonally Adjusted

Frequency: Monthly

Notes:

The Board of Governors consolidated this series onto the H.6 statistical release, "Money Stock Measures", after the H.3 statistical release was discontinued. For more information on the consolidated H.6 release, see the H.6 Technical Q&As posted on August 20, 2020.

Currency in circulation includes Federal Reserve notes and coin outside the U.S. Treasury and Federal Reserve Banks. The total includes Treasury estimates of coins outstanding and Treasury paper currency outstanding. This definition of currency in circulation differs from the currency component of the money stock (CURRENCY), which excludes currency held in vaults of depository institutions.

For questions on the data, please contact the data source. For questions on FRED functionality, please contact us here.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Monetary Base: Currency in Circulation [MBCURRCIR], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/MBCURRCIR, .

Source: Federal Reserve Bank of Cleveland

Release: Current Median CPI

Units: Percent Change at Annual Rate, Seasonally Adjusted

Frequency: Monthly

Notes:

Median Consumer Price Index (CPI) is a measure of core inflation calculated the Federal Reserve Bank of Cleveland and the Ohio State University. Median CPI was created as a different way to get a 'Core CPI' measure, or a better measure of underlying inflation trends. To calculate the Median CPI, the Cleveland Fed analyzes the median price change of the goods and services published by the BLS. The median price change is the price change that's right in the middle of the long list of all of the price changes. This series excludes 49.5% of the CPI components with the highest and lowest one-month price changes from each tail of the price-change distribution resulting in a Median CPI Inflation Estimate.

According to research from the Cleveland Fed, the Median CPI provides a better signal of the inflation trend than either the all-items CPI or the CPI excluding food and energy. According to newer research done at the Cleveland Fed, the Median CPI is even better at PCE inflation in the near and longer term than the core PCE.

For further information, visit The Federal Reserve Bank of Cleveland.

Suggested Citation:

Federal Reserve Bank of Cleveland, Median Consumer Price Index [MEDCPIM158SFRBCLE], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/MEDCPIM158SFRBCLE, .

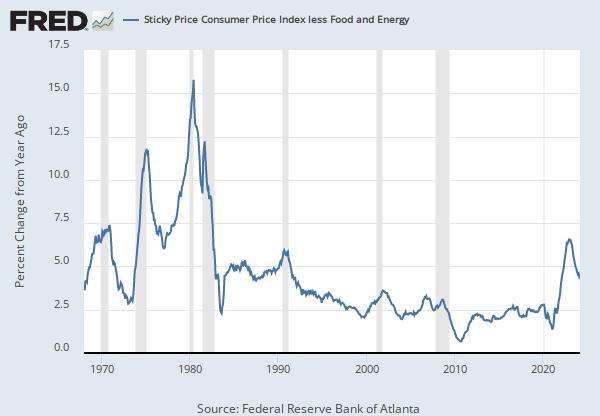

Source: Federal Reserve Bank of Atlanta

Release: Sticky Price CPI

Units: Percent Change from Year Ago, Seasonally Adjusted

Frequency: Monthly

Notes:

The Sticky Price Consumer Price Index (CPI) is calculated from a subset of goods and services included in the CPI that change price relatively infrequently. Because these goods and services change price relatively infrequently, they are thought to incorporate expectations about future inflation to a greater degree than prices that change on a more frequent basis. One possible explanation for sticky prices could be the costs firms incur when changing price.

To obtain more information about this release see: Michael F. Bryan, and Brent H. Meyer. “Are Some Prices in the CPI More Forward Looking Than Others? We Think So.” Economic Commentary (Federal Reserve Bank of Cleveland) (May 19, 2010): 1–6. https://doi.org/10.26509/frbc-ec-201002.

Suggested Citation:

Federal Reserve Bank of Atlanta, Sticky Price Consumer Price Index less Food and Energy [CORESTICKM159SFRBATL], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CORESTICKM159SFRBATL, .

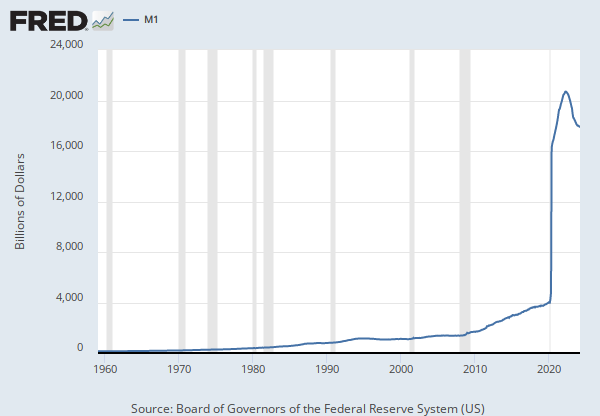

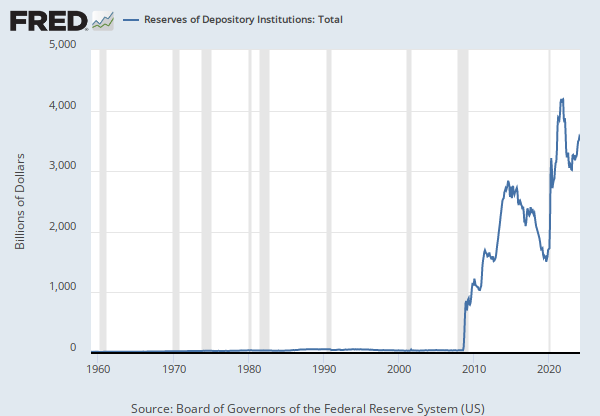

Source: Board of Governors of the Federal Reserve System (US)

Release: H.6 Money Stock Measures

Units: Billions of Dollars, Not Seasonally Adjusted

Frequency: Monthly

Notes:

The Board of Governors consolidated this series onto the H.6 statistical release, "Money Stock Measures", after the H.3 statistical release was discontinued. For more information on the consolidated H.6 release, see the H.6 Technical Q&As posted on August 20, 2020.

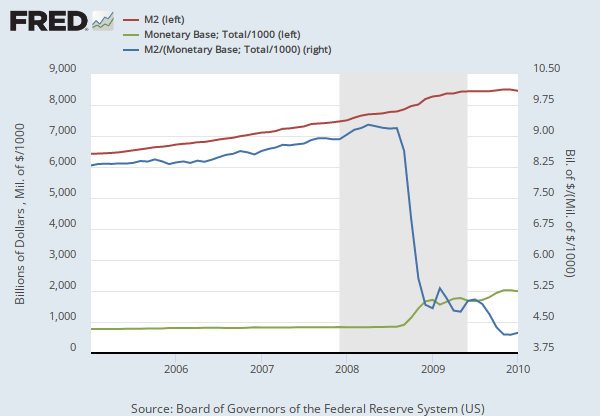

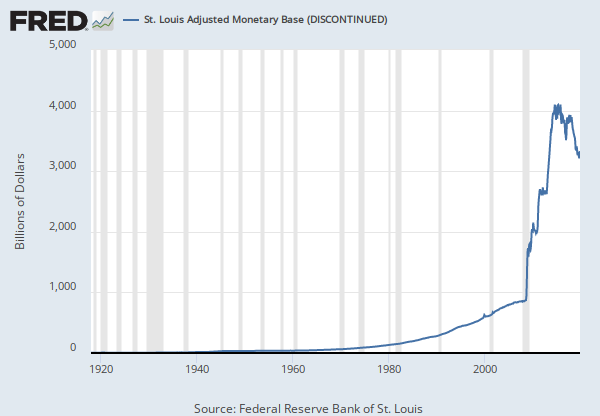

The monetary base equals currency in circulation plus reserve balances.

For questions on the data, please contact the data source. For questions on FRED functionality, please contact us here.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Monetary Base: Total [BOGMBASE], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/BOGMBASE, .

RELEASE TABLES

RELATED DATA AND CONTENT

Data Suggestions Based On Your Search

Content Suggestions

Other Formats

Median Consumer Price Index

Index Dec 1982=100, Monthly, Seasonally Adjusted Percent Change, Monthly, Seasonally Adjusted Percent Change from Year Ago, Monthly, Seasonally AdjustedSticky Price Consumer Price Index less Food and Energy

3-Month Annualized Percent Change, Monthly, Seasonally Adjusted Percent Change, Monthly, Seasonally Adjusted Percent Change at Annual Rate, Monthly, Seasonally Adjusted