Federal Reserve Economic Data: Your trusted data source since 1991

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

NOTES

Source: U.S. Bureau of Economic Analysis

Release: Gross Domestic Product

Units: Billions of Dollars, Not Seasonally Adjusted

Frequency: Annual

Notes:

BEA Account Code: A2015C

For more information about this series, please see http://www.bea.gov/national/.

Suggested Citation:

U.S. Bureau of Economic Analysis, Owner-occupied housing: Net interest [A2015C1A027NBEA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/A2015C1A027NBEA, .

Source: U.S. Bureau of Economic Analysis

Release: Gross Domestic Product

Units: Billions of Dollars, Not Seasonally Adjusted

Frequency: Annual

Notes:

BEA Account Code: A2217C

For more information about this series, please see http://www.bea.gov/national/.

Suggested Citation:

U.S. Bureau of Economic Analysis, Rental income of persons with capital consumption adjustment: Households and nonprofit institutions: Nonfarm owner-occupied housing [A2217C1A027NBEA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/A2217C1A027NBEA, .

Source: Board of Governors of the Federal Reserve System (US)

Release: Z.1 Financial Accounts of the United States

Units: Billions of Dollars, Not Seasonally Adjusted

Frequency: Quarterly

Notes:

Source ID: LM155035015.Q

For more information about the Flow of Funds tables, see the Financial Accounts Guide.

With each quarterly release, the source may make major data and structural revisions to the series and tables. These changes are available in the Release Highlights.

In the Financial Accounts, the source identifies each series by a string of patterned letters and numbers. For a detailed description, including how this series is constructed, see the series analyzer provided by the source.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Households; Owner-Occupied Real Estate Including Vacant Land and Mobile Homes at Market Value, Market Value Levels [HOOREVLMHMV], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/HOOREVLMHMV, .

Source: Haver Analytics

Source: Federal Reserve Bank of St. Louis

Release: Monthly Treasury Inflation-Indexed Securities

Units: Percent, Not Seasonally Adjusted

Frequency: Monthly

Notes:

This series will no longer be updated. It has been replaced with DTP30A28 that updates on a daily basis.

Treasury Inflation-Protected Securities, or TIPS, are securities whose principal is tied to the Consumer Price Index (CPI). The principal increases with inflation and decreases with deflation. When the security matures, the U.S. Treasury pays the original or adjusted principal, whichever is greater.

Monthly average of business days calculated by Federal Reserve Bank of St. Louis. Yield to maturity on accrued principal.

Calculated from data provided by the Wall Street Journal.

Copyright, 2016, Haver Analytics. Reprinted with permission.

Suggested Citation:

Haver Analytics and Federal Reserve Bank of St. Louis, 30-Year 3-5/8% Treasury Inflation-Indexed Bond, Due 4/15/2028 (DISCONTINUED) [TP30A28], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/TP30A28, .

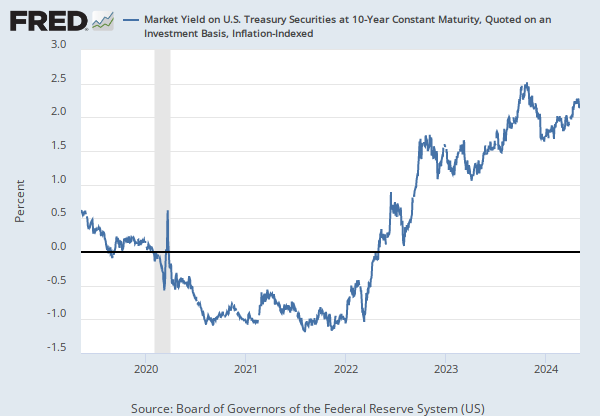

Source: Board of Governors of the Federal Reserve System (US)

Release: H.15 Selected Interest Rates

Units: Percent, Not Seasonally Adjusted

Frequency: Monthly

Notes:

For further information regarding treasury constant maturity data, please refer to the H.15 Statistical Release notes and the Treasury Yield Curve Methodology.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Market Yield on U.S. Treasury Securities at 30-Year Constant Maturity, Quoted on an Investment Basis, Inflation-Indexed [FII30], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/FII30, .

RELEASE TABLES

RELATED DATA AND CONTENT

Data Suggestions Based On Your Search

Content Suggestions

Other Formats

Households; Owner-Occupied Real Estate Including Vacant Land and Mobile Homes at Market Value, Market Value Levels

Millions of Dollars, Annual, Not Seasonally Adjusted30-Year 3-5/8% Treasury Inflation-Indexed Bond, Due 4/15/2028 (DISCONTINUED)

Weekly, Not Seasonally AdjustedMarket Yield on U.S. Treasury Securities at 30-Year Constant Maturity, Quoted on an Investment Basis, Inflation-Indexed

Annual, Not Seasonally Adjusted Daily, Not Seasonally Adjusted Weekly, Not Seasonally Adjusted