Federal Reserve Economic Data

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Notes

Source: National Bureau of Economic Research

Release: NBER Macrohistory Database

Units: Percent, Not Seasonally Adjusted

Frequency: Monthly

Notes:

Series Is Presented Here As Two Variables--(1)--Original Data, 1871-1938 (2)--Original Data, 1926-1969. The Index For 1926-February 1957 Is Based On Daily Quotations For Ninety Stocks; The Index For March 1957-1969 Is Based On Daily Quotations For Five Hundred Stocks. Source: Standard And Poor'S, Data For 1926-1963: Trade And Security Statistics: Security Price Index Record, 1964 Edition. Data For 1964-1969: Current Statistics, Monthly Issues.

This NBER data series m13046b appears on the NBER website in Chapter 13 at http://www.nber.org/databases/macrohistory/contents/chapter13.html.

NBER Indicator: m13046b

Suggested Citation:

National Bureau of Economic Research, Dividend Yield of Common Stocks on the New York Stock Exchange, Composite Index for United States [M1346BUSM156NNBR], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/M1346BUSM156NNBR, .

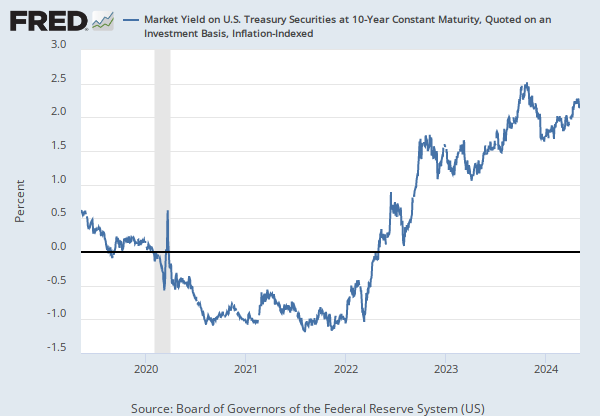

Source: Board of Governors of the Federal Reserve System (US)

Release: H.15 Selected Interest Rates

Units: Percent, Not Seasonally Adjusted

Frequency: Daily

Notes:

For further information regarding treasury constant maturity data, please refer to the H.15 Statistical Release notes and Treasury Yield Curve Methodology.

For questions on the data, please contact the data source. For questions on FRED functionality, please contact us here.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity, Quoted on an Investment Basis [DGS10], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DGS10, .

Source: National Bureau of Economic Research

Release: NBER Macrohistory Database

Units: Percent, Not Seasonally Adjusted

Frequency: Monthly

Notes:

Series Is Presented Here As Two Variables--(1)--Original Data, 1919-1944 (2)--Original Data, 1941-1967. Yield Is The Average For Taxable U.S. Bonds, Averages Being Computed On Basis Of The Mean Of Closing Bid And Ask Quotations On The Over-The-Counter-Market In New York City. Data For 1941-March 1952 Refer To Bonds Which Were Neither Due Or Callable For At Least Fifteen Years; Data For April 1952-March 1953, At Least Twelve Years; Data For April 1953-October 1955, From Twelve To Twenty Years; For November 1955-1967, From Ten To Twenty Years. Data For 1958-1962 Were Figured On Averages Of Daily Figures, Therefore Discrepancies May Result When Averages Of Weekly Figures Are Taken. Source: U.S. Treasury Department, Treasury Bulletin Of February 1948, And Following Monthly Issues (See Issues Of Federal Reserve Board Bulletins, May 1945, October 1947, January 1958, P. 84, And Following Monthly Issues.

This NBER data series m13033b appears on the NBER website in Chapter 13 at http://www.nber.org/databases/macrohistory/contents/chapter13.html.

NBER Indicator: m13033b

Suggested Citation:

National Bureau of Economic Research, Yield on Long-Term United States Bonds for United States [M1333BUSM156NNBR], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/M1333BUSM156NNBR, .

Source: National Bureau of Economic Research

Release: NBER Macrohistory Database

Units: Percent, Not Seasonally Adjusted

Frequency: Monthly

Notes:

Series 13046 Is Presented Here As Two Variables--(1)--Original Data, 1871-1938 (2)--Original Data, 1926-1969. The Rates Represent Expected Annual Dividend Payments Divided By Total Stock Vallues For Each Month. The Stock Exchange Was Closed August-November Of 1914, Therefore Data Was Interpolated. Source: Alfred Cowles Iii And Associates, Commonstock Indexes, Second Edition, 1939.

This NBER data series m13046a appears on the NBER website in Chapter 13 at http://www.nber.org/databases/macrohistory/contents/chapter13.html.

NBER Indicator: m13046a

Suggested Citation:

National Bureau of Economic Research, Dividend Yield of Common Stocks on the New York Stock Exchange for United States [M1346AUSM156NNBR], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/M1346AUSM156NNBR, .

Release Tables

Related Data and Content

Data Suggestions Based On Your Search

Content Suggestions

Other Formats

Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity, Quoted on an Investment Basis

Annual, Not Seasonally Adjusted Monthly, Not Seasonally Adjusted Weekly, Not Seasonally AdjustedYield on Long-Term United States Bonds for United States

Monthly, Not Seasonally AdjustedRelated Categories

Releases

Tags

Permalink/Embed

modal open, choose link customization options

Select automatic updates to the data or a static time frame. All data are subject to revision.