Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Notes

Source: Chicago Board Options Exchange

Release: CBOE Market Statistics

Units: Index, Not Seasonally Adjusted

Frequency: Daily, Close

Notes:

Copyright, 2016, Chicago Board Options Exchange, Inc. Reprinted with permission.

Suggested Citation:

Chicago Board Options Exchange, CBOE 10-Year Treasury Note Volatility Futures (DISCONTINUED) [VXTYN], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/VXTYN, .

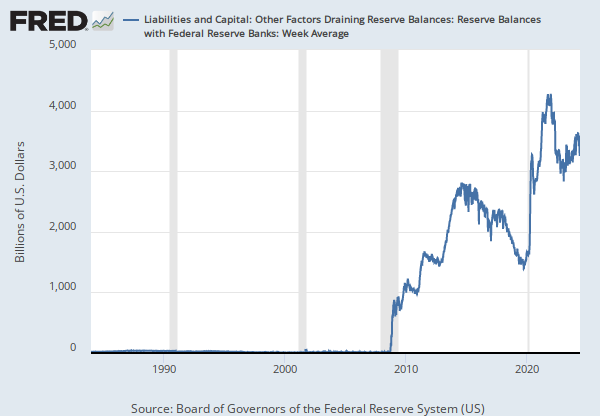

Source: Board of Governors of the Federal Reserve System (US)

Units: Percent, Not Seasonally Adjusted

Frequency: Daily

Notes:

Kim and Wright (2005) produced this data by fitting a simple three-factor arbitrage-free term structure model to U.S. Treasury yields since 1990, in order to evaluate the behavior of long-term yields, distant-horizon forward rates, and term premiums. For the full paper, please go to http://www.federalreserve.gov/pubs/feds/2005/200533/200533abs.html

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Term Premium on a 10 Year Zero Coupon Bond [THREEFYTP10], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/THREEFYTP10, .

Release Tables

Related Data and Content

Data Suggestions Based On Your Search

Content Suggestions

Related Categories

Releases

Tags

Permalink/Embed

modal open, choose link customization options

Select automatic updates to the data or a static time frame. All data are subject to revision.