Federal Reserve Economic Data

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Notes

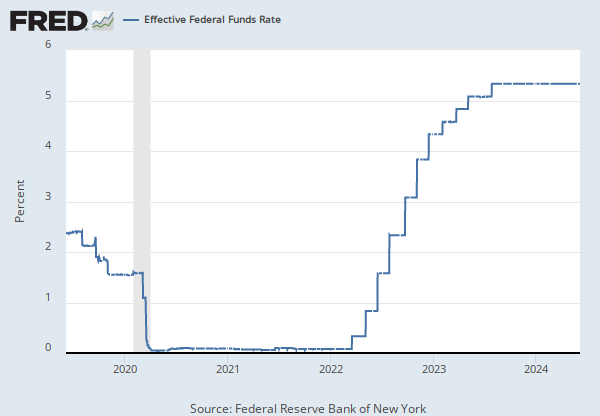

Source: Federal Reserve Bank of New York

Release: Federal Funds Data

Units: Percent, Not Seasonally Adjusted

Frequency: Daily

Notes:

For additional historical federal funds rate data, please see Daily Federal Funds Rate from 1928-1954.

The federal funds market consists of domestic unsecured borrowings in U.S. dollars by depository institutions from other depository institutions and certain other entities, primarily government-sponsored enterprises.

The effective federal funds rate (EFFR) is calculated as a volume-weighted median of overnight federal funds transactions reported in the FR 2420 Report of Selected Money Market Rates.

For more information, visit the Federal Reserve Bank of New York.

Suggested Citation:

Federal Reserve Bank of New York, Effective Federal Funds Rate [EFFR], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/EFFR, .

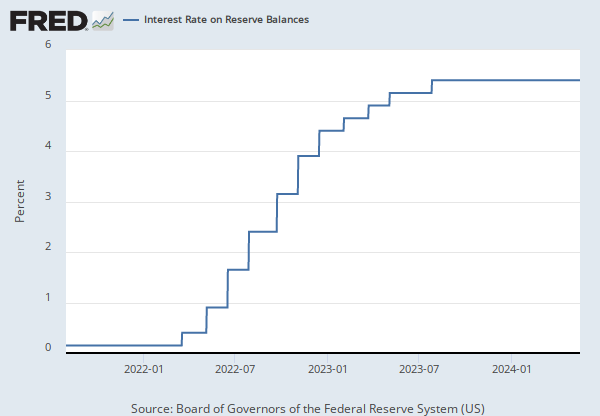

Source: Board of Governors of the Federal Reserve System (US)

Release: FOMC Press Release

Units: Percent, Not Seasonally Adjusted

Frequency: Daily, 7-Day

Notes:

This series represents upper limit of the federal funds target range established by the Federal Open Market Committee. The data updated each day is the data effective as of that day.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Federal Funds Target Range - Upper Limit [DFEDTARU], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DFEDTARU, .

Source: Board of Governors of the Federal Reserve System (US)

Release: FOMC Press Release

Units: Percent, Not Seasonally Adjusted

Frequency: Daily, 7-Day

Notes:

This series represents lower limit of the federal funds target range established by the Federal Open Market Committee. The data updated each day is the data effective as of that day.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Federal Funds Target Range - Lower Limit [DFEDTARL], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DFEDTARL, .

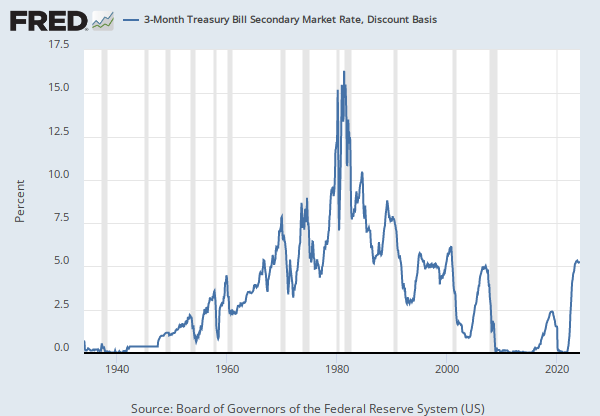

Source: Board of Governors of the Federal Reserve System (US)

Release: H.15 Selected Interest Rates

Units: Percent, Not Seasonally Adjusted

Frequency: Daily

Notes:

Discount Basis

For questions on the data, please contact the data source. For questions on FRED functionality, please contact us here.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), 3-Month Treasury Bill Secondary Market Rate, Discount Basis [DTB3], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DTB3, .

Release Tables

Related Data and Content

Data Suggestions Based On Your Search

Content Suggestions

Other Formats

Related Categories

Releases

Tags

Permalink/Embed

modal open, choose link customization options

Select automatic updates to the data or a static time frame. All data are subject to revision.