Federal Reserve Economic Data

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Notes

Source: Board of Governors of the Federal Reserve System (US)

Release: Interest Rate on Reserve Balances

Units: Percent, Not Seasonally Adjusted

Frequency: Daily, 7-Day

Notes:

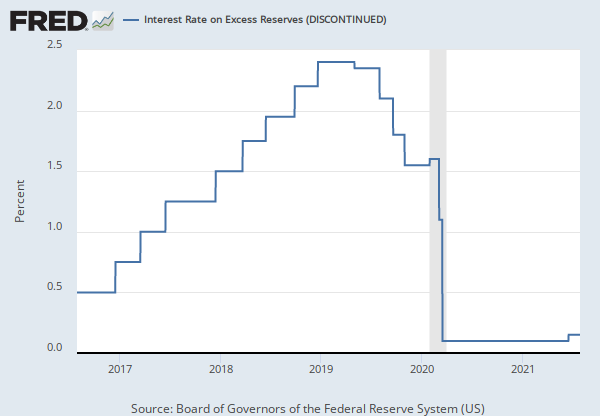

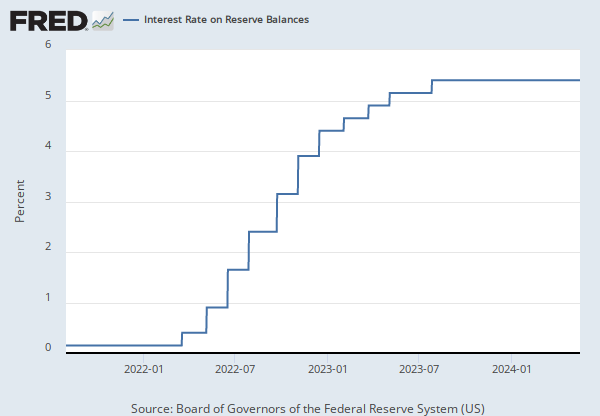

Starting July 29, 2021, the interest rate on excess reserves (IOER) and the interest rate on required reserves (IORR) were replaced with a single rate, the interest rate on reserve balances (IORB). See the source's announcement for more details.

The interest rate on excess reserves (IOER rate) is determined by the Board of Governors and gives the Federal Reserve an additional tool to conduct monetary policy.

See Policy Tools for more information.

For questions on FRED functionality, please contact us here.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Interest Rate on Excess Reserves (IOER Rate) (DISCONTINUED) [IOER], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/IOER, .

Source: Board of Governors of the Federal Reserve System (US)

Release: Interest Rate on Reserve Balances

Units: Percent, Not Seasonally Adjusted

Frequency: Daily, 7-Day

Notes:

Starting July 29, 2021, the interest rate on excess reserves (IOER) and the interest rate on required reserves (IORR) were replaced with a single rate, the interest rate on reserve balances (IORB). See the source's announcement for more details.

The interest rate on required reserves (IORR rate) is determined by the Board of Governors and is intended to eliminate effectively the implicit tax that reserve requirements used to impose on depository institutions.

See Policy Tools for more information.

For questions on FRED functionality, please contact us here.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Interest Rate on Required Reserves (IORR Rate) (DISCONTINUED) [IORR], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/IORR, .

Source: Board of Governors of the Federal Reserve System (US)

Release: H.15 Selected Interest Rates

Units: Percent, Not Seasonally Adjusted

Frequency: Daily

Notes:

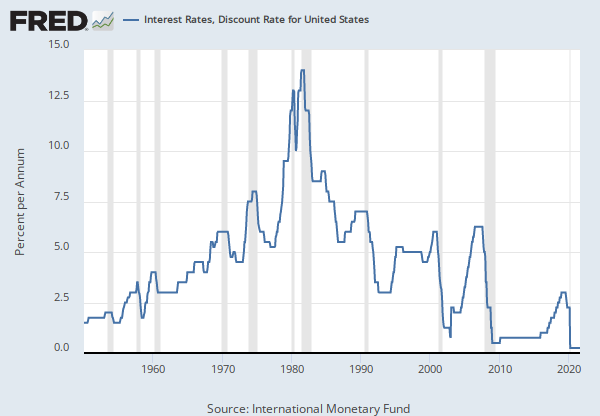

This data represent rate charged for discounts made and advances extended under the Federal Reserve's primary credit discount window program, which became effective January 9, 2003.

Primary credit is available to generally sound depository institutions at a rate set relative to the Federal Open Market Committee's (FOMC) target range for the federal funds rate. Depository institutions are not required to seek alternative sources of funds before requesting advances of primary credit. Primary credit may be used for any purpose, including financing the sale of federal funds. By making funds readily available at the primary credit rate the primary credit program complements open market operations in the implementation of monetary policy.

Reserve Banks ordinarily do not require depository institutions to provide reasons for requesting very short-term primary credit. Rather, borrowers are asked to provide only the minimum information necessary to process a loan, usually the amount and term of the loan.

This rate replaces that for adjustment credit, which was discontinued after January 8, 2003. For further information, see Board of Governor's announcement. The rate reported is that for the Federal Reserve Bank of New York.

For questions on the data, please contact the data source. For questions on FRED functionality, please contact us here.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Discount Window Primary Credit Rate [DPCREDIT], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DPCREDIT, .

Source: Board of Governors of the Federal Reserve System (US)

Release: FOMC Press Release

Units: Percent, Not Seasonally Adjusted

Frequency: Daily, 7-Day

Notes:

This series represents upper limit of the federal funds target range established by the Federal Open Market Committee. The data updated each day is the data effective as of that day.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Federal Funds Target Range - Upper Limit [DFEDTARU], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DFEDTARU, .

Source: Board of Governors of the Federal Reserve System (US)

Release: H.15 Selected Interest Rates

Units: Percent, Not Seasonally Adjusted

Frequency: Daily, 7-Day

Notes:

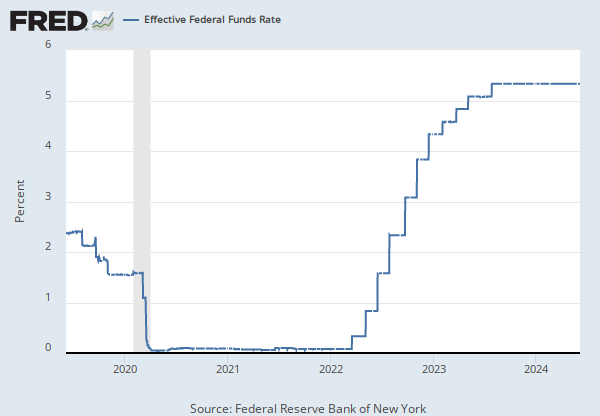

For additional historical federal funds rate data, please see Daily Federal Funds Rate from 1928-1954.

The federal funds rate is the interest rate at which depository institutions trade federal funds (balances held at Federal Reserve Banks) with each other overnight. When a depository institution has surplus balances in its reserve account, it lends to other banks in need of larger balances. In simpler terms, a bank with excess cash, which is often referred to as liquidity, will lend to another bank that needs to quickly raise liquidity. (1) The rate that the borrowing institution pays to the lending institution is determined between the two banks; the weighted average rate for all of these types of negotiations is called the effective federal funds rate.(2) The effective federal funds rate is essentially determined by the market but is influenced by the Federal Reserve as it uses the Interest on Reserve Balances rate to steer the federal funds rate toward the target range.(2)

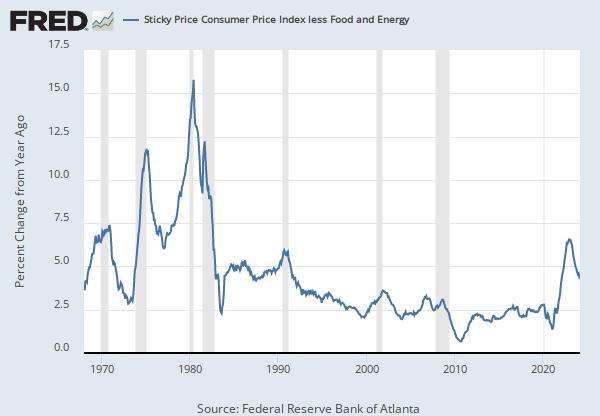

The Federal Open Market Committee (FOMC) meets eight times a year to determine the federal funds target range. The Fed's primary tool for influencing the federal funds rate is the interest the Fed pays on the funds that banks hold as reserve balances at their Federal Reserve Bank, which is the Interest on Reserves Balances (IORB) rate. Because banks are unlikely to lend funds in the federal funds market for less than they get paid in their reserve balance account at the Federal Reserve, the Interest on Reserve Balances (IORB) is an effective tool for guiding the federal funds rate. (3) Whether the Federal Reserve raises or lowers the target range for the federal funds rate depends on the state of the economy. If the FOMC believes the economy is growing too fast and inflation pressures are inconsistent with the dual mandate of the Federal Reserve, the Committee may temper economic activity by raising the target range for federal funds rate, and increasing the IORB rate to steer the federal funds rate into the target range. In the opposing scenario, the FOMC may spur greater economic activity by lowering the target range for federal funds rate, and decreasing the IORB rate to steer the federal funds rate into the target range. (3) Therefore, the FOMC must observe the current state of the economy to determine the best course of monetary policy that will maximize economic growth while adhering to the dual mandate set forth by Congress. In making its monetary policy decisions, the FOMC considers a wealth of economic data, such as: trends in prices and wages, employment, consumer spending and income, business investments, and foreign exchange markets.

The federal funds rate is the central interest rate in the U.S. financial market. It influences other interest rates such as the prime rate, which is the rate banks charge their customers with higher credit ratings. Additionally, the federal funds rate indirectly influences longer- term interest rates such as mortgages, loans, and savings, all of which are very important to consumer wealth and confidence.(2)

References

(1) Federal Reserve Bank of New York. "Federal funds." Fedpoints, August 2007.

(2) Monetary Policy, Board of Governors of the Federal Reserve System.

(3) The Fed Explained, Board of Governors of the Federal Reserve System

For further information, see The Fed's New Monetary Policy Tools, Page One Economics, Federal Reserve Bank of St. Louis.

For questions on the data, please contact the data source. For questions on FRED functionality, please contact us here.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Federal Funds Effective Rate [DFF], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DFF, .

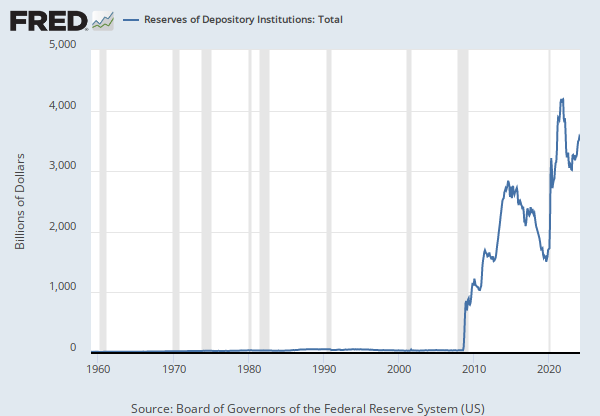

Source: Federal Reserve Bank of St. Louis

Release: H.3 Aggregate Reserves of Depository Institutions and the Monetary Base (data not included in press release)

Units: Millions of Dollars, Not Seasonally Adjusted

Frequency: Weekly, Ending Wednesday

Notes:

The Board of Governors discontinued the H.3 statistical release on September 17, 2020. For more information, please see the announcement posted on August 20, 2020.

Series is calculated using data from the H.3 release as Total reserve balances maintained (RESBALNSW) less Reserve balance requirements (RESBALREQW).

Effective February 2, 1984, reserve computation and maintenance periods have been changed from weekly to bi-weekly. Series with data prior to February 2, 1984 have different values reported from one week to the next. After February 2, 1984, the value repeats for 2 consecutive weeks.

Please note though that this historical concept of "excess reserves" no longer has the same meaning following phase two of the simplification of reserves administration. https://federalregister.gov/a/2012-8562

Suggested Citation:

Federal Reserve Bank of St. Louis, Excess Reserves of Depository Institutions (DISCONTINUED) [EXCSRESNW], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/EXCSRESNW, .

Release Tables

Related Data and Content

Data Suggestions Based On Your Search

Content Suggestions

Other Formats

Discount Window Primary Credit Rate

Annual, Not Seasonally Adjusted Daily, Not Seasonally Adjusted Monthly, Not Seasonally Adjusted Weekly, Not Seasonally AdjustedFederal Funds Effective Rate

Annual, Not Seasonally Adjusted Biweekly, Not Seasonally Adjusted Daily, Not Seasonally Adjusted Monthly, Not Seasonally Adjusted Weekly, Not Seasonally AdjustedExcess Reserves of Depository Institutions (DISCONTINUED)

Billions of Dollars, Monthly, Not Seasonally Adjusted Monthly, Not Seasonally AdjustedRelated Categories

Releases

Tags

Permalink/Embed

modal open, choose link customization options

Select automatic updates to the data or a static time frame. All data are subject to revision.