Federal Reserve Economic Data

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Notes

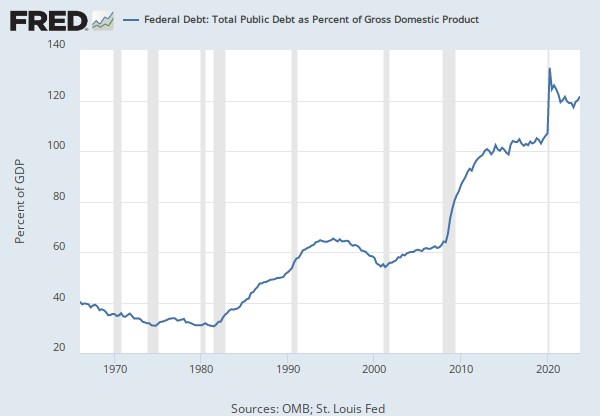

Source: U.S. Office of Management and Budget

Source: Federal Reserve Bank of St. Louis

Release: Debt to Gross Domestic Product Ratios

Units: Percent of GDP, Seasonally Adjusted

Frequency: Quarterly

Notes:

Federal Debt: Total Public Debt as Percent of Gross Domestic Product (GFDEGDQ188S) was first constructed by the Federal Reserve Bank of St. Louis in October 2012. It is calculated using Federal Government Debt: Total Public Debt (GFDEBTN) and Gross Domestic Product, 1 Decimal (GDP):

GFDEGDQ188S = ((GFDEBTN/1000)/GDP)*100

GFDEBTN/1000 transforms GFDEBTN from millions of dollars to billions of dollars.

Suggested Citation:

U.S. Office of Management and Budget and Federal Reserve Bank of St. Louis, Federal Debt: Total Public Debt as Percent of Gross Domestic Product [GFDEGDQ188S], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/GFDEGDQ188S, .

Source: Board of Governors of the Federal Reserve System (US)

Release: Z.1 Financial Accounts of the United States

Units: Millions of U.S. Dollars, Not Seasonally Adjusted

Frequency: Quarterly, End of Period

Notes:

For more information about the Flow of Funds tables, see the Financial Accounts Guide.

With each quarterly release, the source may make major data and structural revisions to the series and tables. These changes are available in the Release Highlights.

In the Financial Accounts, the source identifies each series by a string of patterned letters and numbers. For a detailed description, including how this series is constructed, see the series analyzer provided by the source.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Nonfinancial Corporate Business; Debt Securities; Liability, Level [NCBDBIQ027S], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/NCBDBIQ027S, .

Source: Bank for International Settlements

Release: International Debt Securities

Units: Millions of US Dollars, Not Seasonally Adjusted

Frequency: Quarterly

Notes:

This series appears in Table 16b.

Source Code: Q:CN:3P:J:1:A:A:A:TO1:A:A:A:A:A:I

Nationality refers to the ultimate obligor, as opposed to the immediate borrower on a residence basis, and is linked to the consolidation of assets and liabilities for related entities. Information on a nationality basis is useful to analyse potential support that might be available from the parent company and to understand links between borrowers in different countries and sectors.

For example, the debts of a Cayman Islands subsidiary of a Brazilian bank may be guaranteed by the parent bank. Consistent with the approach taken in the international banking statistics, the BIS bases the nationality of an issuer on the residency of its controlling parent, regardless of any intermediate owners. (December 2012, BIS Quarterly Review, https://www.bis.org/publ/qtrpdf/r_qt1212h.pdf)

Copyright, 2016, Bank for International Settlements (BIS). Terms and conditions of use are available at http://www.bis.org/terms_conditions.htm#Copyright_and_Permissions.

Suggested Citation:

Bank for International Settlements, Amount Outstanding of Domestic Debt Securities for Non-financial Corporations Issuers, All Maturities, Residence of Issuer in China [DSAMRIAONCCN], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DSAMRIAONCCN, .

Release Tables

Related Data and Content

Data Suggestions Based On Your Search

Content Suggestions

Other Formats

Related Categories

Releases

Tags

Permalink/Embed

modal open, choose link customization options

Select automatic updates to the data or a static time frame. All data are subject to revision.