Federal Reserve Economic Data

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Notes

Source: Federal Reserve Bank of St. Louis

Release: Money Velocity

Units: Ratio, Seasonally Adjusted

Frequency: Quarterly

Notes:

This series has been discontinued and will no longer be updated. The institutional money market funds component (IMFSL) used to calculate MZM has been discontinued by the Board of Governors and is no longer available in the H.6 statistical release, Money Stock Measures. For further information about the changes to the H.6 statistical release, please see the announcements provided by the source.

Calculated as the ratio of quarterly nominal GDP (GDP) to the quarterly average of MZM money stock (MZMSL).

The velocity of money is the frequency at which one unit of currency is used to purchase domestically- produced goods and services within a given time period. In other words, it is the number of times one dollar is spent to buy goods and services per unit of time. If the velocity of money is increasing, then more transactions are occurring between individuals in an economy.

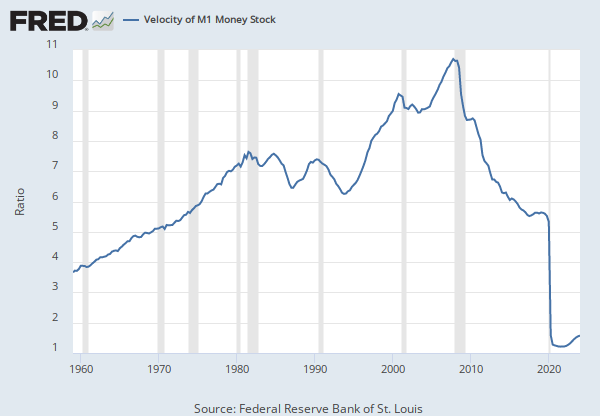

The frequency of currency exchange can be used to determine the velocity of a given component of the money supply, providing some insight into whether consumers and businesses are saving or spending their money. There are several components of the money supply,: M1, M2, and MZM (M3 is no longer tracked by the Federal Reserve); these components are arranged on a spectrum of narrowest to broadest. Consider M1, the narrowest component. M1 is the money supply of currency in circulation (notes and coins, traveler’s checks [non-bank issuers], demand deposits, and checkable deposits). A decreasing velocity of M1 might indicate fewer short- term consumption transactions are taking place. We can think of shorter- term transactions as consumption we might make on an everyday basis.

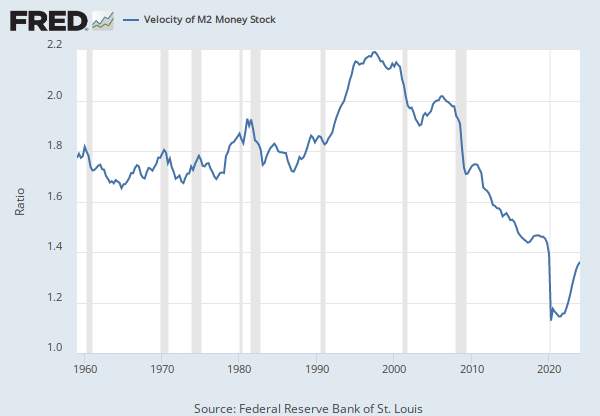

The broader M2 component includes M1 in addition to saving deposits, certificates of deposit (less than $100,000), and money market deposits for individuals. Comparing the velocities of M1 and M2 provides some insight into how quickly the economy is spending and how quickly it is saving.

MZM (money with zero maturity) is the broadest component and consists of the supply of financial assets redeemable at par on demand: notes and coins in circulation, traveler’s checks (non-bank issuers), demand deposits, other checkable deposits, savings deposits, and all money market funds. The velocity of MZM helps determine how often financial assets are switching hands within the economy.

Suggested Citation:

Federal Reserve Bank of St. Louis, Velocity of MZM Money Stock (DISCONTINUED) [MZMV], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/MZMV, .

Source: U.S. Bureau of Labor Statistics

Release: Employment Situation

Units: Thousands of Persons, Seasonally Adjusted

Frequency: Monthly

Notes:

The series comes from the 'Current Population Survey (Household Survey)'

The source code is: LNS13000000

The Unemployment Level is the aggregate measure of people currently unemployed in the US. Someone in the labor force is defined as unemployed if they were not employed during the survey reference week, were available for work, and made at least one active effort to find a job during the 4-week survey period.

The Unemployment Level is collected in the CPS and published by the BLS. It is provided on a monthly basis, so this data is used in part by macroeconomists as an initial economic indicator of current trends. The Unemployment Level helps government agencies, financial markets, and researchers gauge the overall health of the economy.

Note that individuals that are not employed but not actively looking for a job are not counted as unemployed. For instance, declines in the Unemployment Level may either reflect movements of unemployed individuals into the labor force because they found a job, or movements of unemployed individuals out of the labor force because they stopped looking to find a job.

For more information, see:

U.S. Bureau of Labor Statistics, CES Overview

U.S. Bureau of Labor Statistics, BLS Handbook of Methods: Chapter 2. Employment, Hours, and Earnings from the Establishment Survey

Suggested Citation:

U.S. Bureau of Labor Statistics, Unemployment Level [UNEMPLOY], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/UNEMPLOY, .

Release Tables

Related Data and Content

Data Suggestions Based On Your Search

Content Suggestions

Other Formats

Related Categories

Releases

Tags

Permalink/Embed

modal open, choose link customization options

Select automatic updates to the data or a static time frame. All data are subject to revision.