Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Notes

Source: U.S. Department of the Treasury

Release: Corporate Bond Yield Curve

Units: Percent, Not Seasonally Adjusted

Frequency: Monthly

Notes:

The spot rate for any maturity is defined as the yield on a bond that gives a single payment at that maturity. This is called a zero coupon bond. Because high quality zero coupon bonds are not generally available, the HQM methodology computes the spot rates so as to make them consistent with the yields on other high quality bonds. The HQM yield curve uses data from a set of high quality corporate bonds rated AAA, AA, or A that accurately represent the high quality corporate bond market.

The HQM methodology projects yields beyond 30 years maturity out to 100 years maturity to get discount rates for long-dated pension liabilities.

For more information see https://www.treasury.gov/resource-center/economic-policy/corp-bond-yield/Pages/Corp-Yield-Bond-Curve-Papers.aspx

Suggested Citation:

U.S. Department of the Treasury, 3-Year High Quality Market (HQM) Corporate Bond Spot Rate [HQMCB3YR], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/HQMCB3YR, .

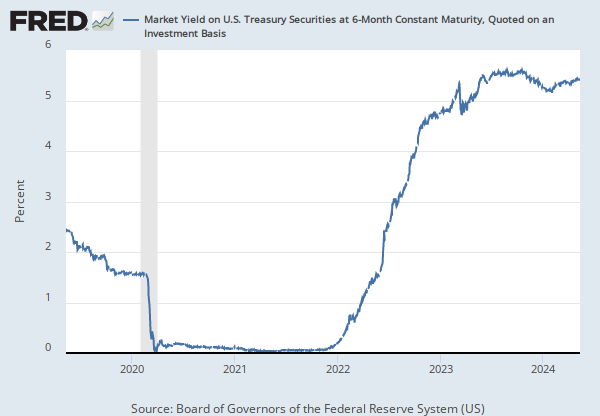

Source: Board of Governors of the Federal Reserve System (US)

Release: H.15 Selected Interest Rates

Units: Percent, Not Seasonally Adjusted

Frequency: Daily

Notes:

For further information regarding treasury constant maturity data, please refer to the H.15 Statistical Release notes and the Treasury Yield Curve Methodology.

For questions on the data, please contact the data source. For questions on FRED functionality, please contact us here.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Market Yield on U.S. Treasury Securities at 3-Year Constant Maturity, Quoted on an Investment Basis [DGS3], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DGS3, .

Release Tables

Permalink/Embed

modal open, choose link customization options

Select automatic updates to the data or a static time frame. All data are subject to revision.