Observations

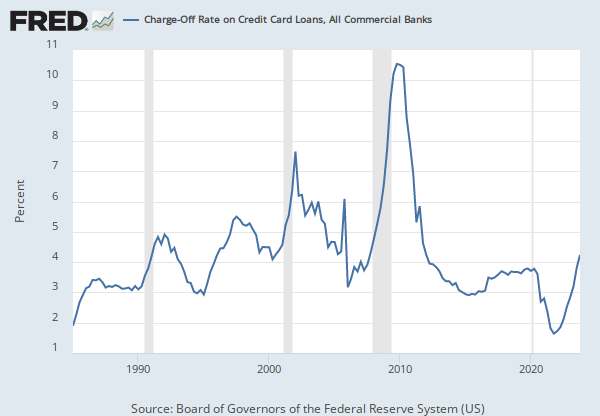

Q4 2025: 8.32 | Percent, Not Seasonally Adjusted | Quarterly

Updated: Feb 24, 2026 1:20 PM CST

Next Release Date: Not Available

Observations

Q4 2025:

8.32

Updated:

Feb 24, 2026

1:20 PM CST

Next Release Date:

Not Available

| Q4 2025: | 8.32 | |

| Q3 2025: | 8.23 | |

| Q2 2025: | 8.89 | |

| Q1 2025: | 9.25 | |

| Q4 2024: | 9.28 | |

| View All | ||

Units:

Percent,

Not Seasonally Adjusted

Frequency:

Quarterly

Fullscreen