Observations

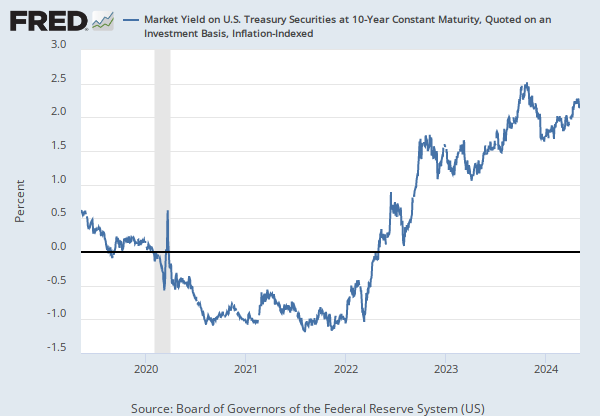

2012-07-13: 0.47 |

Percent, Not Seasonally Adjusted |

Weekly,

Ending Friday

Updated: Jul 16, 2012 6:02 AM CDT

Next Release Date: Not Available

Observations

2012-07-13:

0.47

Updated:

Jul 16, 2012

6:02 AM CDT

Next Release Date:

Not Available

| 2012-07-13: | 0.47 | |

| 2012-07-06: | 2.29 | |

| 2012-06-29: | 1.12 | |

| 2012-06-22: | -0.24 | |

| 2012-06-15: | -0.87 | |

| View All | ||

Units:

Percent,

Not Seasonally Adjusted

Frequency:

Weekly,

Ending Friday

Fullscreen