Observations

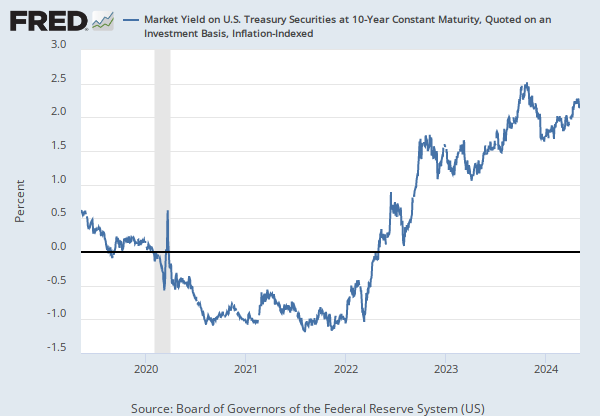

2020-07-10: -1.6904 |

Percent, Not Seasonally Adjusted |

Weekly,

Ending Friday

Updated: Jul 13, 2020 9:07 AM CDT

Next Release Date: Not Available

Observations

2020-07-10:

-1.6904

Updated:

Jul 13, 2020

9:07 AM CDT

Next Release Date:

Not Available

| 2020-07-10: | -1.6904 | |

| 2020-07-03: | -1.2275 | |

| 2020-06-26: | 2.1138 | |

| 2020-06-19: | 3.1746 | |

| 2020-06-12: | 4.2568 | |

| View All | ||

Units:

Percent,

Not Seasonally Adjusted

Frequency:

Weekly,

Ending Friday

Fullscreen