Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Notes

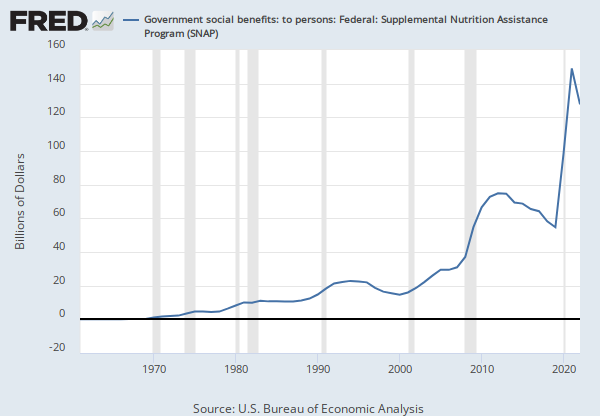

Source: U.S. Bureau of Economic Analysis

Release: Gross Domestic Product

Units: Billions of Dollars, Not Seasonally Adjusted

Frequency: Annual

Notes:

BEA Account Code: Y282RC

A Guide to the National Income and Product Accounts of the United States (NIPA) - (http://www.bea.gov/national/pdf/nipaguid.pdf)

Suggested Citation:

U.S. Bureau of Economic Analysis, Federal Government Defined Benefit Pension Plans: Current receipts, accrual basis: Income receipts on assets: Interest: Imputed interest on plans' claims on employers [Y282RC1A027NBEA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/Y282RC1A027NBEA, .

Release Tables

Related Data and Content

Data Suggestions Based On Your Search

Content Suggestions

Related Categories

Releases

Tags

Permalink/Embed

modal open, choose link customization options

Select automatic updates to the data or a static time frame. All data are subject to revision.