Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Notes

Source: Freddie Mac

Release: Primary Mortgage Market Survey

Units: Percent, Not Seasonally Adjusted

Frequency: Weekly, Ending Thursday

Notes:

On November 17, 2022, Freddie Mac changed the methodology of the Primary Mortgage Market Survey® (PMMS®). The weekly mortgage rate is now based on applications submitted to Freddie Mac from lenders across the country. For more information regarding Freddie Mac’s enhancement, see their research note.

Data are provided “as is” by Freddie Mac®, with no warranties of any kind, express or implied, including but not limited to warranties of accuracy or implied warranties of merchantability or fitness for a particular purpose. Use of the data is at the user’s sole risk. In no event will Freddie Mac be liable for any damages arising out of or related to the data, including but not limited to direct, indirect, incidental, special, consequential, or punitive damages, whether under a contract, tort, or any other theory of liability, even if Freddie Mac is aware of the possibility of such damages.

Copyright, 2016, Freddie Mac. Reprinted with permission.

Suggested Citation:

Freddie Mac, 30-Year Fixed Rate Mortgage Average in the United States [MORTGAGE30US], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/MORTGAGE30US, .

Source: Freddie Mac

Release: Primary Mortgage Market Survey

Units: Percent, Not Seasonally Adjusted

Frequency: Weekly, Ending Thursday

Notes:

On November 17, 2022, Freddie Mac changed the methodology of the Primary Mortgage Market Survey® (PMMS®). The weekly mortgage rate is now based on applications submitted to Freddie Mac from lenders across the country. For more information regarding Freddie Mac’s enhancement, see their research note.

Data are provided “as is” by Freddie Mac®, with no warranties of any kind, express or implied, including but not limited to warranties of accuracy or implied warranties of merchantability or fitness for a particular purpose. Use of the data is at the user’s sole risk. In no event will Freddie Mac be liable for any damages arising out of or related to the data, including but not limited to direct, indirect, incidental, special, consequential, or punitive damages, whether under a contract, tort, or any other theory of liability, even if Freddie Mac is aware of the possibility of such damages.

Copyright, 2016, Freddie Mac. Reprinted with permission.

Suggested Citation:

Freddie Mac, 15-Year Fixed Rate Mortgage Average in the United States [MORTGAGE15US], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/MORTGAGE15US, .

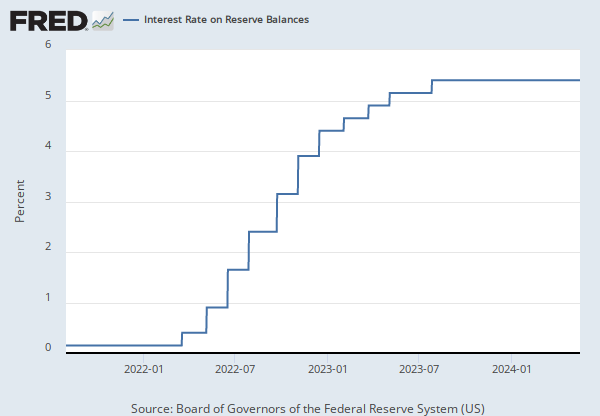

Source: Federal Reserve Bank of New York

Release: Federal Funds Data

Units: Percent, Not Seasonally Adjusted

Frequency: Daily

Notes:

For additional historical federal funds rate data, please see Daily Federal Funds Rate from 1928-1954.

The federal funds market consists of domestic unsecured borrowings in U.S. dollars by depository institutions from other depository institutions and certain other entities, primarily government-sponsored enterprises.

The effective federal funds rate (EFFR) is calculated as a volume-weighted median of overnight federal funds transactions reported in the FR 2420 Report of Selected Money Market Rates.

For more information, visit the Federal Reserve Bank of New York.

Suggested Citation:

Federal Reserve Bank of New York, Effective Federal Funds Rate [EFFR], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/EFFR, .

Release Tables

Related Data and Content

Data Suggestions Based On Your Search

Content Suggestions

Related Categories

Releases

Tags

Permalink/Embed

modal open, choose link customization options

Select automatic updates to the data or a static time frame. All data are subject to revision.