Federal Reserve Economic Data

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Notes

Source: Bank for International Settlements

Release: Credit to Non-Financial Sector

Units: Billions of US Dollars, Not Seasonally Adjusted

Frequency: Quarterly, End of Quarter

Notes:

Credit is provided by domestic banks, all other sectors of the economy and non-residents. The "private non-financial sector" includes non-financial corporations (both private-owned and public-owned), households and non-profit institutions serving households as defined in the System of National Accounts 2008. The series have quarterly frequency and capture the outstanding amount of credit at the end of the reference quarter. In terms of financial instruments, credit covers loans and debt securities.(1)

The combination of different sources and data from various methodological frameworks resulted in breaks in the series. The BIS is therefore, in addition, publishing a second set of series adjusted for breaks, which covers the same time span as the unadjusted series. The break-adjusted series are the result of the BIS's own calculations, and were obtained by adjusting levels through standard statistical techniques described in the special feature on the long credit series of the March 2013 issue of the BIS Quarterly Review at https://www.bis.org/publ/qtrpdf/r_qt1303h.htm. (1)

Source Code: Q:US:P:A:M:USD:A

(1) Bank for International Settlements. "Long series on credit to private non-financial sectors".https://www.bis.org/statistics/credtopriv.htm

Copyright, 2016, Bank for International Settlements (BIS). Terms and conditions of use are available at http://www.bis.org/terms_conditions.htm#Copyright_and_Permissions.

Suggested Citation:

Bank for International Settlements, Total Credit to Private Non-Financial Sector, Adjusted for Breaks, for United States [CRDQUSAPABIS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CRDQUSAPABIS, .

Source: Board of Governors of the Federal Reserve System (US)

Release: Z.1 Financial Accounts of the United States

Units: Millions of U.S. Dollars, Not Seasonally Adjusted

Frequency: Quarterly, End of Period

Notes:

For more information about the Flow of Funds tables, see the Financial Accounts Guide.

With each quarterly release, the source may make major data and structural revisions to the series and tables. These changes are available in the Release Highlights.

In the Financial Accounts, the source identifies each series by a string of patterned letters and numbers. For a detailed description, including how this series is constructed, see the series analyzer provided by the source.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Domestic Nonfinancial Sectors; Debt Securities and Loans; Liability, Level [TCMDODNS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/TCMDODNS, .

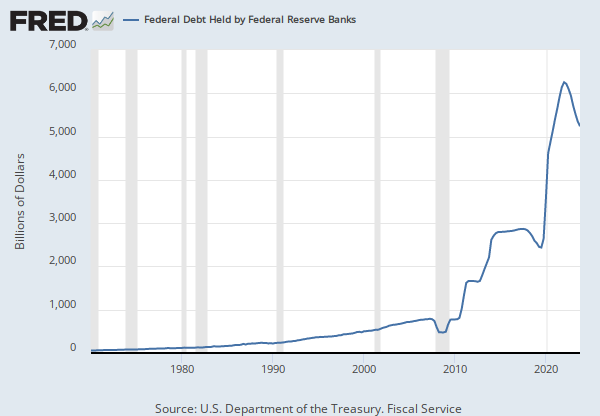

Source: U.S. Department of the Treasury. Fiscal Service

Release: Treasury Bulletin

Units: Millions of Dollars, Not Seasonally Adjusted

Frequency: Quarterly, End of Period

Suggested Citation:

U.S. Department of the Treasury. Fiscal Service, Federal Debt: Total Public Debt [GFDEBTN], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/GFDEBTN, .

Source: Bank for International Settlements

Release: Credit to Non-Financial Sector

Units: Billions of Chinese Renminbi Yuans, Not Seasonally Adjusted

Frequency: Quarterly, End of Quarter

Notes:

Credit is provided by domestic banks, all other sectors of the economy and non-residents. The "private non-financial sector" includes non-financial corporations (both private-owned and public-owned), households and non-profit institutions serving households as defined in the System of National Accounts 2008. The series have quarterly frequency and capture the outstanding amount of credit at the end of the reference quarter. In terms of financial instruments, credit covers loans and debt securities.(1)

The combination of different sources and data from various methodological frameworks resulted in breaks in the series. The BIS is therefore, in addition, publishing a second set of series adjusted for breaks, which covers the same time span as the unadjusted series. The break-adjusted series are the result of the BIS's own calculations, and were obtained by adjusting levels through standard statistical techniques described in the special feature on the long credit series of the March 2013 issue of the BIS Quarterly Review at https://www.bis.org/publ/qtrpdf/r_qt1303h.htm. (1)

Source Code: Q:CN:C:A:M:XDC:A

(1) Bank for International Settlements. "Long series on credit to private non-financial ://www.bis.org/statistics/credtopriv.htm

Copyright, 2016, Bank for International Settlements (BIS). Terms and conditions of use are available at http://www.bis.org/terms_conditions.htm#Copyright_and_Permissions.

Unless otherwise specified, series values are market values. For information specifying what comprises G20, Advanced Economies, Emerging Market Economies, and All Reporting Economies, visit https://www.bis.org/statistics/totcredit/tables_f.pdf

Suggested Citation:

Bank for International Settlements, Total Credit to Non-Financial Sector, Adjusted for Breaks, for China [QCNCAMXDCA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/QCNCAMXDCA, .

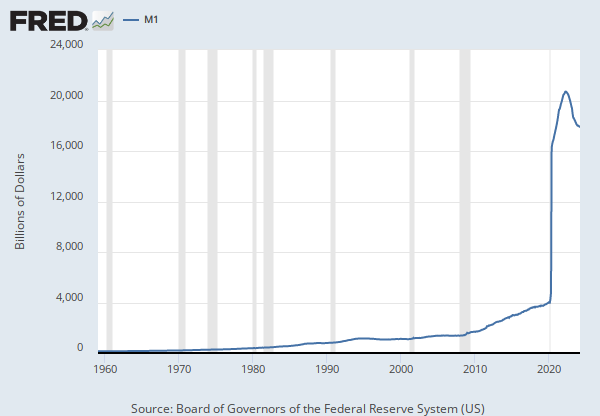

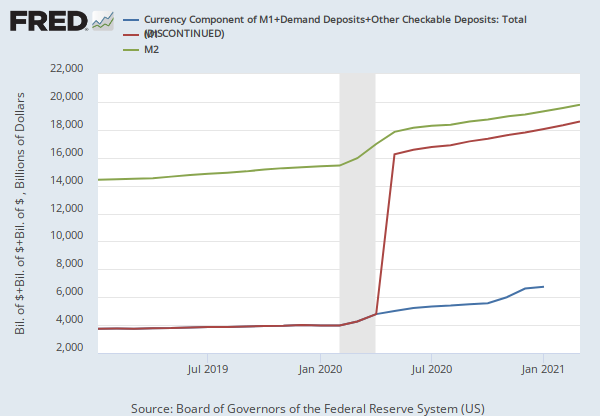

Source: Board of Governors of the Federal Reserve System (US)

Release: H.6 Money Stock Measures

Units: Billions of Dollars, Seasonally Adjusted

Frequency: Monthly

Notes:

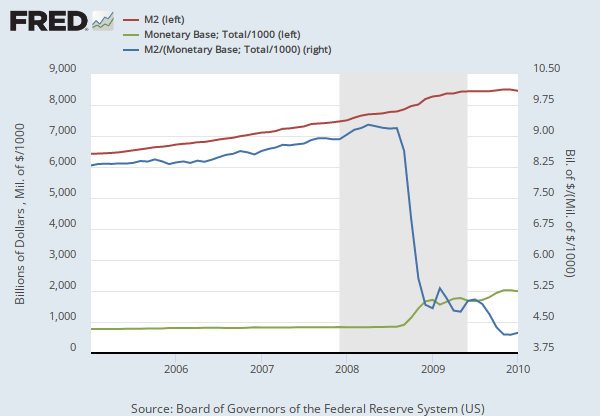

Before May 2020, M2 consists of M1 plus (1) savings deposits (including money market deposit accounts); (2) small-denomination time deposits (time deposits in amounts of less than $100,000) less individual retirement account (IRA) and Keogh balances at depository institutions; and (3) balances in retail money market funds (MMFs) less IRA and Keogh balances at MMFs.

Beginning May 2020, M2 consists of M1 plus (1) small-denomination time deposits (time deposits in amounts of less than $100,000) less IRA and Keogh balances at depository institutions; and (2) balances in retail MMFs less IRA and Keogh balances at MMFs. Seasonally adjusted M2 is constructed by summing savings deposits (before May 2020), small-denomination time deposits, and retail MMFs, each seasonally adjusted separately, and adding this result to seasonally adjusted M1.

For more information on the H.6 release changes and the regulatory amendment that led to the creation of the other liquid deposits component and its inclusion in the M1 monetary aggregate, see the H.6 announcements and Technical Q&As posted on December 17, 2020.

For questions on the data, please contact the data source. For questions on FRED functionality, please contact us here.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), M2 [M2SL], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/M2SL, .

Source: Bank for International Settlements

Release: Credit to Non-Financial Sector

Units: Percentage of GDP, Not Seasonally Adjusted

Frequency: Quarterly, End of Quarter

Notes:

Credit is provided by domestic banks, all other sectors of the economy and non-residents. The "private non-financial sector" includes non-financial corporations (both private-owned and public-owned), households and non-profit institutions serving households as defined in the System of National Accounts 2008. The series have quarterly frequency and capture the outstanding amount of credit at the end of the reference quarter. In terms of financial instruments, credit covers loans and debt securities.(1)

The combination of different sources and data from various methodological frameworks resulted in breaks in the series. The BIS is therefore, in addition, publishing a second set of series adjusted for breaks, which covers the same time span as the unadjusted series. The break-adjusted series are the result of the BIS's own calculations, and were obtained by adjusting levels through standard statistical techniques described in the special feature on the long credit series of the March 2013 issue of the BIS Quarterly Review at https://www.bis.org/publ/qtrpdf/r_qt1303h.htm. (1)

Source Code: Q:US:P:A:M:770:A

(1) Bank for International Settlements. "Long series on credit to private non-financial ://www.bis.org/statistics/credtopriv.htm

Copyright, 2016, Bank for International Settlements (BIS). Terms and conditions of use are available at http://www.bis.org/terms_conditions.htm#Copyright_and_Permissions.

Unless otherwise specified, series values are market values.

Suggested Citation:

Bank for International Settlements, Total Credit to Private Non-Financial Sector, Adjusted for Breaks, for United States [QUSPAM770A], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/QUSPAM770A, .

Source: Bank for International Settlements

Release: Credit to Non-Financial Sector

Units: Billions of US Dollars, Not Seasonally Adjusted

Frequency: Quarterly, End of Quarter

Notes:

Credit is provided by domestic banks, all other sectors of the economy and non-residents. The "private non-financial sector" includes non-financial corporations (both private-owned and public-owned), households and non-profit institutions serving households as defined in the System of National Accounts 2008. The series have quarterly frequency and capture the outstanding amount of credit at the end of the reference quarter. In terms of financial instruments, credit covers loans and debt securities.(1)

The combination of different sources and data from various methodological frameworks resulted in breaks in the series. The BIS is therefore, in addition, publishing a second set of series adjusted for breaks, which covers the same time span as the unadjusted series. The break-adjusted series are the result of the BIS's own calculations, and were obtained by adjusting levels through standard statistical techniques described in the special feature on the long credit series of the March 2013 issue of the BIS Quarterly Review at https://www.bis.org/publ/qtrpdf/r_qt1303h.htm. (1)

Source Code: Q:US:G:A:M:USD:A

(1) Bank for International Settlements. "Long series on credit to private non-financial ://www.bis.org/statistics/credtopriv.htm

Copyright, 2016, Bank for International Settlements (BIS). Terms and conditions of use are available at http://www.bis.org/terms_conditions.htm#Copyright_and_Permissions.

Unless otherwise specified, series values are market values.

Suggested Citation:

Bank for International Settlements, Total Credit to General Government, Adjusted for Breaks, for United States [QUSGAMUSDA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/QUSGAMUSDA, .

Source: Board of Governors of the Federal Reserve System (US)

Release: Z.1 Financial Accounts of the United States

Units: Millions of U.S. Dollars, Seasonally Adjusted Annual Rate

Frequency: Quarterly, End of Period

Notes:

For more information about the Flow of Funds tables, see the Financial Accounts Guide.

With each quarterly release, the source may make major data and structural revisions to the series and tables. These changes are available in the Release Highlights.

In the Financial Accounts, the source identifies each series by a string of patterned letters and numbers. For a detailed description, including how this series is constructed, see the series analyzer provided by the source.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Federal Government; Debt Securities and Loans; Liability, Level [FGSDODNS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/FGSDODNS, .

Release Tables

Related Data and Content

Data Suggestions Based On Your Search

Content Suggestions

Other Formats

Total Credit to Private Non-Financial Sector, Adjusted for Breaks, for United States

Quarterly, Not Seasonally Adjusted Percentage of GDP, Quarterly, Not Seasonally AdjustedDomestic Nonfinancial Sectors; Debt Securities and Loans; Liability, Level

Annual, Not Seasonally Adjusted Annual, Seasonally Adjusted Annual Rate Quarterly, Seasonally Adjusted Annual RateTotal Credit to Non-Financial Sector, Adjusted for Breaks, for China

Billions of US Dollars, Quarterly, Not Seasonally Adjusted Percentage of GDP, Quarterly, Not Seasonally AdjustedM2

Monthly, Not Seasonally Adjusted Weekly, Not Seasonally AdjustedTotal Credit to General Government, Adjusted for Breaks, for United States

Quarterly, Not Seasonally Adjusted Percentage of GDP, Quarterly, Not Seasonally AdjustedFederal Government; Debt Securities and Loans; Liability, Level

Annual, Not Seasonally Adjusted Annual, Seasonally Adjusted Annual Rate Quarterly, Not Seasonally AdjustedRelated Categories

Releases

Tags

Permalink/Embed

modal open, choose link customization options

Select automatic updates to the data or a static time frame. All data are subject to revision.