Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Notes

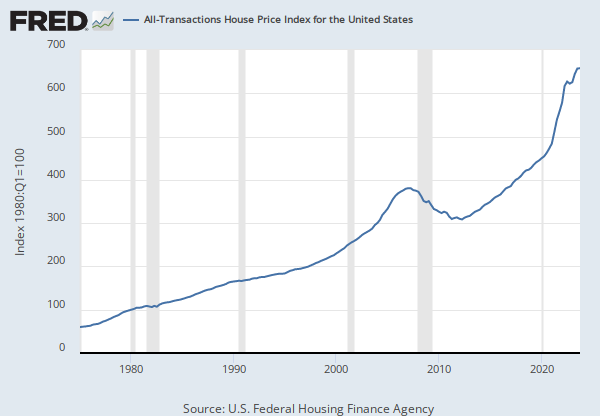

Source: U.S. Census Bureau

Source: U.S. Department of Housing and Urban Development

Release: New Residential Sales

Units: Dollars, Not Seasonally Adjusted

Frequency: Quarterly

Suggested Citation:

U.S. Census Bureau and U.S. Department of Housing and Urban Development, Median Sales Price of Houses Sold for the United States [MSPUS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/MSPUS, .

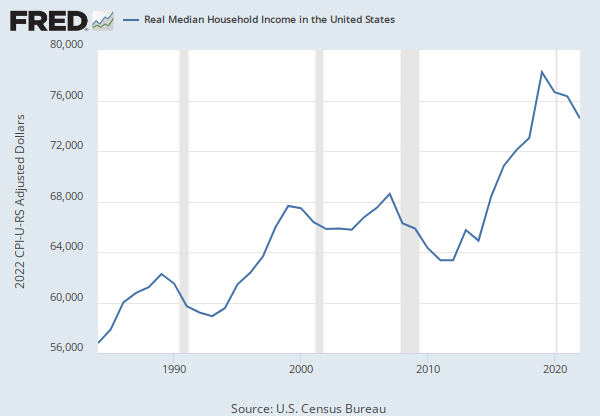

Source: U.S. Census Bureau

Release: Income and Poverty in the United States

Units: Current Dollars, Not Seasonally Adjusted

Frequency: Annual

Notes:

Household data are collected as of March.

As stated in the Census's "Source and Accuracy of Estimates for Income, Poverty, and Health Insurance Coverage in the United States: 2011" (http://www.census.gov/hhes/www/p60_243sa.pdf):

Estimation of Median Incomes. The Census Bureau has changed the methodology for computing median income over time. The Census Bureau has computed medians using either Pareto interpolation or linear interpolation. Currently, we are using linear interpolation to estimate all medians. Pareto interpolation assumes a decreasing density of population within an income interval, whereas linear interpolation assumes a constant density of population within an income interval. The Census Bureau calculated estimates of median income and associated standard errors for 1979 through 1987 using Pareto interpolation if the estimate was larger than $20,000 for people or $40,000 for families and households. This is because the width of the income interval containing the estimate is greater than $2,500.

We calculated estimates of median income and associated standard errors for 1976, 1977, and 1978 using Pareto interpolation if the estimate was larger than $12,000 for people or $18,000 for families and households. This is because the width of the income interval containing the estimate is greater than $1,000. All other estimates of median income and associated standard errors for 1976 through 2011 (2012 ASEC) and almost all of the estimates of median income and associated standard errors for 1975 and earlier were calculated using linear interpolation.

Thus, use caution when comparing median incomes above $12,000 for people or $18,000 for families and households for different years. Median incomes below those levels are more comparable from year to year since they have always been calculated using linear interpolation. For an indication of the comparability of medians calculated using Pareto interpolation with medians calculated using linear interpolation, see Series P-60, Number 114, Money Income in 1976 of Families and Persons in the United States (www2.census.gov/prod2/popscan/p60-114.pdf).

Suggested Citation:

U.S. Census Bureau, Median Household Income in the United States [MEHOINUSA646N], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/MEHOINUSA646N, .

Source: U.S. Census Bureau

Source: U.S. Department of Housing and Urban Development

Release: New Residential Sales

Units: Dollars, Not Seasonally Adjusted

Frequency: Quarterly

Suggested Citation:

U.S. Census Bureau and U.S. Department of Housing and Urban Development, Average Sales Price of Houses Sold for the United States [ASPUS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/ASPUS, .

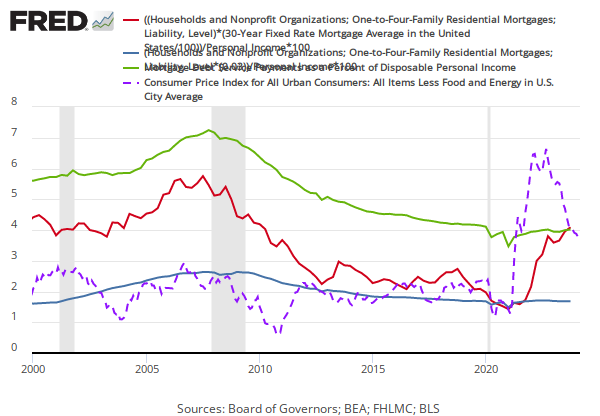

Source: U.S. Bureau of Economic Analysis

Release: Personal Income and Outlays

Units: Billions of Dollars, Seasonally Adjusted Annual Rate

Frequency: Monthly

Notes:

BEA Account Code: A065RC

Personal income is the income that persons receive in return for their provision of labor, land, and capital used in current production and the net current transfer payments that they receive from business and from government.25 Personal income is equal to national income minus corporate profits with inventory valuation and capital consumption adjustments, taxes on production and imports less subsidies, contributions for government social insurance, net interest and miscellaneous payments on assets, business current transfer payments (net), current surplus of government enterprises, and wage accruals less disbursements, plus personal income receipts on assets and personal current transfer receipts.

A Guide to the National Income and Product Accounts of the United States (NIPA) - (http://www.bea.gov/national/pdf/nipaguid.pdf)

Suggested Citation:

U.S. Bureau of Economic Analysis, Personal Income [PI], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/PI, .

Source: U.S. Census Bureau

Release: Families and Living Arrangements

Units: Thousands, Not Seasonally Adjusted

Frequency: Annual

Notes:

Household is an occupied housing unit.

Householder is a person in whose name the housing unit is rented or owned. This person must be at least 15 years old.

Family household is a household in which there is at least 1 person present who is related to the householder by birth, marriage or adoption.

Family is used to refer to a family household. In general, family consists of those related to each other by birth, marriage or adoption.

This data uses the householder's person weight to describe characteristics of people living in households. As a result, estimates of the number of households do not match estimates of housing units from the Housing Vacancy Survey (HVS). The HVS is weighted to housing units, rather than the population, in order to more accurately estimate the number of occupied and vacant housing units. For more information about the source and accuracy statement of the Annual Social and Economic Supplement (ASEC) of the Current Population Survey (CPS) see the technical documentation accessible at: http://www.census.gov/programs-surveys/cps/technical-documentation/complete.html

Suggested Citation:

U.S. Census Bureau, Total Households [TTLHH], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/TTLHH, .

Release Tables

- Median and Average Sales Price of Houses Sold by Region

- Median and Average Sales Price of Houses Sold by Type of Financing

Related Data and Content

Data Suggestions Based On Your Search

Content Suggestions

Other Formats

Related Categories

Releases

Tags

Permalink/Embed

modal open, choose link customization options

Select automatic updates to the data or a static time frame. All data are subject to revision.