Federal Reserve Economic Data: Your trusted data source since 1991

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

NOTES

Source: Federal Reserve Bank of St. Louis

Release: St. Louis Fed Financial Stress Index

Units: Index, Not Seasonally Adjusted

Frequency: Weekly, Ending Friday

Notes:

The methodology for the St. Louis Fed's Financial Stress Index was revised and this series is discontinued. The new version, STLFSI3, can be found here.

The STLFSI measures the degree of financial stress in the markets and is constructed from 18 weekly data series: seven interest rate series, six yield spreads and five other indicators. Each of these variables captures some aspect of financial stress. Accordingly, as the level of financial stress in the economy changes, the data series are likely to move together.

How to Interpret the Index:

The average value of the index, which begins in late 1993, is designed to be zero. Thus, zero is viewed as representing normal financial market conditions. Values below zero suggest below-average financial market stress, while values above zero suggest above-average financial market stress.

More information:

For additional information on the STLFSI and its construction, see "Measuring Financial Market Stress" and the related appendix.

See this list of the components that are used to construct the STLFSI.

As of 07/15/2010 the Vanguard Financial Exchange-Traded Fund series has been replaced with the S&P 500 Financials Index. This change was made to facilitate a more timely and automated updating of the FSI. Switching from the Vanguard series to the S&P series produced no meaningful change in the index.

Copyright, 2016, Federal Reserve Bank of St. Louis.

Suggested Citation:

Federal Reserve Bank of St. Louis, St. Louis Fed Financial Stress Index (DISCONTINUED) [STLFSI], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/STLFSI, May 11, 2024.

Source: Chicago Board Options Exchange

Release: CBOE Market Statistics

Units: Index, Not Seasonally Adjusted

Frequency: Daily, Close

Notes:

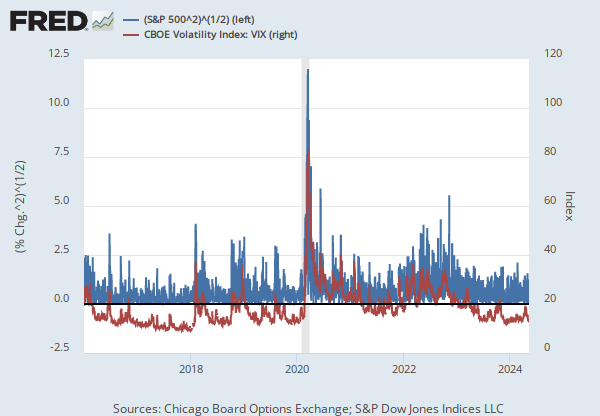

VIX measures market expectation of near term volatility conveyed by stock index option prices. Copyright, 2016, Chicago Board Options Exchange, Inc. Reprinted with permission.

Suggested Citation:

Chicago Board Options Exchange, CBOE Volatility Index: VIX [VIXCLS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/VIXCLS, May 11, 2024.