Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Notes

Source: Federal Reserve Bank of St. Louis

Release: Money Velocity

Units: Ratio, Seasonally Adjusted

Frequency: Quarterly

Notes:

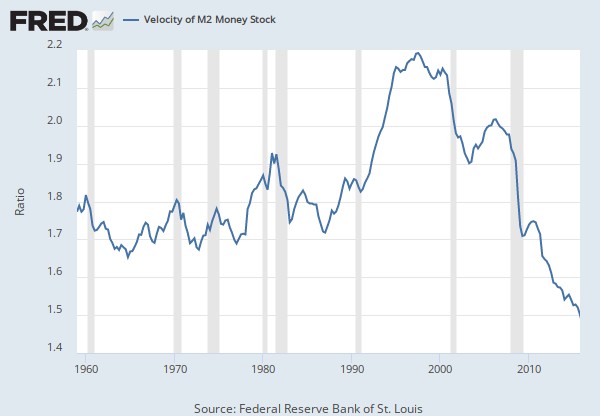

Calculated as the ratio of quarterly nominal GDP to the quarterly average of M2 money stock.

The velocity of money is the frequency at which one unit of currency is used to purchase domestically- produced goods and services within a given time period. In other words, it is the number of times one dollar is spent to buy goods and services per unit of time. If the velocity of money is increasing, then more transactions are occurring between individuals in an economy.

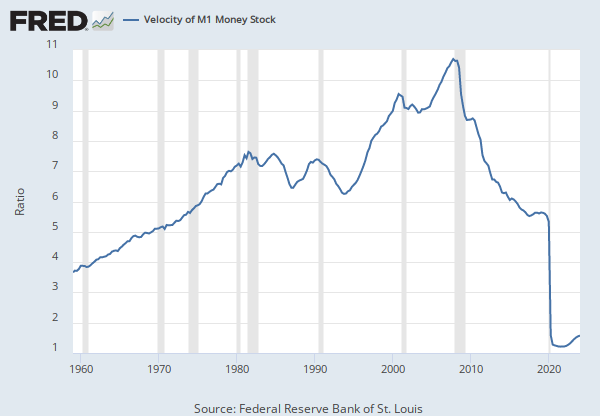

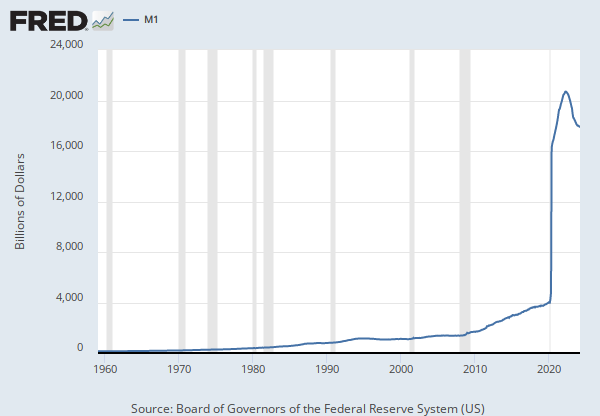

The frequency of currency exchange can be used to determine the velocity of a given component of the money supply, providing some insight into whether consumers and businesses are saving or spending their money. There are several components of the money supply,: M1, M2, and MZM (M3 is no longer tracked by the Federal Reserve); these components are arranged on a spectrum of narrowest to broadest. Consider M1, the narrowest component. M1 is the money supply of currency in circulation (notes and coins, traveler's checks [non-bank issuers], demand deposits, and checkable deposits). A decreasing velocity of M1 might indicate fewer short- term consumption transactions are taking place. We can think of shorter- term transactions as consumption we might make on an everyday basis.

Beginning May 2020, M2 consists of M1 plus (1) small-denomination time deposits (time deposits in amounts of less than $100,000) less IRA and Keogh balances at depository institutions; and (2) balances in retail MMFs less IRA and Keogh balances at MMFs. Seasonally adjusted M2 is constructed by summing savings deposits (before May 2020), small-denomination time deposits, and retail MMFs, each seasonally adjusted separately, and adding this result to seasonally adjusted M1. For more information on the H.6 release changes and the regulatory amendment that led to the creation of the other liquid deposits component and its inclusion in the M1 monetary aggregate, see the H.6 announcements and Technical Q&As posted on December 17, 2020.

MZM (money with zero maturity) is the broadest component and consists of the supply of financial assets redeemable at par on demand: notes and coins in circulation, traveler's checks (non-bank issuers), demand deposits, other checkable deposits, savings deposits, and all money market funds. The velocity of MZM helps determine how often financial assets are switching hands within the economy.

Suggested Citation:

Federal Reserve Bank of St. Louis, Velocity of M2 Money Stock [M2V], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/M2V, .

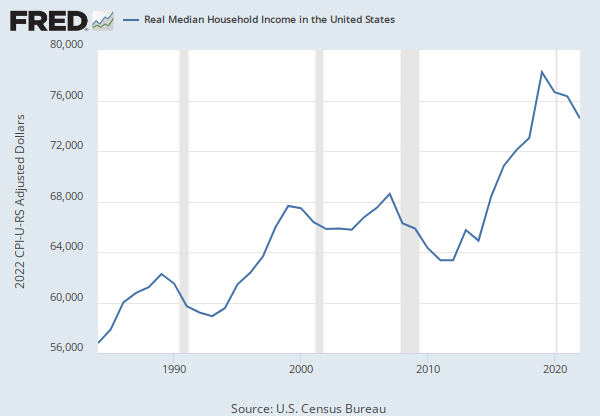

Source: U.S. Census Bureau

Release: Income and Poverty in the United States

Units: Ratio, Not Seasonally Adjusted

Frequency: Annual

Notes:

Beginning with the 2003 Current Population Survey, there are revisions to the available race categories. Respondents are allowed to report more than one race, making selections from a "flash-card" listing. These six race categories are: White, Black or African American, American Indian or Alaskan Native, Asian, Native Hawaiian or Other Pacific Islander, and Other race. The last category includes any other race except the five mentioned. Because of these changes, data on race are not directly comparable to previous series. White Alone, Black Alone, and Asian Alone refer to people who reported White, Black, or Asian and did not report any other race category. Hispanic Origin refers to persons answering the question asking if the person is Spanish, Hispanic, or Latino. If their response is "yes", a follow-up question determines a specific ethnic origin, asking the person to select from a flash-card listing. These selections are Mexican, Mexican-American, Chicano, Puerto Rican, Cuban, Cuban American, or some other Spanish, Hispanic, or Latino group. Use caution when interpreting changes in the racial composition of the U.S. over time.

Suggested Citation:

U.S. Census Bureau, Income Gini Ratio for Households by Race of Householder, All Races [GINIALLRH], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/GINIALLRH, .

Release Tables

Related Data and Content

Data Suggestions Based On Your Search

Content Suggestions

Related Categories

Releases

Tags

Permalink/Embed

modal open, choose link customization options

Select automatic updates to the data or a static time frame. All data are subject to revision.