Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Notes

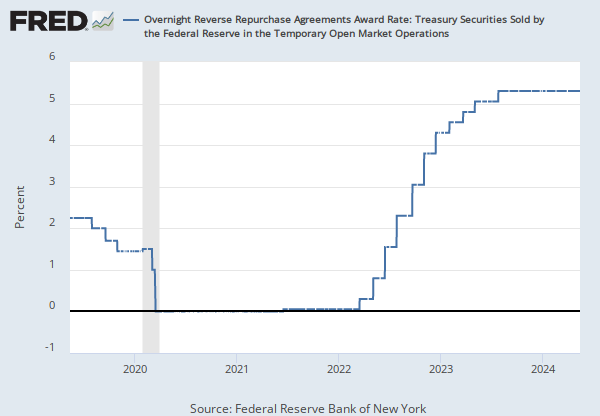

Source: Federal Reserve Bank of New York

Release: Temporary Open Market Operations

Units: Billions of US Dollars, Not Seasonally Adjusted

Frequency: Daily

Notes:

This series is constructed as the aggregated daily amount value of the RRP transactions reported by the New York Fed as part of the Temporary Open Market Operations.

Temporary open market operations involve short-term repurchase and reverse repurchase agreements that are designed to temporarily add or drain reserves available to the banking system and influence day-to-day trading in the federal funds market.

A reverse repurchase agreement (known as reverse repo or RRP) is a transaction in which the New York Fed under the authorization and direction of the Federal Open Market Committee sells a security to an eligible counterparty with an agreement to repurchase that same security at a specified price at a specific time in the future. For these transactions, eligible securities are U.S. Treasury instruments, federal agency debt and the mortgage-backed securities issued or fully guaranteed by federal agencies.

For more information, see https://www.newyorkfed.org/markets/rrp_faq.html

Suggested Citation:

Federal Reserve Bank of New York, Overnight Reverse Repurchase Agreements: Treasury Securities Sold by the Federal Reserve in the Temporary Open Market Operations [RRPONTSYD], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/RRPONTSYD, .

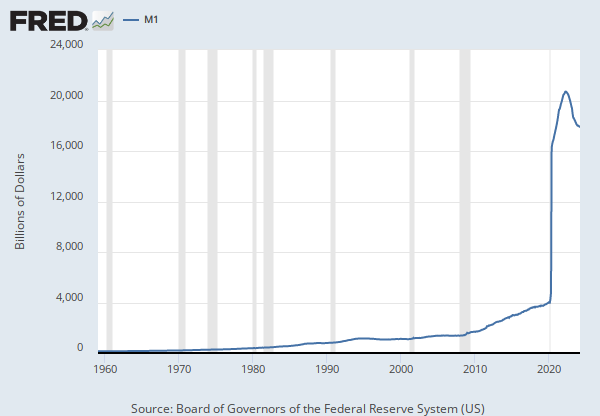

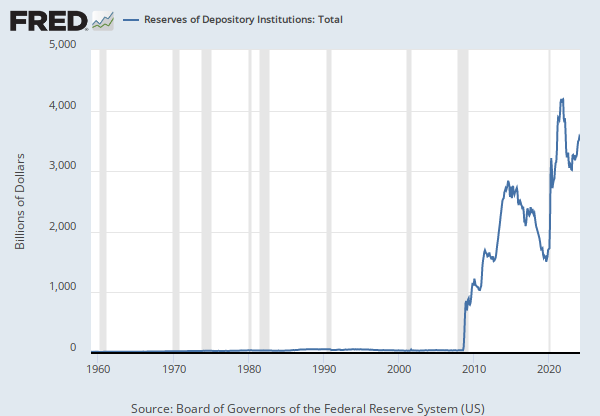

Source: Board of Governors of the Federal Reserve System (US)

Release: H.6 Money Stock Measures

Units: Billions of Dollars, Not Seasonally Adjusted

Frequency: Weekly, Ending Monday

Notes:

The demand deposits component of M1 is defined as demand deposits at domestically chartered commercial banks, U.S. branches and agencies of foreign banks, and Edge Act corporations (excluding those amounts held by depository institutions, the U.S. government, and foreign banks and official institutions) less cash items in the process of collection (CIPC) and Federal Reserve float. CIPC and Federal Reserve float are substracted from the demand deposit component of M1 in order to avoid double counting deposits that are simultaneously on the books of two depository institutions. Demand deposits due to the public and CIPC are reported on the FR 2900 and, for institutions that do not file the FR 2900, are estimated using data reported on the Call Reports. Demand deposits held by foreign banks and foreign official institutions are estimated using data reported on the Call Reports. Federal Reserve float is obtained from the consolidated balance sheet of the Federal Reserve Banks, which is published each week in the Federal Reserve Board's H.4.1 statistical release.

For questions on the data, please contact the data source. For questions on FRED functionality, please contact us here.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Demand Deposits [WDDNS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/WDDNS, .

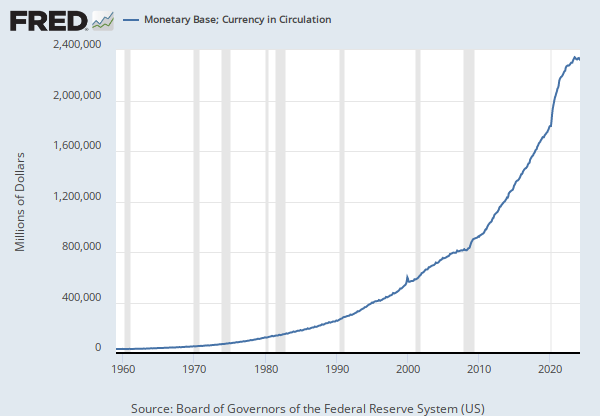

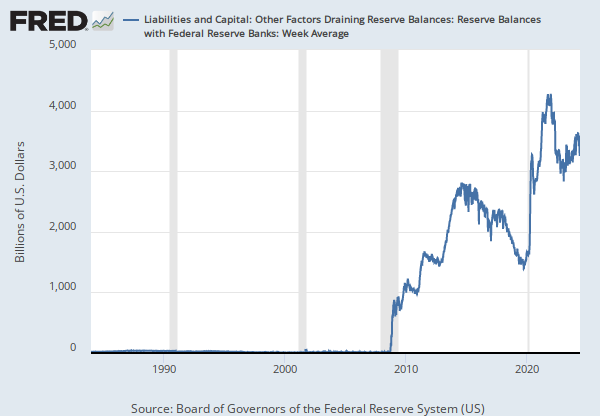

Source: Board of Governors of the Federal Reserve System (US)

Release: H.4.1 Factors Affecting Reserve Balances (data not included in press release)

Units: Billions of Dollars, Not Seasonally Adjusted

Frequency: Monthly

Notes:

This series has been discontinued and will no longer be updated. The weekly version of this monthly series is WCURCIR.####

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Currency in Circulation (DISCONTINUED) [CURRCIR], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CURRCIR, .

Source: Board of Governors of the Federal Reserve System (US)

Release: Z.1 Financial Accounts of the United States

Units: Millions of U.S. Dollars, Not Seasonally Adjusted

Frequency: Quarterly, End of Period

Notes:

For more information about the Flow of Funds tables, see the Financial Accounts Guide.

With each quarterly release, the source may make major data and structural revisions to the series and tables. These changes are available in the Release Highlights.

In the Financial Accounts, the source identifies each series by a string of patterned letters and numbers. For a detailed description, including how this series is constructed, see the series analyzer provided by the source.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Monetary Authority; Deposits in Treasury General Deposit Account; Liability, Level [BOGZ1FL713123030Q], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/BOGZ1FL713123030Q, .

Release Tables

Related Data and Content

Data Suggestions Based On Your Search

Content Suggestions

Other Formats

Demand Deposits

Monthly, Not Seasonally Adjusted Monthly, Seasonally AdjustedMonetary Authority; Deposits in Treasury General Deposit Account; Liability, Level

Annual, Not Seasonally AdjustedRelated Categories

Releases

Tags

Permalink/Embed

modal open, choose link customization options

Select automatic updates to the data or a static time frame. All data are subject to revision.