Federal Reserve Economic Data

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Notes

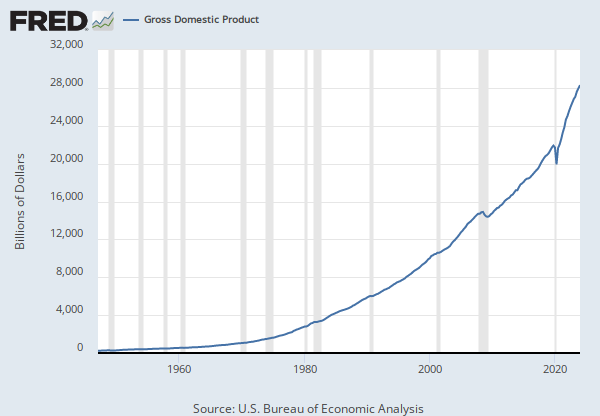

Source: U.S. Bureau of Economic Analysis

Release: Gross Domestic Product

Units: Dollars, Not Seasonally Adjusted

Frequency: Annual

Notes:

BEA Account Code: A792RC

For more information about this series, please see http://www.bea.gov/national/.

Suggested Citation:

U.S. Bureau of Economic Analysis, Personal income per capita [A792RC0A052NBEA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/A792RC0A052NBEA, .

Source: U.S. Department of the Treasury. Internal Revenue Service

Release: SOI Tax Stats - Historical Data Tables

Units: U.S. Dollars, Not Seasonally Adjusted

Frequency: Annual

Notes:

Years represent the tax years. As stated by the source, the definition of the income base (and, thus, the tax bracket boundaries) to which the tax rates were applied differs over the years, depending on how the following were determined and figured: statutory adjustments to or exclusions from income; personal exemptions; itemized deduction expenditures, which were sometimes described as income credits; standard deductions; the various thresholds and ceilings; and statutory taxable income (and its predecessor net income). Therefore, the lowest and highest taxable income amounts are not comparable for all years, and the amounts described as for statutory taxable income for tax years preceding 1954 are actually for statutory net income.

Statutory net income was income after subtracting deductions but, for most years, was before subtracting personal exemptions.

Statutory taxable income was after subtracting both deductions and personal exemptions.

Taxable income is the tax base for recent years. Net income required certain adjustments to arrive at the tax base, depending on whether the income was subject to normal tax, surtax, or both.

For more information on the specific adjustments, see Appendix to Selected Historical and Other Data Tables at https://www.irs.gov/uac/soi-tax-stats-historical-table-23

Suggested Citation:

U.S. Department of the Treasury. Internal Revenue Service, U.S Individual Income Tax: Taxable Income Boundary Under which the Lowest Tax Rate Bracket Applies [IITTILB], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/IITTILB, .

Release Tables

Related Data and Content

Data Suggestions Based On Your Search

Content Suggestions

Other Formats

Related Categories

Releases

Tags

Permalink/Embed

modal open, choose link customization options

Select automatic updates to the data or a static time frame. All data are subject to revision.