Federal Reserve Economic Data

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Notes

Source: Bank of England

Release: A Millennium of Macroeconomic Data for the UK

Units: Percent per Annum, Not Seasonally Adjusted

Frequency: Monthly

Notes:

This series was constructed by the Bank of England as part of the Three Centuries of Macroeconomic Data project by combining data from a number of academic and official sources. For more information, please refer to the Three Centuries spreadsheet at https://www.bankofengland.co.uk/statistics/research-datasets. Users are advised to check the underlying assumptions behind this series in the relevant worksheets of the spreadsheet. In many cases alternative assumptions might be appropriate. Users are permitted to reproduce this series in their own work as it represents Bank calculations and manipulations of underlying series that are the copyright of the Bank of England provided that underlying sources are cited appropriately. For appropriate citation please see the Three Centuries spreadsheet for guidance and a list of the underlying sources.

Suggested Citation:

Bank of England, 3-month London Interbank Offered Rate (LIBOR) in the United Kingdom [LIOR3MUKM], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/LIOR3MUKM, .

Source: Board of Governors of the Federal Reserve System (US)

Release: H.15 Selected Interest Rates

Units: Percent, Not Seasonally Adjusted

Frequency: Monthly

Notes:

Averages of daily figures.

For additional historical federal funds rate data, please see Daily Federal Funds Rate from 1928-1954.

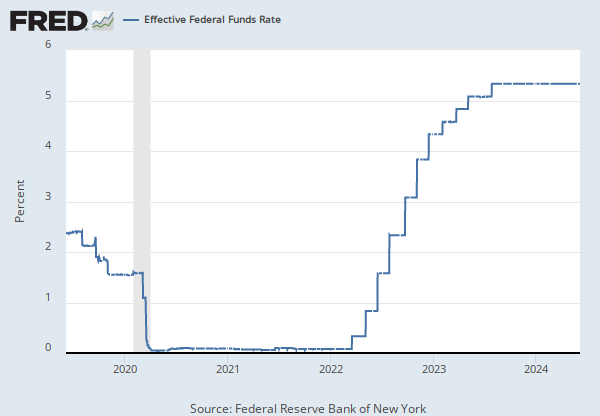

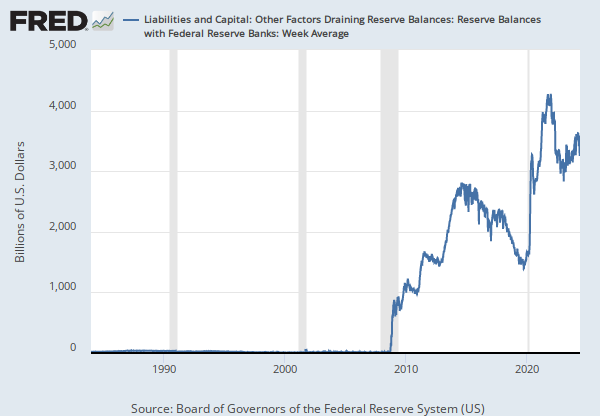

The federal funds rate is the interest rate at which depository institutions trade federal funds (balances held at Federal Reserve Banks) with each other overnight. When a depository institution has surplus balances in its reserve account, it lends to other banks in need of larger balances. In simpler terms, a bank with excess cash, which is often referred to as liquidity, will lend to another bank that needs to quickly raise liquidity. (1) The rate that the borrowing institution pays to the lending institution is determined between the two banks; the weighted average rate for all of these types of negotiations is called the effective federal funds rate.(2) The effective federal funds rate is essentially determined by the market but is influenced by the Federal Reserve as it uses the Interest on Reserve Balances rate to steer the federal funds rate toward the target range.(2)

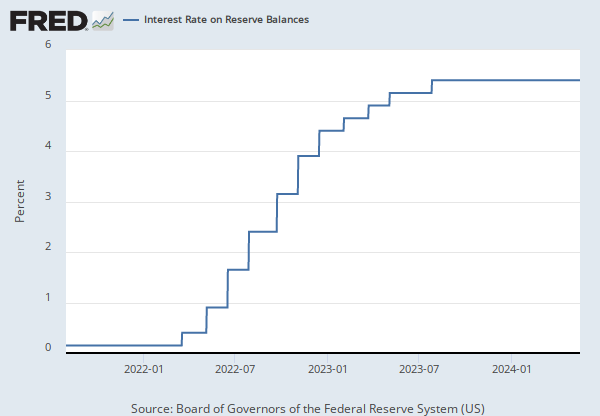

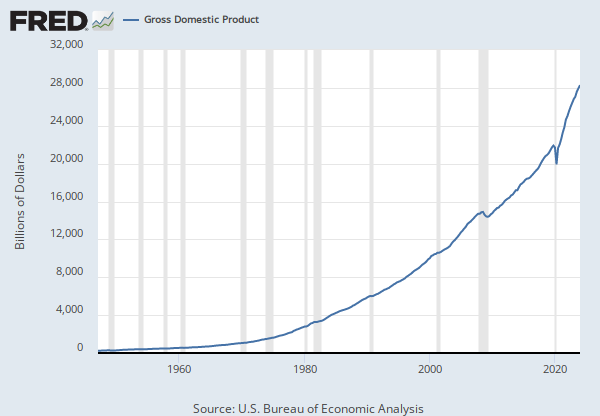

The Federal Open Market Committee (FOMC) meets eight times a year to determine the federal funds target range. The Fed's primary tool for influencing the federal funds rate is the interest the Fed pays on the funds that banks hold as reserve balances at their Federal Reserve Bank, which is the Interest on Reserves Balances (IORB) rate. Because banks are unlikely to lend funds in the federal funds market for less than they get paid in their reserve balance account at the Federal Reserve, the Interest on Reserve Balances (IORB) is an effective tool for guiding the federal funds rate. (3) Whether the Federal Reserve raises or lowers the target range for the federal funds rate depends on the state of the economy. If the FOMC believes the economy is growing too fast and inflation pressures are inconsistent with the dual mandate of the Federal Reserve, the Committee may temper economic activity by raising the target range for federal funds rate, and increasing the IORB rate to steer the federal funds rate into the target range. In the opposing scenario, the FOMC may spur greater economic activity by lowering the target range for federal funds rate, and decreasing the IORB rate to steer the federal funds rate into the target range. (3) Therefore, the FOMC must observe the current state of the economy to determine the best course of monetary policy that will maximize economic growth while adhering to the dual mandate set forth by Congress. In making its monetary policy decisions, the FOMC considers a wealth of economic data, such as: trends in prices and wages, employment, consumer spending and income, business investments, and foreign exchange markets.

The federal funds rate is the central interest rate in the U.S. financial market. It influences other interest rates such as the prime rate, which is the rate banks charge their customers with higher credit ratings. Additionally, the federal funds rate indirectly influences longer- term interest rates such as mortgages, loans, and savings, all of which are very important to consumer wealth and confidence.(2)

References

(1) Federal Reserve Bank of New York. "Federal funds." Fedpoints, August 2007.

(2) Monetary Policy, Board of Governors of the Federal Reserve System.

(3) The Fed Explained, Board of Governors of the Federal Reserve System

For further information, see The Fed's New Monetary Policy Tools, Page One Economics, Federal Reserve Bank of St. Louis.

For questions on the data, please contact the data source. For questions on FRED functionality, please contact us here.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Federal Funds Effective Rate [FEDFUNDS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/FEDFUNDS, .

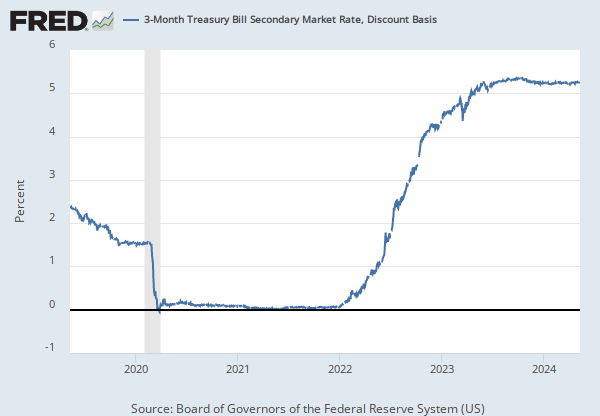

Source: Board of Governors of the Federal Reserve System (US)

Release: H.15 Selected Interest Rates

Units: Percent, Not Seasonally Adjusted

Frequency: Monthly

Notes:

Averages of Business Days, Discount Basis

For questions on the data, please contact the data source. For questions on FRED functionality, please contact us here.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), 3-Month Treasury Bill Secondary Market Rate, Discount Basis [TB3MS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/TB3MS, .

Source: Board of Governors of the Federal Reserve System (US)

Release: H.15 Selected Interest Rates

Units: Percent, Not Seasonally Adjusted

Frequency: Daily

Notes:

The Federal Reserve Board has discontinued this series as of October 11, 2016. More information, including possible alternative series, can be found at http://www.federalreserve.gov/feeds/h15.html.

Annualized using a 360-day year or bank interest. Source: Bloomberg and CTRB ICAP Fixed Income & Money Market Products.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), U.S. Short-Term Interest Rates: Daily 3-Month Eurodollar Deposit Rate (DISCONTINUED) [DED3], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DED3, .

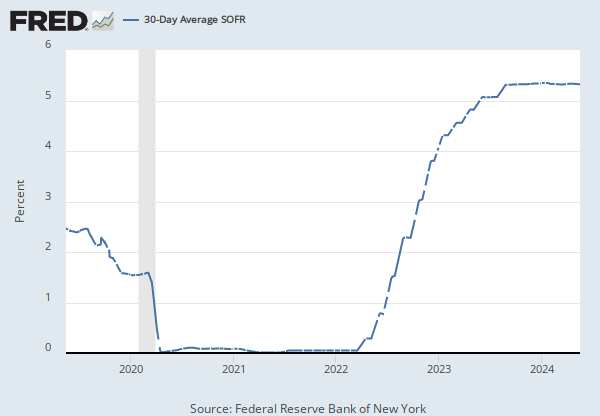

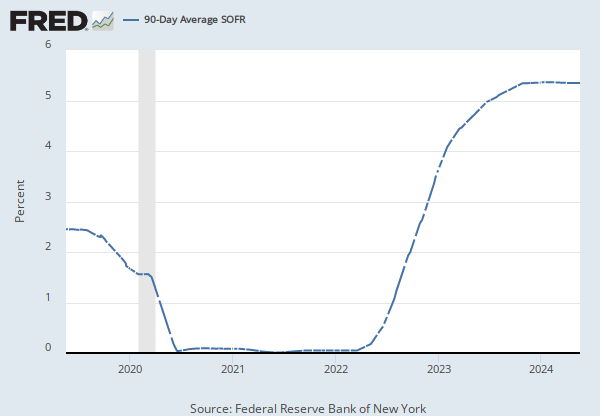

Source: Federal Reserve Bank of New York

Release: Secured Overnight Financing Rate Data

Units: Percent, Not Seasonally Adjusted

Frequency: Daily

Suggested Citation:

Federal Reserve Bank of New York, Secured Overnight Financing Rate [SOFR], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/SOFR, .

Release Tables

Related Data and Content

Data Suggestions Based On Your Search

Content Suggestions

Other Formats

Federal Funds Effective Rate

Annual, Not Seasonally Adjusted Biweekly, Not Seasonally Adjusted Daily, Not Seasonally Adjusted Daily, Not Seasonally Adjusted Weekly, Not Seasonally Adjusted3-Month Treasury Bill Secondary Market Rate, Discount Basis

Annual, Not Seasonally Adjusted Daily, Not Seasonally Adjusted Weekly, Not Seasonally AdjustedU.S. Short-Term Interest Rates: Daily 3-Month Eurodollar Deposit Rate (DISCONTINUED)

Annual, Not Seasonally Adjusted Monthly, Not Seasonally Adjusted Weekly, Not Seasonally AdjustedRelated Categories

Releases

Tags

Permalink/Embed

modal open, choose link customization options

Select automatic updates to the data or a static time frame. All data are subject to revision.