Observations

2026-02-11: 0 |

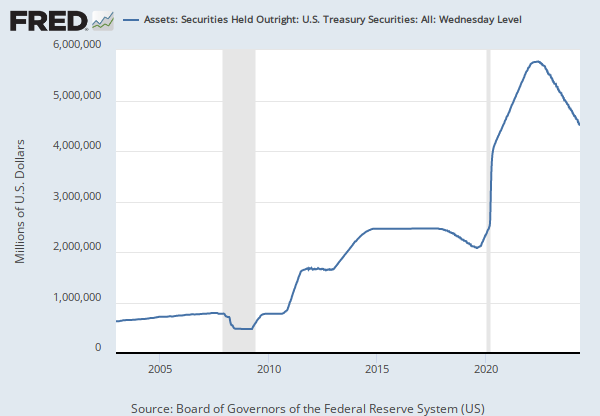

Millions of U.S. Dollars, Not Seasonally Adjusted |

Weekly,

As of Wednesday

Updated: Feb 12, 2026 3:33 PM CST

Observations

2026-02-11:

0

Updated:

Feb 12, 2026

3:33 PM CST

| 2026-02-11: | 0 | |

| 2026-02-04: | 0 | |

| 2026-01-28: | 0 | |

| 2026-01-21: | 0 | |

| 2026-01-14: | 28 | |

| View All | ||

Units:

Millions of U.S. Dollars,

Not Seasonally Adjusted

Frequency:

Weekly,

As of Wednesday

Fullscreen