Observations

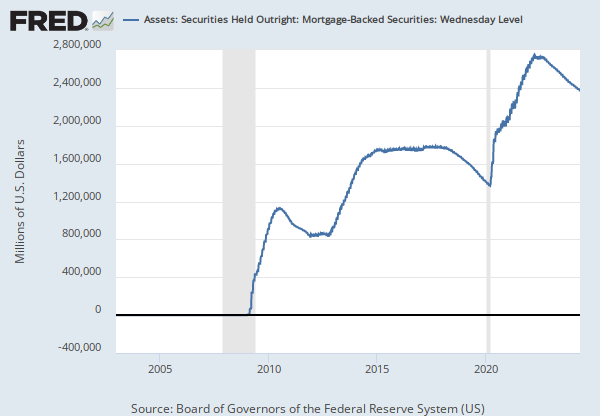

2011-01-19: 3,842 |

Millions of Dollars, Not Seasonally Adjusted |

Weekly,

Ending Wednesday

Updated: Jul 14, 2011 10:31 AM CDT

Observations

2011-01-19:

3,842

Updated:

Jul 14, 2011

10:31 AM CDT

| 2011-01-19: | 3,842 | |

| 2011-01-12: | 26,896 | |

| 2011-01-05: | 26,896 | |

| 2010-12-29: | 26,896 | |

| 2010-12-22: | 26,838 | |

| View All | ||

Units:

Millions of Dollars,

Not Seasonally Adjusted

Frequency:

Weekly,

Ending Wednesday

Fullscreen