Observations

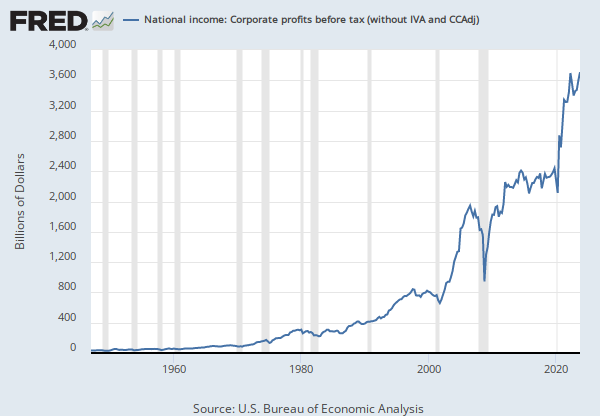

2021: 14.912 | Billions of Dollars, Not Seasonally Adjusted | Annual

Updated: Oct 2, 2024 1:09 PM CDT

Observations

2021:

14.912

Updated:

Oct 2, 2024

1:09 PM CDT

| 2021: | 14.912 | |

| 2020: | -13.434 | |

| 2019: | 3.972 | |

| 2018: | 9.474 | |

| 2017: | -63.198 | |

| View All | ||

Units:

Billions of Dollars,

Not Seasonally Adjusted

Frequency:

Annual

Fullscreen