Federal Reserve Economic Data

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Notes

Source: Board of Governors of the Federal Reserve System (US)

Release: H.6 Money Stock Measures

Units: Billions of Dollars, Not Seasonally Adjusted

Frequency: Weekly, Ending Monday

Notes:

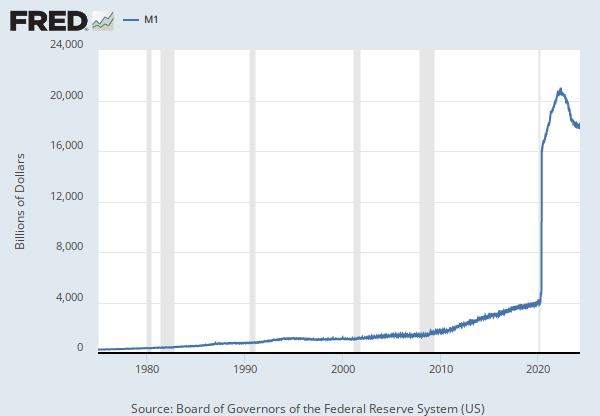

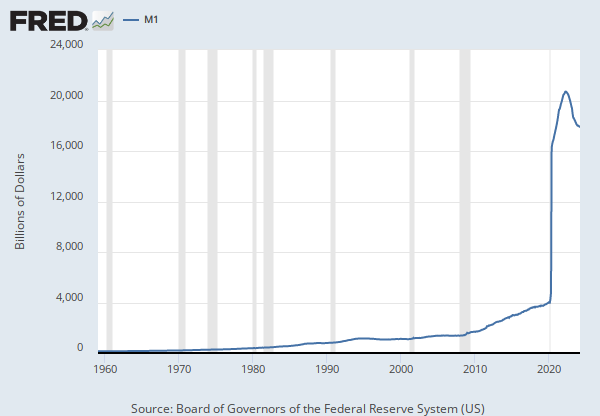

Before May 2020, M1 consists of (1) currency outside the U.S. Treasury, Federal Reserve Banks, and the vaults of depository institutions; (2) demand deposits at commercial banks (excluding those amounts held by depository institutions, the U.S. government, and foreign banks and official institutions) less cash items in the process of collection and Federal Reserve float; and (3) other checkable deposits (OCDs), consisting of negotiable order of withdrawal, or NOW, and automatic transfer service, or ATS, accounts at depository institutions, share draft accounts at credit unions, and demand deposits at thrift institutions.

Beginning May 2020, M1 consists of (1) currency outside the U.S. Treasury, Federal Reserve Banks, and the vaults of depository institutions; (2) demand deposits at commercial banks (excluding those amounts held by depository institutions, the U.S. government, and foreign banks and official institutions) less cash items in the process of collection and Federal Reserve float; and (3) other liquid deposits, consisting of OCDs and savings deposits (including money market deposit accounts). Seasonally adjusted M1 is constructed by summing currency, demand deposits, and OCDs (before May 2020) or other liquid deposits (beginning May 2020), each seasonally adjusted separately.

For more information on the H.6 release changes and the regulatory amendment that led to the creation of the other liquid deposits component and its inclusion in the M1 monetary aggregate, see the H.6 announcements and Technical Q&As posted on December 17, 2020.

For questions on the data, please contact the data source. For questions on FRED functionality, please contact us here.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), M1 [WM1NS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/WM1NS, .

Source: Board of Governors of the Federal Reserve System (US)

Release: H.6 Money Stock Measures

Units: Billions of Dollars, Not Seasonally Adjusted

Frequency: Weekly, Ending Monday

Notes:

Before May 2020, M2 consists of M1 plus (1) savings deposits (including money market deposit accounts); (2) small-denomination time deposits (time deposits in amounts of less than $100,000) less individual retirement account (IRA) and Keogh balances at depository institutions; and (3) balances in retail money market funds (MMFs) less IRA and Keogh balances at MMFs.

Beginning May 2020, M2 consists of M1 plus (1) small-denomination time deposits (time deposits in amounts of less than $100,000) less IRA and Keogh balances at depository institutions; and (2) balances in retail MMFs less IRA and Keogh balances at MMFs. Seasonally adjusted M2 is constructed by summing savings deposits (before May 2020), small-denomination time deposits, and retail MMFs, each seasonally adjusted separately, and adding this result to seasonally adjusted M1.

For more information on the H.6 release changes and the regulatory amendment that led to the creation of the other liquid deposits component and its inclusion in the M1 monetary aggregate, see the H.6 announcements and Technical Q&As posted on December 17, 2020.

For questions on the data, please contact the data source. For questions on FRED functionality, please contact us here.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), M2 [WM2NS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/WM2NS, .

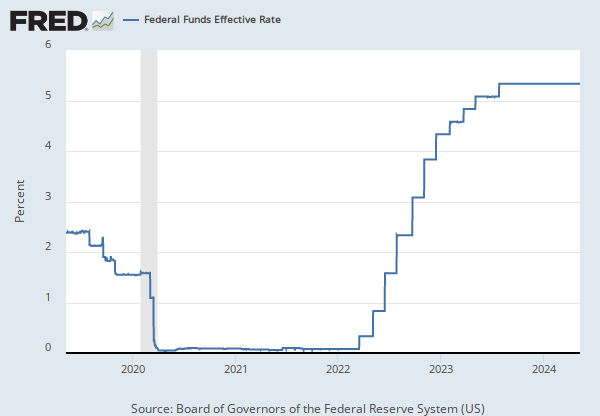

Source: Federal Reserve Bank of New York

Release: Federal Funds Data

Units: Percent, Not Seasonally Adjusted

Frequency: Daily

Notes:

For additional historical federal funds rate data, please see Daily Federal Funds Rate from 1928-1954.

The federal funds market consists of domestic unsecured borrowings in U.S. dollars by depository institutions from other depository institutions and certain other entities, primarily government-sponsored enterprises.

The effective federal funds rate (EFFR) is calculated as a volume-weighted median of overnight federal funds transactions reported in the FR 2420 Report of Selected Money Market Rates.

For more information, visit the Federal Reserve Bank of New York.

Suggested Citation:

Federal Reserve Bank of New York, Effective Federal Funds Rate [EFFR], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/EFFR, .

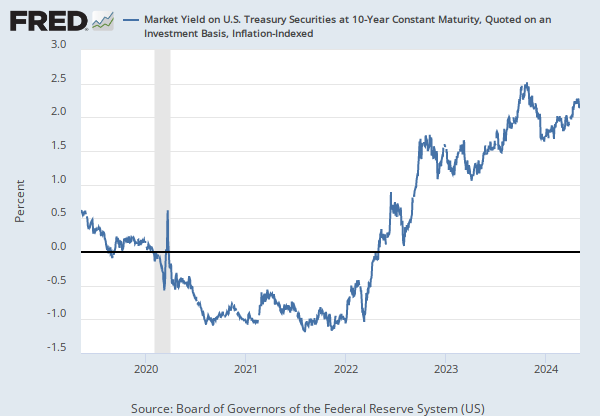

Source: Board of Governors of the Federal Reserve System (US)

Release: H.15 Selected Interest Rates

Units: Percent, Not Seasonally Adjusted

Frequency: Daily

Notes:

For further information regarding treasury constant maturity data, please refer to the H.15 Statistical Release notes and the Treasury Yield Curve Methodology.

For questions on the data, please contact the data source. For questions on FRED functionality, please contact us here.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Market Yield on U.S. Treasury Securities at 2-Year Constant Maturity, Quoted on an Investment Basis [DGS2], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DGS2, .

Source: Board of Governors of the Federal Reserve System (US)

Release: H.15 Selected Interest Rates

Units: Percent, Not Seasonally Adjusted

Frequency: Daily

Notes:

For further information regarding treasury constant maturity data, please refer to the H.15 Statistical Release notes and Treasury Yield Curve Methodology.

For questions on the data, please contact the data source. For questions on FRED functionality, please contact us here.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity, Quoted on an Investment Basis [DGS10], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DGS10, .

Source: U.S. Bureau of Labor Statistics

Release: Consumer Price Index

Units: Index 1982-1984=100, Not Seasonally Adjusted

Frequency: Monthly

Notes:

Handbook of Methods

Understanding the CPI: Frequently Asked Questions

Suggested Citation:

U.S. Bureau of Labor Statistics, Consumer Price Index for All Urban Consumers: All Items in U.S. City Average [CPIAUCNS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CPIAUCNS, .

Release Tables

Related Data and Content

Data Suggestions Based On Your Search

Content Suggestions

Other Formats

M1

Monthly, Not Seasonally Adjusted Monthly, Seasonally AdjustedM2

Monthly, Not Seasonally Adjusted Monthly, Seasonally AdjustedMarket Yield on U.S. Treasury Securities at 2-Year Constant Maturity, Quoted on an Investment Basis

Annual, Not Seasonally Adjusted Monthly, Not Seasonally Adjusted Weekly, Not Seasonally AdjustedMarket Yield on U.S. Treasury Securities at 10-Year Constant Maturity, Quoted on an Investment Basis

Annual, Not Seasonally Adjusted Monthly, Not Seasonally Adjusted Weekly, Not Seasonally AdjustedConsumer Price Index for All Urban Consumers: All Items in U.S. City Average

Monthly, Seasonally Adjusted Semiannual, Not Seasonally AdjustedRelated Categories

Releases

Tags

Permalink/Embed

modal open, choose link customization options

Select automatic updates to the data or a static time frame. All data are subject to revision.