Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Notes

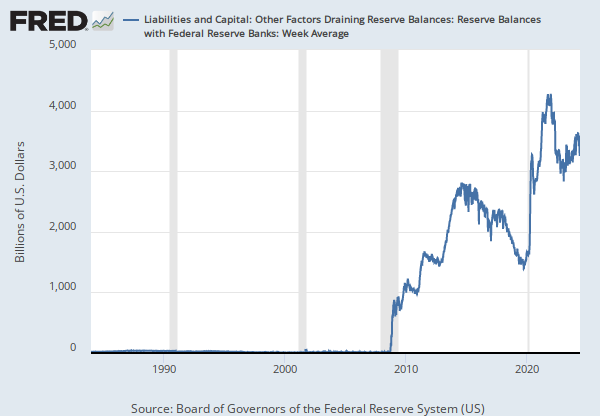

Source: Board of Governors of the Federal Reserve System (US)

Release: H.4.1 Factors Affecting Reserve Balances

Units: Millions of U.S. Dollars, Not Seasonally Adjusted

Frequency: Weekly, As of Wednesday

Notes:

For questions on the data, please contact the data source. For questions on FRED functionality, please contact us here.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Assets: Total Assets: Total Assets (Less Eliminations from Consolidation): Wednesday Level [WALCL], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/WALCL, .

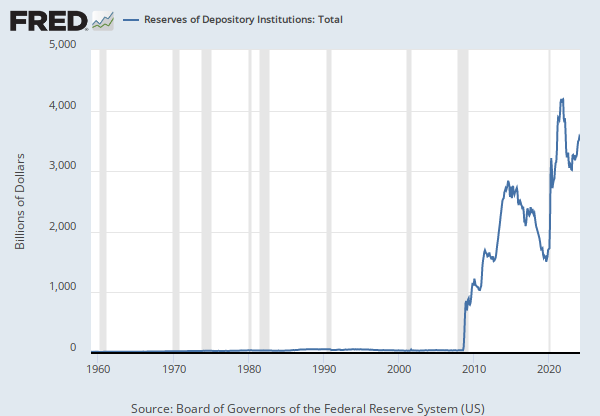

Source: Board of Governors of the Federal Reserve System (US)

Release: H.4.1 Factors Affecting Reserve Balances

Units: Millions of U.S. Dollars, Not Seasonally Adjusted

Frequency: Weekly, Ending Wednesday

Notes:

For questions on the data, please contact the data source. For questions on FRED functionality, please contact us here.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Liabilities and Capital: Liabilities: Deposits with F.R. Banks, Other Than Reserve Balances: U.S. Treasury, General Account: Week Average [WTREGEN], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/WTREGEN, .

Source: Federal Reserve Bank of New York

Release: Temporary Open Market Operations

Units: Billions of US Dollars, Not Seasonally Adjusted

Frequency: Daily

Notes:

This series is constructed as the aggregated daily amount value of the RRP transactions reported by the New York Fed as part of the Temporary Open Market Operations.

Temporary open market operations involve short-term repurchase and reverse repurchase agreements that are designed to temporarily add or drain reserves available to the banking system and influence day-to-day trading in the federal funds market.

A reverse repurchase agreement (known as reverse repo or RRP) is a transaction in which the New York Fed under the authorization and direction of the Federal Open Market Committee sells a security to an eligible counterparty with an agreement to repurchase that same security at a specified price at a specific time in the future. For these transactions, eligible securities are U.S. Treasury instruments, federal agency debt and the mortgage-backed securities issued or fully guaranteed by federal agencies.

For more information, see https://www.newyorkfed.org/markets/rrp_faq.html

Suggested Citation:

Federal Reserve Bank of New York, Overnight Reverse Repurchase Agreements: Treasury Securities Sold by the Federal Reserve in the Temporary Open Market Operations [RRPONTSYD], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/RRPONTSYD, .

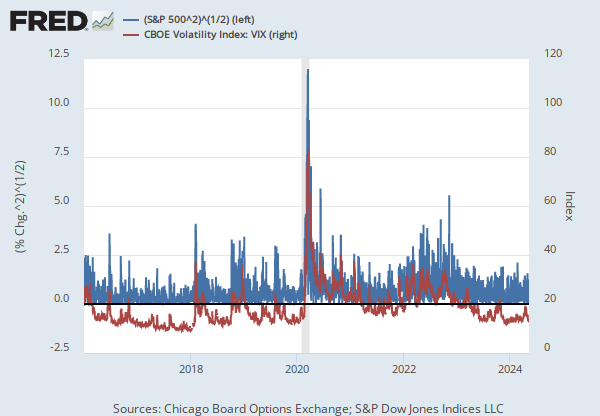

Source: S&P Dow Jones Indices LLC

Release: Standard & Poors

Units: Index, Not Seasonally Adjusted

Frequency: Daily, Close

Notes:

The observations for the S&P 500 represent the daily index value at market close. The market typically closes at 4 PM ET, except for holidays when it sometimes closes early.

The Federal Reserve Bank of St. Louis and S&P Dow Jones Indices LLC have reached a new agreement on the use of Standard & Poors and Dow Jones Averages series in FRED. FRED and its associated services will include 10 years of daily history for Standard & Poors and Dow Jones Averages series.

The S&P 500 is regarded as a gauge of the large cap U.S. equities market. The index includes 500 leading companies in leading industries of the U.S. economy, which are publicly held on either the NYSE or NASDAQ, and covers 75% of U.S. equities. Since this is a price index and not a total return index, the S&P 500 index here does not contain dividends.

Copyright © 2016, S&P Dow Jones Indices LLC. All rights reserved. Reproduction of S&P 500 in any form is prohibited except with the prior written permission of S&P Dow Jones Indices LLC ("S&P"). S&P does not guarantee the accuracy, adequacy, completeness or availability of any information and is not responsible for any errors or omissions, regardless of the cause or for the results obtained from the use of such information. S&P DISCLAIMS ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE. In no event shall S&P be liable for any direct, indirect, special or consequential damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with subscriber's or others' use of S&P 500.

Permission to reproduce S&P 500 can be requested from index_services@spdji.com. More contact details are available here, including phone numbers for all regional offices.

Suggested Citation:

S&P Dow Jones Indices LLC, S&P 500 [SP500], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/SP500, .

Release Tables

- Table 1. Factors Affecting Reserve Balances of Depository Institutions: Week Average

- Table 5. Consolidated Statement of Condition of All Federal Reserve Banks

Related Data and Content

Data Suggestions Based On Your Search

Content Suggestions

Related Categories

Releases

Tags

Permalink/Embed

modal open, choose link customization options

Select automatic updates to the data or a static time frame. All data are subject to revision.