Federal Reserve Economic Data

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Notes

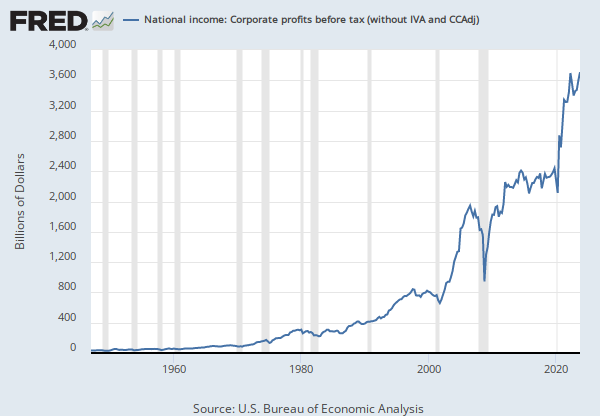

Source: U.S. Bureau of Economic Analysis

Release: Gross Domestic Product

Units: Billions of Dollars, Seasonally Adjusted Annual Rate

Frequency: Quarterly

Notes:

BEA Account Code: A455RC

For more information about this series, please see http://www.bea.gov/national/.

Suggested Citation:

U.S. Bureau of Economic Analysis, Gross value added of nonfinancial corporate business [A455RC1Q027SBEA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/A455RC1Q027SBEA, .

Source: U.S. Bureau of Economic Analysis

Release: Gross Domestic Product

Units: Billions of Dollars, Seasonally Adjusted Annual Rate

Frequency: Quarterly

Notes:

BEA Account Code: A464RC

For more information about this series, please see http://www.bea.gov/national/.

Suggested Citation:

U.S. Bureau of Economic Analysis, Nonfinancial corporate business: Profits before tax (without IVA and CCAdj) [A464RC1Q027SBEA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/A464RC1Q027SBEA, .

Source: U.S. Bureau of Economic Analysis

Release: Gross Domestic Product

Units: Billions of Dollars, Seasonally Adjusted Annual Rate

Frequency: Quarterly

Notes:

BEA Account Code: A454RC

For more information about this series, please see http://www.bea.gov/national/.

Suggested Citation:

U.S. Bureau of Economic Analysis, Gross value added of financial corporate business [A454RC1Q027SBEA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/A454RC1Q027SBEA, .

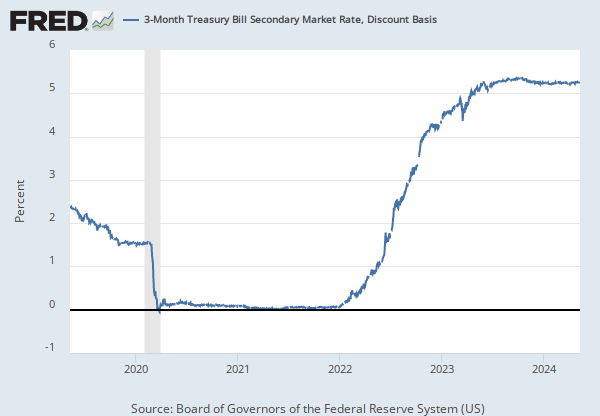

Source: Board of Governors of the Federal Reserve System (US)

Release: Z.1 Financial Accounts of the United States

Units: Millions of U.S. Dollars, Seasonally Adjusted Annual Rate

Frequency: Quarterly, End of Period

Notes:

For more information about the Flow of Funds tables, see the Financial Accounts Guide.

With each quarterly release, the source may make major data and structural revisions to the series and tables. These changes are available in the Release Highlights.

In the Financial Accounts, the source identifies each series by a string of patterned letters and numbers. For a detailed description, including how this series is constructed, see the series analyzer provided by the source.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Domestic Financial Sectors; Corporate Profits Before Tax Excluding IVA and CCAdj, Transactions [BOGZ1FA796060005Q], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/BOGZ1FA796060005Q, .

Source: Board of Governors of the Federal Reserve System (US)

Release: H.15 Selected Interest Rates

Units: Percent, Not Seasonally Adjusted

Frequency: Monthly

Notes:

Averages of Business Days, Discount Basis

For questions on the data, please contact the data source. For questions on FRED functionality, please contact us here.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), 3-Month Treasury Bill Secondary Market Rate, Discount Basis [TB3MS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/TB3MS, .

Source: U.S. Bureau of Economic Analysis

Release: Personal Income and Outlays

Units: Index 2017=100, Seasonally Adjusted

Frequency: Monthly

Notes:

BEA Account Code: DPCERG

The Personal Consumption Expenditures Price Index is a measure of the prices that people living in the United States, or those buying on their behalf, pay for goods and services. The change in the PCE price index is known for capturing inflation (or deflation) across a wide range of consumer expenses and reflecting changes in consumer behavior. For example, if the price of beef rises, shoppers may buy less beef and more chicken.

The PCE Price Index is produced by the Bureau of Economic Analysis (BEA), which revises previously published PCE data to reflect updated information or new methodology, providing consistency across decades of data that's valuable for researchers. They also offer the series as a Chain-Type index, as above. The PCE price index is used primarily for macroeconomic analysis and forecasting.

The PCE Price index is the Federal Reserve’s preferred measure of inflation. The PCE Price Index is similar to the Bureau of Labor Statistics' consumer price index for urban consumers. The two indexes, which have their own purposes and uses, are constructed differently, resulting in different inflation rates.

For more information on the PCE price index, see:

U.S. Bureau of Economic Analysis, Guide to the National Income and Product Accounts of the United States (NIPA)

U.S. Bureau of Economic Analysis, Personal Consumption Expenditures Price Index

U.S. Bureau of Economic Analysis, Prices & Inflation

U.S. Bureau of Labor Statistics, Differences between the Consumer Price Index and the Personal Consumption Expenditure Price Index

Suggested Citation:

U.S. Bureau of Economic Analysis, Personal Consumption Expenditures: Chain-type Price Index [PCEPI], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/PCEPI, .

Release Tables

Related Data and Content

Data Suggestions Based On Your Search

Content Suggestions

Other Formats

Gross value added of nonfinancial corporate business

Annual, Not Seasonally AdjustedNonfinancial corporate business: Profits before tax (without IVA and CCAdj)

Annual, Not Seasonally AdjustedGross value added of financial corporate business

Annual, Not Seasonally AdjustedDomestic Financial Sectors; Corporate Profits Before Tax Excluding IVA and CCAdj, Transactions

Annual, Not Seasonally Adjusted Annual, Seasonally Adjusted Annual Rate Quarterly, Not Seasonally Adjusted3-Month Treasury Bill Secondary Market Rate, Discount Basis

Annual, Not Seasonally Adjusted Daily, Not Seasonally Adjusted Weekly, Not Seasonally AdjustedPersonal Consumption Expenditures: Chain-type Price Index

Annual, Not Seasonally Adjusted Quarterly, Seasonally AdjustedRelated Categories

Releases

Tags

Permalink/Embed

modal open, choose link customization options

Select automatic updates to the data or a static time frame. All data are subject to revision.