Federal Reserve Economic Data

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Notes

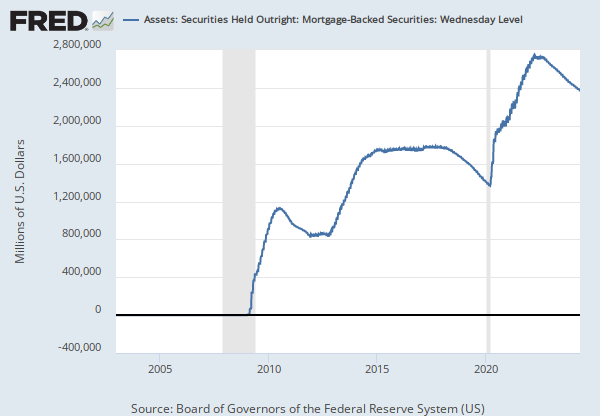

Source: Board of Governors of the Federal Reserve System (US)

Release: H.4.1 Factors Affecting Reserve Balances

Units: Millions of U.S. Dollars, Not Seasonally Adjusted

Frequency: Weekly, Ending Wednesday

Notes:

For questions on the data, please contact the data source. For questions on FRED functionality, please contact us here.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Liabilities and Capital: Other Factors Draining Reserve Balances: Currency in Circulation: Week Average [WCURCIR], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/WCURCIR, .

Source: Board of Governors of the Federal Reserve System (US)

Release: H.4.1 Factors Affecting Reserve Balances

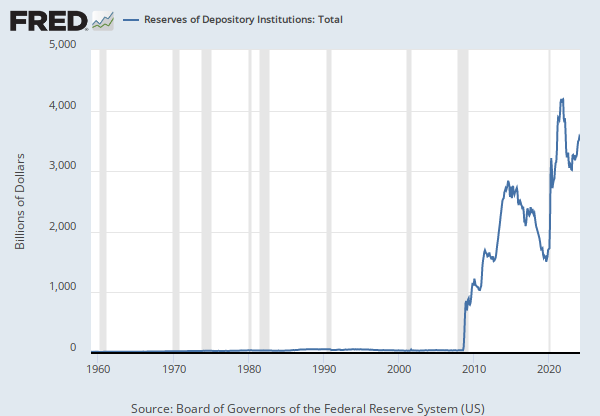

Units: Billions of Dollars, Not Seasonally Adjusted

Frequency: Weekly, Ending Wednesday

Notes:

Feb 1984 - Dec 1990: Annual Statistical Digest, various issues, Table 2.

Jan 1991 to date: Federal Reserve Board, H.4.1.

Service-related deposits are the sum of "required clearing balances" and "adjustments to compensate for float." For more details, see http://www.federalreserve.gov/releases/h41/20120719/

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Service-Related Balances and Adjustments (DISCONTINUED) [WSVCBAL], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/WSVCBAL, .

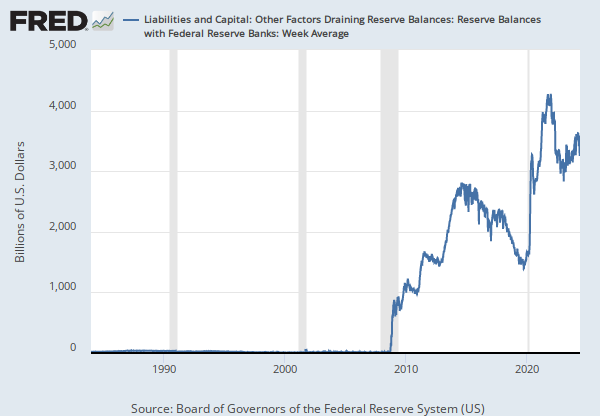

Source: Board of Governors of the Federal Reserve System (US)

Release: H.4.1 Factors Affecting Reserve Balances

Units: Millions of U.S. Dollars, Not Seasonally Adjusted

Frequency: Weekly, Ending Wednesday

Notes:

For questions on the data, please contact the data source. For questions on FRED functionality, please contact us here.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Liabilities and Capital: Other Factors Draining Reserve Balances: Reserve Balances with Federal Reserve Banks: Week Average [WRESBAL], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/WRESBAL, .

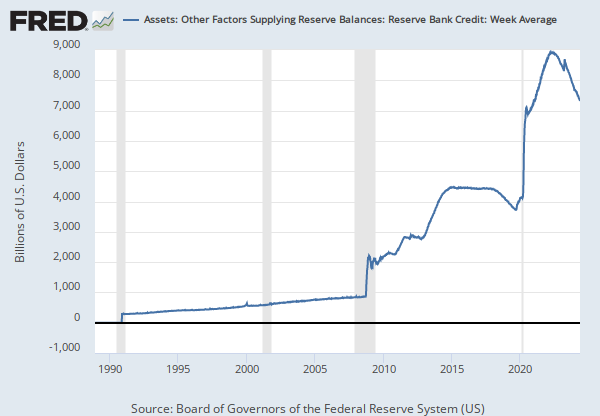

Source: Federal Reserve Bank of St. Louis

Release: St. Louis Monthly Reserves and Monetary Base

Units: Billions of Dollars, Not Seasonally Adjusted

Frequency: Monthly

Notes:

Updates of this series will be ceased on December 20, 2019. Interested users can construct a proxy by summing Currency in circulation (H.4.1 release); Service Related Balances and Adjustments (H.4.1 release); and Reserve Balances with FR Banks (H.4.1 release). The discontinued series plotted on the same graph with the calculated data can be accessed for comparison at https://fred.stlouisfed.org/graph/?g=oJ6w

For more details, see the FRED Announcement.

Suggested Citation:

Federal Reserve Bank of St. Louis, St. Louis Source Base (DISCONTINUED) [SBASENS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/SBASENS, .

Release Tables

Related Data and Content

Data Suggestions Based On Your Search

Content Suggestions

Other Formats

Related Categories

Releases

Tags

Permalink/Embed

modal open, choose link customization options

Select automatic updates to the data or a static time frame. All data are subject to revision.