Federal Reserve Economic Data

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Notes

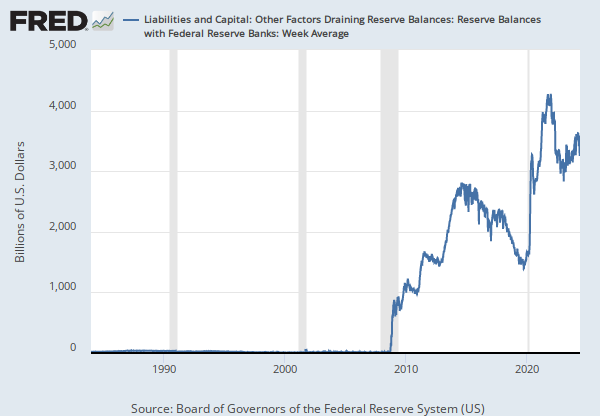

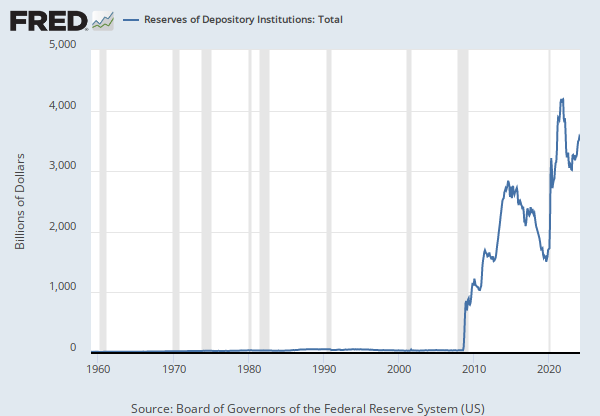

Source: Board of Governors of the Federal Reserve System (US)

Release: H.4.1 Factors Affecting Reserve Balances

Units: Millions of U.S. Dollars, Not Seasonally Adjusted

Frequency: Weekly, Ending Wednesday

Notes:

For questions on the data, please contact the data source. For questions on FRED functionality, please contact us here.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Liabilities and Capital: Liabilities: Deposits with F.R. Banks, Other Than Reserve Balances: U.S. Treasury, General Account: Week Average [WTREGEN], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/WTREGEN, .

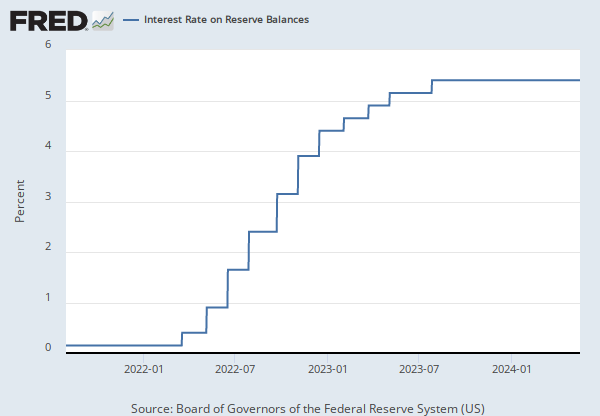

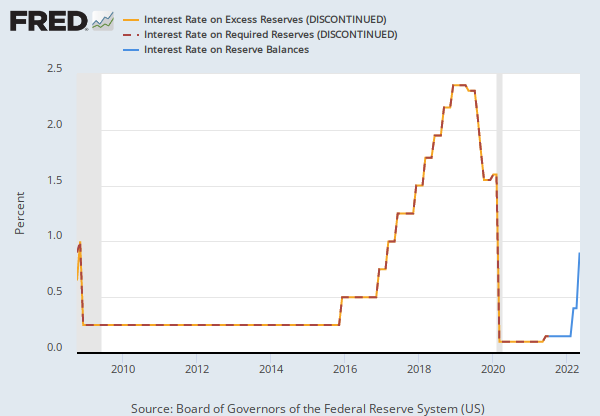

Source: Board of Governors of the Federal Reserve System (US)

Release: Interest Rate on Reserve Balances

Units: Percent, Not Seasonally Adjusted

Frequency: Daily, 7-Day

Notes:

Starting July 29, 2021, the interest rate on excess reserves (IOER) and the interest rate on required reserves (IORR) were replaced with a single rate, the interest rate on reserve balances (IORB). See the source's announcement for more details.

The interest rate on excess reserves (IOER rate) is determined by the Board of Governors and gives the Federal Reserve an additional tool to conduct monetary policy.

See Policy Tools for more information.

For questions on FRED functionality, please contact us here.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Interest Rate on Excess Reserves (IOER Rate) (DISCONTINUED) [IOER], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/IOER, .

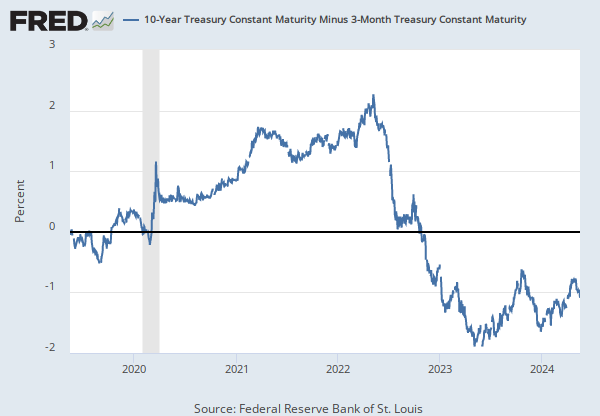

Source: Federal Reserve Bank of St. Louis

Release: Interest Rate Spreads

Units: Percent, Not Seasonally Adjusted

Frequency: Daily

Notes:

Starting with the update on June 21, 2019, the Treasury bond data used in calculating interest rate spreads is obtained directly from the U.S. Treasury Department.

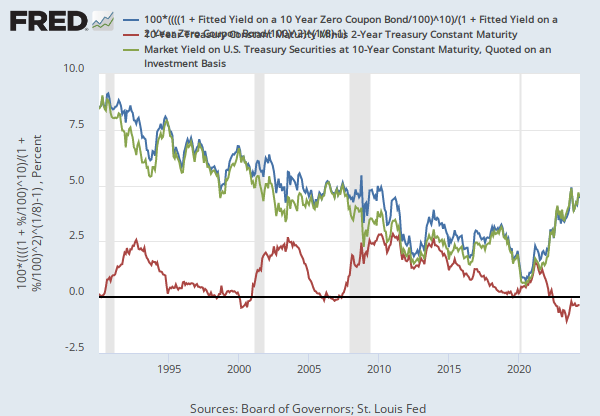

Series is calculated as the spread between 10-Year Treasury Constant Maturity (BC_10YEAR) and 2-Year Treasury Constant Maturity (BC_2YEAR). Both underlying series are published at the U.S. Treasury Department.

Suggested Citation:

Federal Reserve Bank of St. Louis, 10-Year Treasury Constant Maturity Minus 2-Year Treasury Constant Maturity [T10Y2Y], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/T10Y2Y, .

Release Tables

Related Data and Content

Data Suggestions Based On Your Search

Content Suggestions

Other Formats

Related Categories

Releases

Tags

Permalink/Embed

modal open, choose link customization options

Select automatic updates to the data or a static time frame. All data are subject to revision.