Federal Reserve Economic Data

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Notes

Source: International Monetary Fund

Release: Financial Soundness Indicators

Units: Percent Change from Year Ago, Not Seasonally Adjusted

Frequency: Quarterly

Notes:

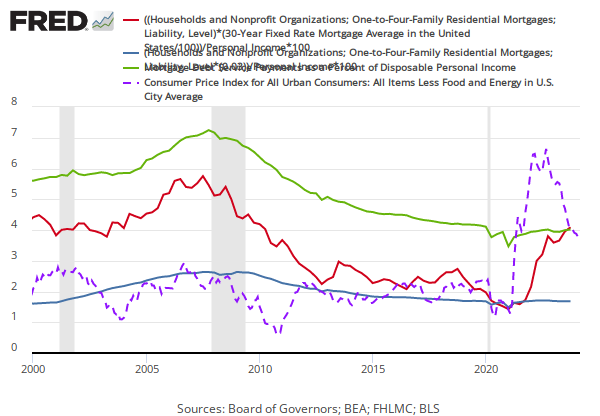

This series covers commercial real estate price indices. Currently, there is limited international experience in constructing representative real estate price indices as real estate markets are heterogeneous, both within and across countries, and illiquid. A rapid increase in real estate prices, followed by a sharp economic downturn, can have a detrimental effect on financial sector soundness by affecting credit quality and the value of collateral.

Copyright © 2016, International Monetary Fund. Reprinted with permission. Complete terms of use and contact details are available at http://www.imf.org/external/terms.htm.

Suggested Citation:

International Monetary Fund, Commercial Real Estate Prices for United States [COMREPUSQ159N], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/COMREPUSQ159N, .

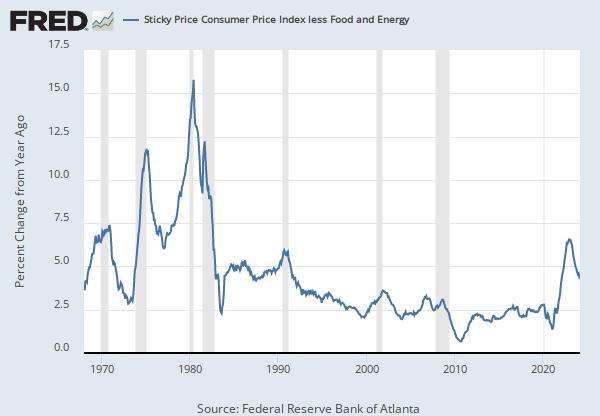

Source: U.S. Bureau of Labor Statistics

Release: Consumer Price Index

Units: Index 1982-1984=100, Seasonally Adjusted

Frequency: Monthly

Notes:

The "Consumer Price Index for All Urban Consumers: All Items Less Food & Energy" is an aggregate of prices paid by urban consumers for a typical basket of goods, excluding food and energy. This measurement, known as "Core CPI," is widely used by economists because food and energy have very volatile prices. The Bureau of Labor Statistics defines and measures the official CPI, and more information can be found in the FAQ or in this article.

Suggested Citation:

U.S. Bureau of Labor Statistics, Consumer Price Index for All Urban Consumers: All Items Less Food and Energy in U.S. City Average [CPILFESL], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CPILFESL, .

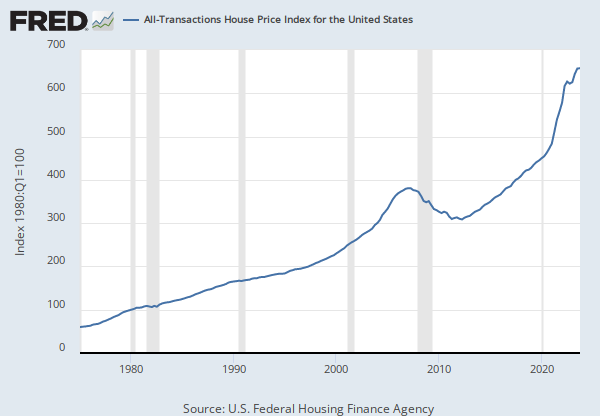

Source: S&P Dow Jones Indices LLC

Release: S&P Cotality Case-Shiller Home Price Indices

Units: Index Jan 2000=100, Not Seasonally Adjusted

Frequency: Monthly

Notes:

For more information regarding the index, please visit Standard & Poor's. There is more information about home price sales pairs in the Methodology section. Copyright, 2016, Standard & Poor's Financial Services LLC. Reprinted with permission.

Suggested Citation:

S&P Dow Jones Indices LLC, S&P Cotality Case-Shiller U.S. National Home Price Index [CSUSHPINSA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CSUSHPINSA, .

Release Tables

Related Data and Content

Data Suggestions Based On Your Search

Content Suggestions

Other Formats

Consumer Price Index for All Urban Consumers: All Items Less Food and Energy in U.S. City Average

Monthly, Not Seasonally Adjusted Semiannual, Not Seasonally AdjustedS&P Cotality Case-Shiller U.S. National Home Price Index

Monthly, Seasonally AdjustedRelated Categories

Releases

Tags

Permalink/Embed

modal open, choose link customization options

Select automatic updates to the data or a static time frame. All data are subject to revision.