Federal Reserve Economic Data

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Notes

Source: Board of Governors of the Federal Reserve System (US)

Release: H.15 Selected Interest Rates

Units: Percent, Not Seasonally Adjusted

Frequency: Daily

Notes:

For further information regarding treasury constant maturity data, please refer to the H.15 Statistical Release notes and Treasury Yield Curve Methodology.

For questions on the data, please contact the data source. For questions on FRED functionality, please contact us here.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity, Quoted on an Investment Basis [DGS10], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DGS10, .

Source: Board of Governors of the Federal Reserve System (US)

Release: H.15 Selected Interest Rates

Units: Percent, Not Seasonally Adjusted

Frequency: Daily

Notes:

For further information regarding treasury constant maturity data, please refer to the H.15 Statistical Release notes and the Treasury Yield Curve Methodology.

For questions on the data, please contact the data source. For questions on FRED functionality, please contact us here.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Market Yield on U.S. Treasury Securities at 2-Year Constant Maturity, Quoted on an Investment Basis [DGS2], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DGS2, .

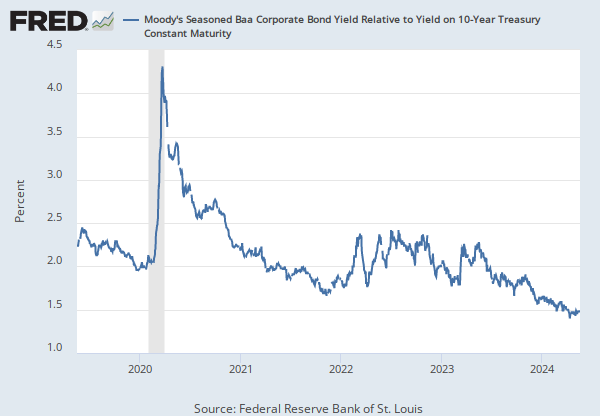

Source: Federal Reserve Bank of St. Louis

Release: Interest Rate Spreads

Units: Percent, Not Seasonally Adjusted

Frequency: Daily

Notes:

Series is calculated as the spread between 3-Month LIBOR based on US dollars (USD3MTD156N) and 3-Month Treasury Bill (DTB3).

Starting with the update on June 21, 2019, the Treasury bond data used in calculating interest rate spreads is obtained directly from the U.S. Treasury Department.

The 3-Month LIBOR based on US Dollars has been removed from FRED as of January 31, 2022, so this calculated series has been discontinued and will no longer be updated. Users interested in calculating a similar credit risk can use the Secured Overnight Financing Rate (SOFR), which has been identified as the rate that represents best practice for use in certain new U.S. Dollar derivatives and other financial contracts. For more details, see the article Transition from LIBOR from the Alternative Reference Rates Committee (AARC).

Suggested Citation:

Federal Reserve Bank of St. Louis, TED Spread (DISCONTINUED) [TEDRATE], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/TEDRATE, .

Source: Federal Reserve Bank of St. Louis

Release: St. Louis Fed Financial Stress Index

Units: Index, Not Seasonally Adjusted

Frequency: Weekly, Ending Friday

Notes:

The methodology for the St. Louis Fed's Financial Stress Index was revised and this series is discontinued. The new version, STLFSI3, can be found here.

The STLFSI2 measures the degree of financial stress in the markets and is constructed from 18 weekly data series, all of which are weekly averages of daily data series: seven interest rates, six yield spreads, and five other indicators. Each of these variables captures some aspect of financial stress. Accordingly, as the level of financial stress in the economy changes, the data series are likely to move together.

How to Interpret the Index:

The average value of the index, which begins in late 1993, is designed to be zero. Thus, zero is viewed as representing normal financial market conditions. Values below zero suggest below-average financial market stress, while values above zero suggest above-average financial market stress.

More information:

The STLFSI2 is a revision of the original STLFSI. For additional information on the STLFSI2 and its construction, see “The St. Louis Fed’s Financial Stress Index, Version 2.0”.

Suggested Citation:

Federal Reserve Bank of St. Louis, St. Louis Fed Financial Stress Index (DISCONTINUED) [STLFSI2], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/STLFSI2, .

Release Tables

Related Data and Content

Data Suggestions Based On Your Search

Content Suggestions

Other Formats

Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity, Quoted on an Investment Basis

Annual, Not Seasonally Adjusted Monthly, Not Seasonally Adjusted Weekly, Not Seasonally AdjustedMarket Yield on U.S. Treasury Securities at 2-Year Constant Maturity, Quoted on an Investment Basis

Annual, Not Seasonally Adjusted Monthly, Not Seasonally Adjusted Weekly, Not Seasonally AdjustedSt. Louis Fed Financial Stress Index (DISCONTINUED)

Weekly, Not Seasonally Adjusted Weekly, Not Seasonally AdjustedRelated Categories

Releases

Tags

Permalink/Embed

modal open, choose link customization options

Select automatic updates to the data or a static time frame. All data are subject to revision.