Federal Reserve Economic Data: Your trusted data source since 1991

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

NOTES

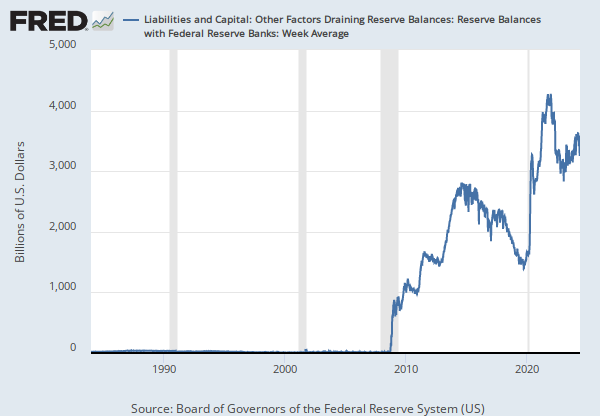

Source: Board of Governors of the Federal Reserve System (US)

Release: H.4.1 Factors Affecting Reserve Balances

Units: Millions of U.S. Dollars, Not Seasonally Adjusted

Frequency: Weekly, As of Wednesday

Notes:

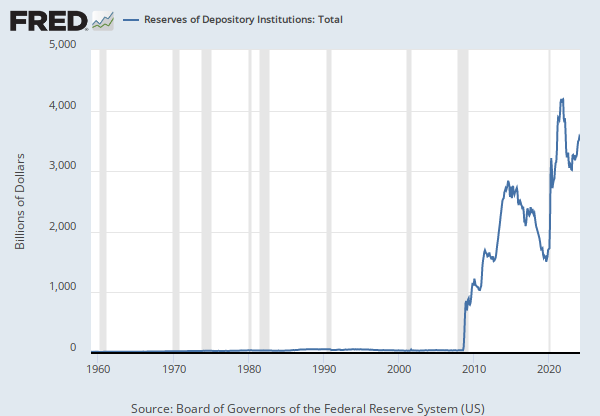

Reserve balances with Federal Reserve Banks are the difference between "total factors supplying reserve funds" and "total factors, other than reserve balances, absorbing reserve funds." This item includes balances at the Federal Reserve of all depository institutions that are used to satisfy reserve requirements and balances held in excess of balance requirements. It excludes reserves held in the form of cash in bank vaults, and excludes service-related deposits.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Liabilities and Capital: Other Factors Draining Reserve Balances: Reserve Balances with Federal Reserve Banks: Wednesday Level [WRBWFRBL], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/WRBWFRBL, May 21, 2024.

Source: Board of Governors of the Federal Reserve System (US)

Release: H.4.1 Factors Affecting Reserve Balances

Units: Millions of U.S. Dollars, Not Seasonally Adjusted

Frequency: Weekly, Ending Wednesday

Notes:

This item is the sum of "currency in circulation," "reverse repurchase agreements," "Treasury cash holdings," "deposits with Federal Reserve Banks other than reserve balances," and "other liabilities and capital.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Liabilities and Capital: Other Factors Draining Reserve Balances: Total Factors, Other Than Reserve Balances, Absorbing Reserve Funds: Week Average [WTFORBAFA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/WTFORBAFA, May 21, 2024.

Source: Board of Governors of the Federal Reserve System (US)

Release: H.3 Aggregate Reserves of Depository Institutions and the Monetary Base

Units: Millions of Dollars, Not Seasonally Adjusted

Frequency: Weekly, Ending Wednesday

Notes:

The Board of Governors discontinued the H.3 statistical release on September 17, 2020. For more information, please see the announcement posted on August 20, 2020.

Reserve balance requirements series is the portion of the reserve requirements not satisfied by vault cash. The series is calculated as Required reserves (REQRESNSW) less Vault cash used to satisfy required reserves (VAULTW).

Effective February 2, 1984, reserve computation and maintenance periods have been changed from weekly to bi-weekly. Series with data prior to February 2, 1984 have different values reported from one week to the next. After February 2, 1984, the value repeats for 2 consecutive weeks.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Reserve Balances Required; Reserve Balance Requirements (DISCONTINUED) [RESBALREQW], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/RESBALREQW, May 21, 2024.

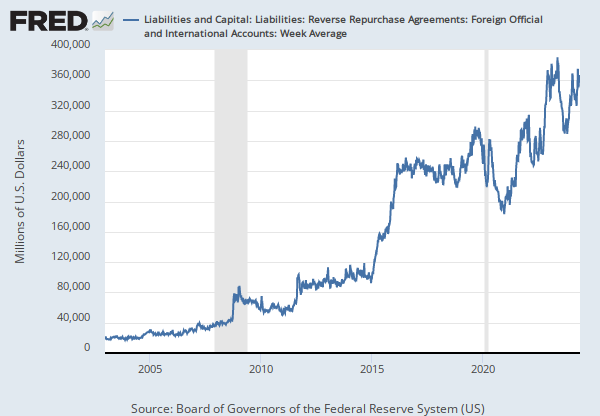

Source: Board of Governors of the Federal Reserve System (US)

Release: H.4.1 Factors Affecting Reserve Balances

Units: Millions of U.S. Dollars, Not Seasonally Adjusted

Frequency: Weekly, As of Wednesday

Notes:

Reverse repurchase agreements are transactions in which securities are sold to a set of counterparties under an agreement to buy them back from the same party on a specified date at the same price plus interest. Reverse repurchase agreements may be conducted with foreign official and international accounts as a service to the holders of these accounts. All other reverse repurchase agreements, including transactions with primary dealers and a set of eligible money market funds, are open market operations intended to manage the supply of reserve balances; reverse repurchase agreements absorb reserve balances from the banking system for the length of the agreement. As with repurchase agreements, the naming convention used here reflects the transaction from the counterparties' perspective; the Federal Reserve receives cash in a reverse repurchase agreement and provides collateral to the counterparties.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Liabilities and Capital: Liabilities: Reverse Repurchase Agreements: Foreign Official and International Accounts: Wednesday Level [WLRRAFOIAL], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/WLRRAFOIAL, May 21, 2024.

Source: Board of Governors of the Federal Reserve System (US)

Release: H.4.1 Factors Affecting Reserve Balances

Units: Millions of U.S. Dollars, Not Seasonally Adjusted

Frequency: Weekly, Ending Wednesday

Notes:

Reverse repurchase agreements are transactions in which securities are sold to primary dealers or foreign central banks under an agreement to buy them back from the same party on a specified date at the same price plus interest. Reverse repurchase agreements absorb reserve balances from the banking system for the length of the agreement. As with repurchase agreements, the naming convention used here reflects the transaction from the dealers' perspective; the Federal Reserve receives cash in a reverse repurchase agreement and provides collateral to the dealers.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Liabilities and Capital: Liabilities: Reverse Repurchase Agreements: Foreign Official and International Accounts: Week Average [WREPOFOR], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/WREPOFOR, May 21, 2024.

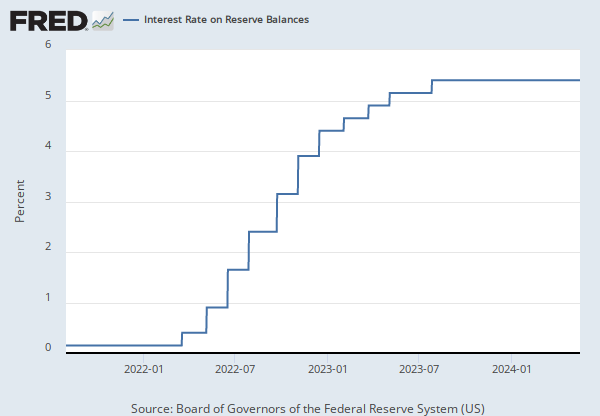

Source: Board of Governors of the Federal Reserve System (US)

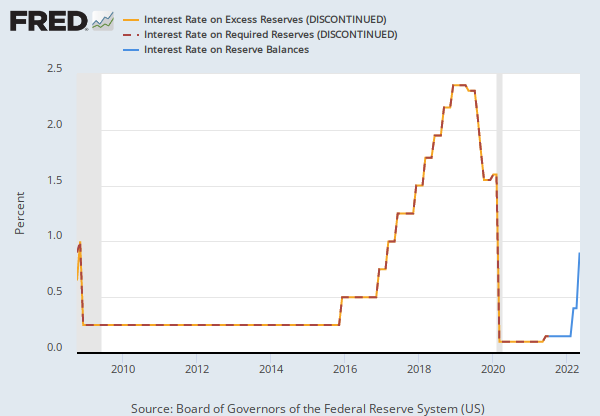

Release: Interest Rate on Reserve Balances

Units: Percent, Not Seasonally Adjusted

Frequency: Daily, 7-Day

Notes:

Starting July 29, 2021, the interest rate on excess reserves (IOER) and the interest rate on required reserves (IORR) were replaced with a single rate, the interest rate on reserve balances (IORB). See the source's announcement for more details.

The interest rate on required reserves (IORR rate) is determined by the Board of Governors and is intended to eliminate effectively the implicit tax that reserve requirements used to impose on depository institutions.

See Policy Tools for more information.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Interest Rate on Required Reserves (DISCONTINUED) [IORR], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/IORR, May 21, 2024.

Source: Board of Governors of the Federal Reserve System (US)

Release: H.4.1 Factors Affecting Reserve Balances

Units: Millions of U.S. Dollars, Not Seasonally Adjusted

Frequency: Weekly, Ending Wednesday

Notes:

On November 25, 2008, the Federal Reserve announced a program to purchase mortgage-backed securities guaranteed by Fannie Mae, Freddie Mac, and Ginnie Mae. The goal of the program is to provide support to mortgage and housing markets and to foster improved conditions in financial markets. Purchases of these securities began on January 5, 2009.

Additional information on System transactions in mortgage-backed securities is available at www.newyorkfed.org/markets/mbs/.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Assets: Securities Held Outright: Mortgage-Backed Securities: Week Average [WMBSEC], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/WMBSEC, May 21, 2024.

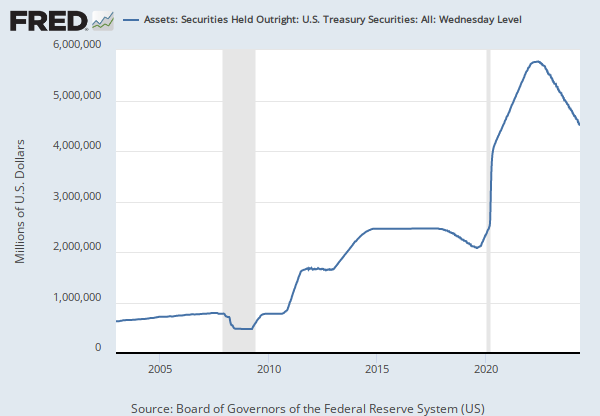

Source: Board of Governors of the Federal Reserve System (US)

Release: H.4.1 Factors Affecting Reserve Balances

Units: Millions of U.S. Dollars, Not Seasonally Adjusted

Frequency: Weekly, Ending Wednesday

Notes:

The current face value of federal agency obligations held by Federal Reserve Banks. These securities are direct obligations of Fannie Mae, Freddie Mac, and the Federal Home Loan Banks.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Assets: Securities Held Outright: Federal Agency Debt Securities: Week Average [WFEDSEC], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/WFEDSEC, May 21, 2024.

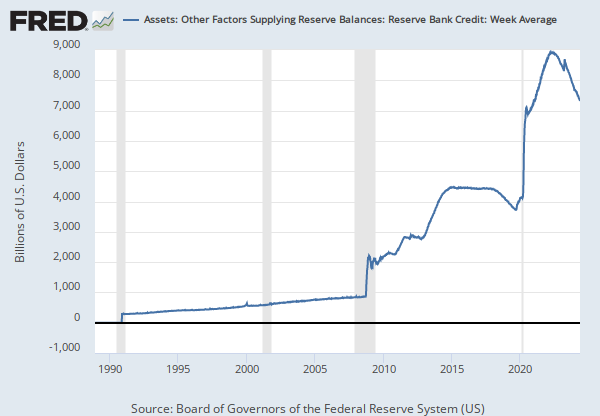

Source: Board of Governors of the Federal Reserve System (US)

Release: H.4.1 Factors Affecting Reserve Balances

Units: Millions of U.S. Dollars, Not Seasonally Adjusted

Frequency: Weekly, As of Wednesday

Notes:

Reserve Bank credit is the sum of securities held outright, repurchase agreements, term auction credit, other loans, net portfolio holdings of Commercial Paper Funding Facility LLC, net portfolio holdings of LLCs funded through the Money Market Investor Funding Facility, net portfolio holdings of Maiden Lane LLC, net portfolio holdings of Maiden Lane II LLC, net portfolio holdings of Maiden Lane III LLC, float, central bank liquidity swaps, and other Federal Reserve assets.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Assets: Other Factors Supplying Reserve Balances: Reserve Bank Credit: Wednesday Level [WOFSRBRBC], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/WOFSRBRBC, May 21, 2024.

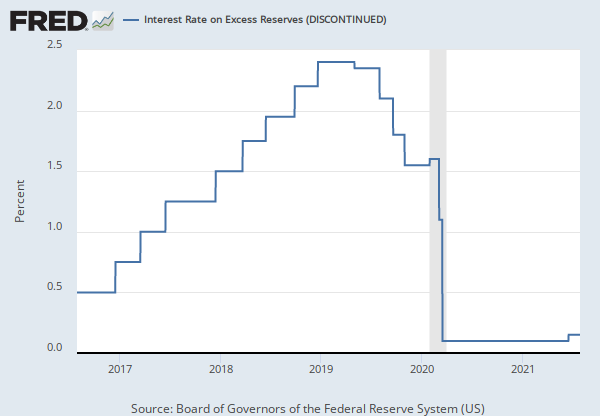

Source: Board of Governors of the Federal Reserve System (US)

Release: Interest Rate on Reserve Balances

Units: Percent, Not Seasonally Adjusted

Frequency: Daily, 7-Day

Notes:

Starting July 29, 2021, the interest rate on excess reserves (IOER) and the interest rate on required reserves (IORR) were replaced with a single rate, the interest rate on reserve balances (IORB). See the source's announcement for more details.

The interest rate on excess reserves (IOER rate) is determined by the Board of Governors and gives the Federal Reserve an additional tool to conduct monetary policy.

See Policy Tools for more information.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Interest Rate on Excess Reserves (DISCONTINUED) [IOER], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/IOER, May 21, 2024.

Source: Board of Governors of the Federal Reserve System (US)

Release: H.4.1 Factors Affecting Reserve Balances

Units: Millions of U.S. Dollars, Not Seasonally Adjusted

Frequency: Weekly, As of Wednesday

Notes:

Reverse repurchase agreements are transactions in which securities are sold to a set of counterparties under an agreement to buy them back from the same party on a specified date at the same price plus interest. Reverse repurchase agreements may be conducted with foreign official and international accounts as a service to the holders of these accounts. All other reverse repurchase agreements, including transactions with primary dealers and a set of eligible money market funds, are open market operations intended to manage the supply of reserve balances; reverse repurchase agreements absorb reserve balances from the banking system for the length of the agreement. As with repurchase agreements, the naming convention used here reflects the transaction from the counterparties' perspective; the Federal Reserve receives cash in a reverse repurchase agreement and provides collateral to the counterparties.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Liabilities and Capital: Liabilities: Reverse Repurchase Agreements: Wednesday Level [WLRRAL], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/WLRRAL, May 21, 2024.

Source: Board of Governors of the Federal Reserve System (US)

Release: H.4.1 Factors Affecting Reserve Balances

Units: Billions of U.S. Dollars, Not Seasonally Adjusted

Frequency: Weekly, Ending Wednesday

Notes:

This account is the primary operational account of the U.S. Treasury at the Federal Reserve. Virtually all U.S. government disbursements are made from this account. Some tax receipts, primarily individual and other tax payments made directly to the Treasury, are deposited in this account, and it is also used to collect funds from sales of Treasury debt.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Liabilities and Capital: Liabilities: Deposits with F.R. Banks, Other Than Reserve Balances: U.S. Treasury, General Account: Week Average [WTREGEN], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/WTREGEN, May 21, 2024.

RELEASE TABLES

- Table 1. Factors Affecting Reserve Balances of Depository Institutions: Wednesday Level

- Table 1. Factors Affecting Reserve Balances of Depository Institutions: Week Average

- Table 2. Maturity Distribution of Securities, Loans, and Selected Other Assets and Liabilities

- Table 5. Consolidated Statement of Condition of All Federal Reserve Banks

- Table 6. Statement of Condition of Each Federal Reserve Bank