Observations

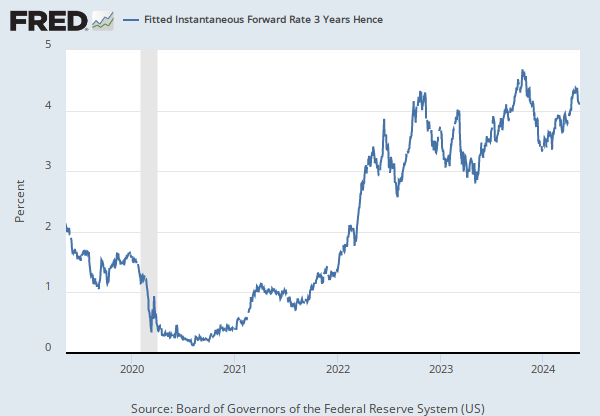

2026-03-06: 5.0046 | Percent, Not Seasonally Adjusted | Daily

Updated: Mar 10, 2026 2:03 PM CDT

Next Release Date: Not Available

Observations

2026-03-06:

5.0046

Updated:

Mar 10, 2026

2:03 PM CDT

Next Release Date:

Not Available

| 2026-03-06: | 5.0046 | |

| 2026-03-05: | 4.9914 | |

| 2026-03-04: | 4.9666 | |

| 2026-03-03: | 4.9538 | |

| 2026-03-02: | 4.9422 | |

| View All | ||

Units:

Percent,

Not Seasonally Adjusted

Frequency:

Daily

Fullscreen