Observations

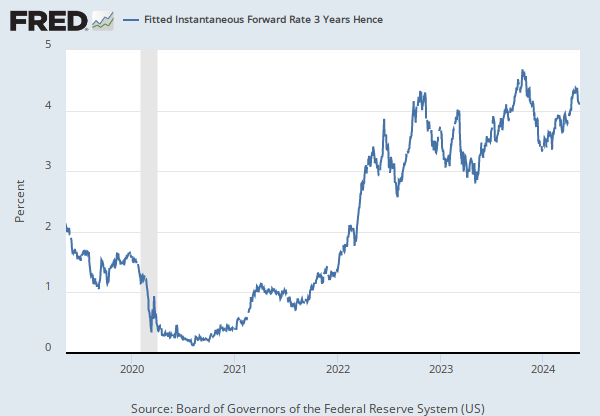

2026-02-27: 3.7375 | Percent, Not Seasonally Adjusted | Daily

Updated: Mar 3, 2026 2:03 PM CST

Next Release Date: Not Available

Observations

2026-02-27:

3.7375

Updated:

Mar 3, 2026

2:03 PM CST

Next Release Date:

Not Available

| 2026-02-27: | 3.7375 | |

| 2026-02-26: | 3.7910 | |

| 2026-02-25: | 3.8217 | |

| 2026-02-24: | 3.8149 | |

| 2026-02-23: | 3.8175 | |

| View All | ||

Units:

Percent,

Not Seasonally Adjusted

Frequency:

Daily

Fullscreen