Federal Reserve Economic Data

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Notes

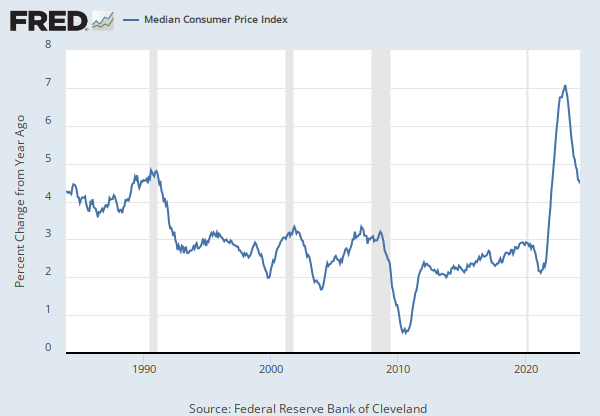

Source: Federal Reserve Bank of Atlanta

Release: Sticky Price CPI

Units: Percent Change from Year Ago, Seasonally Adjusted

Frequency: Monthly

Notes:

The Sticky Price Consumer Price Index (CPI) is calculated from a subset of goods and services included in the CPI that change price relatively infrequently. Because these goods and services change price relatively infrequently, they are thought to incorporate expectations about future inflation to a greater degree than prices that change on a more frequent basis. One possible explanation for sticky prices could be the costs firms incur when changing price.

To obtain more information about this release see: Michael F. Bryan, and Brent H. Meyer. “Are Some Prices in the CPI More Forward Looking Than Others? We Think So.” Economic Commentary (Federal Reserve Bank of Cleveland) (May 19, 2010): 1–6. https://doi.org/10.26509/frbc-ec-201002.

Suggested Citation:

Federal Reserve Bank of Atlanta, Sticky Price Consumer Price Index less Shelter [STICKCPIXSHLTRM159SFRBATL], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/STICKCPIXSHLTRM159SFRBATL, .

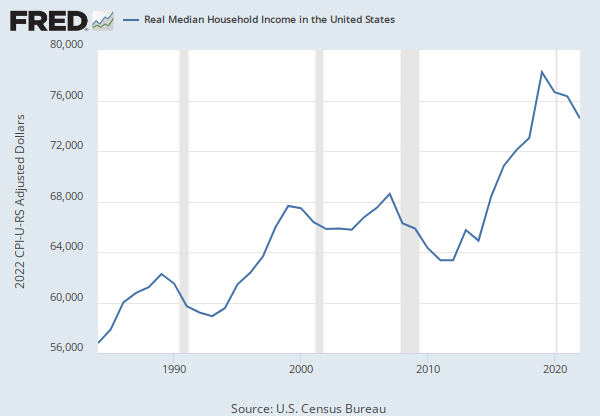

Source: U.S. Census Bureau

Source: U.S. Department of Housing and Urban Development

Release: New Residential Sales

Units: Dollars, Not Seasonally Adjusted

Frequency: Quarterly

Suggested Citation:

U.S. Census Bureau and U.S. Department of Housing and Urban Development, Median Sales Price of Houses Sold for the United States [MSPUS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/MSPUS, .

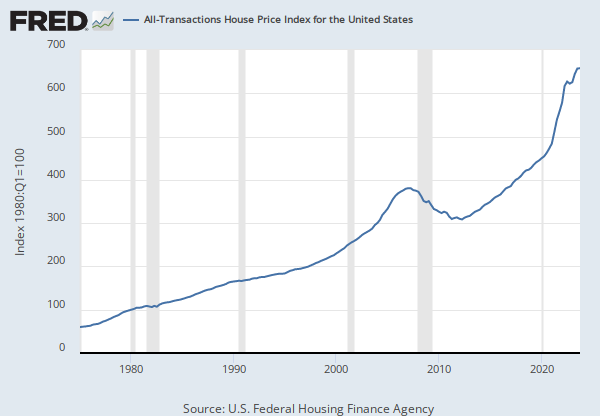

Source: S&P Dow Jones Indices LLC

Release: S&P Cotality Case-Shiller Home Price Indices

Units: Index Jan 2000=100, Not Seasonally Adjusted

Frequency: Monthly

Notes:

For more information regarding the index, please visit Standard & Poor's. There is more information about home price sales pairs in the Methodology section. Copyright, 2016, Standard & Poor's Financial Services LLC. Reprinted with permission.

Suggested Citation:

S&P Dow Jones Indices LLC, S&P Cotality Case-Shiller U.S. National Home Price Index [CSUSHPINSA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CSUSHPINSA, .

Source: Federal Reserve Bank of Atlanta

Release: Sticky Price CPI

Units: Percent Change from Year Ago, Seasonally Adjusted

Frequency: Monthly

Notes:

The Sticky Price Consumer Price Index (CPI) is calculated from a subset of goods and services included in the CPI that change price relatively infrequently. Because these goods and services change price relatively infrequently, they are thought to incorporate expectations about future inflation to a greater degree than prices that change on a more frequent basis. One possible explanation for sticky prices could be the costs firms incur when changing price.

To obtain more information about this release see: Michael F. Bryan, and Brent H. Meyer. “Are Some Prices in the CPI More Forward Looking Than Others? We Think So.” Economic Commentary (Federal Reserve Bank of Cleveland) (May 19, 2010): 1–6. https://doi.org/10.26509/frbc-ec-201002.

Suggested Citation:

Federal Reserve Bank of Atlanta, Sticky Price Consumer Price Index less Food and Energy [CORESTICKM159SFRBATL], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CORESTICKM159SFRBATL, .

Release Tables

- Median and Average Sales Price of Houses Sold by Region

- Median and Average Sales Price of Houses Sold by Type of Financing

Related Data and Content

Data Suggestions Based On Your Search

Content Suggestions

Other Formats

Sticky Price Consumer Price Index less Shelter

3-Month Annualized Percent Change, Monthly, Seasonally Adjusted Percent Change, Monthly, Seasonally Adjusted Percent Change at Annual Rate, Monthly, Seasonally AdjustedS&P Cotality Case-Shiller U.S. National Home Price Index

Monthly, Seasonally AdjustedSticky Price Consumer Price Index less Food and Energy

3-Month Annualized Percent Change, Monthly, Seasonally Adjusted Percent Change, Monthly, Seasonally Adjusted Percent Change at Annual Rate, Monthly, Seasonally AdjustedRelated Categories

Releases

Tags

Permalink/Embed

modal open, choose link customization options

Select automatic updates to the data or a static time frame. All data are subject to revision.