Federal Reserve Economic Data

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Notes

Source: U.S. Bureau of Economic Analysis

Release: Gross Domestic Product

Units: Billions of Dollars, Not Seasonally Adjusted

Frequency: Annual

Notes:

BEA Account Code: DOWNRC

For more information about this series, please see http://www.bea.gov/national/.

Suggested Citation:

U.S. Bureau of Economic Analysis, Personal consumption expenditures: Services: Housing: Imputed rental of owner-occupied nonfarm housing [DOWNRC1A027NBEA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DOWNRC1A027NBEA, .

Source: Board of Governors of the Federal Reserve System (US)

Release: Z.1 Financial Accounts of the United States

Units: Millions of U.S. Dollars, Not Seasonally Adjusted

Frequency: Quarterly, End of Period

Notes:

For more information about the Flow of Funds tables, see the Financial Accounts Guide.

With each quarterly release, the source may make major data and structural revisions to the series and tables. These changes are available in the Release Highlights.

In the Financial Accounts, the source identifies each series by a string of patterned letters and numbers. For a detailed description, including how this series is constructed, see the series analyzer provided by the source.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Households; Owner-Occupied Real Estate Including Vacant Land and Mobile Homes at Market Value, Market Value Levels [HOOREVLMHMV], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/HOOREVLMHMV, .

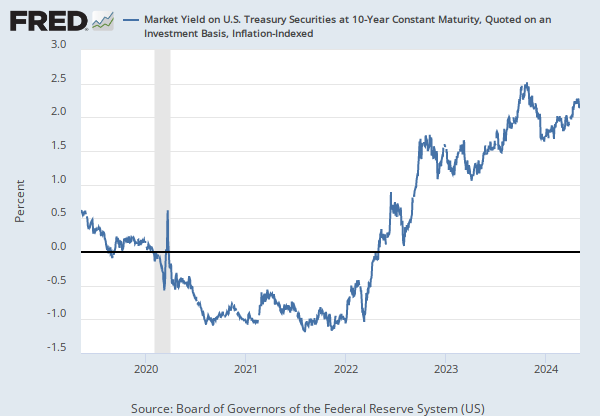

Source: Board of Governors of the Federal Reserve System (US)

Release: H.15 Selected Interest Rates

Units: Percent, Not Seasonally Adjusted

Frequency: Daily

Notes:

For further information regarding treasury constant maturity data, please refer to the H.15 Statistical Release notes and the Treasury Yield Curve Methodology.

For questions on the data, please contact the data source. For questions on FRED functionality, please contact us here.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Market Yield on U.S. Treasury Securities at 30-Year Constant Maturity, Quoted on an Investment Basis, Inflation-Indexed [DFII30], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DFII30, .

Source: Haver Analytics

Source: Dow Jones & Company

Release: Daily Treasury Inflation-Indexed Securities

Units: Percent, Not Seasonally Adjusted

Frequency: Daily

Notes:

Yield to maturity on accrued principal.

Treasury Inflation-Protected Securities, or TIPS, are securities whose principal is tied to the Consumer Price Index (CPI). The principal increases with inflation and decreases with deflation. When the security matures, the U.S. Treasury pays the original or adjusted principal, whichever is greater.

Copyright, 2016, Haver Analytics. Reprinted with permission.

Suggested Citation:

Haver Analytics and Dow Jones & Company, 30-Year 3-5/8% Treasury Inflation-Indexed Bond, Due 4/15/2028 [DTP30A28], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DTP30A28, .

Source: S&P Dow Jones Indices LLC

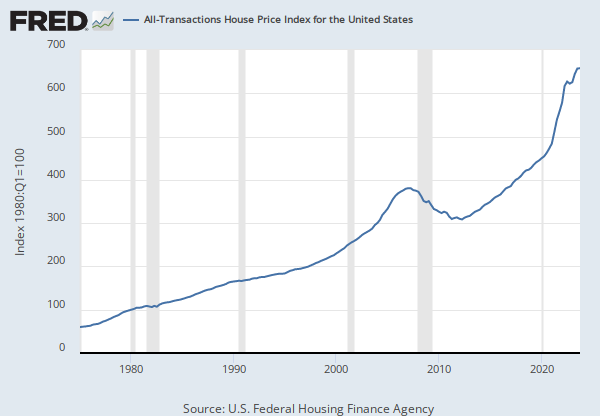

Release: S&P Cotality Case-Shiller Home Price Indices

Units: Index Jan 2000=100, Not Seasonally Adjusted

Frequency: Monthly

Notes:

For more information regarding the index, please visit Standard & Poor's. There is more information about home price sales pairs in the Methodology section. Copyright, 2016, Standard & Poor's Financial Services LLC. Reprinted with permission.

Suggested Citation:

S&P Dow Jones Indices LLC, S&P Cotality Case-Shiller U.S. National Home Price Index [CSUSHPINSA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CSUSHPINSA, .

Source: U.S. Bureau of Labor Statistics

Release: Consumer Price Index

Units: Index Dec 1982=100, Seasonally Adjusted

Frequency: Monthly

Suggested Citation:

U.S. Bureau of Labor Statistics, Consumer Price Index for All Urban Consumers: Owners' Equivalent Rent of Residences in U.S. City Average [CUSR0000SEHC], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CUSR0000SEHC, .

Release Tables

- Table 2.4.5. Personal Consumption Expenditures by Type of Product: Annual

- Table 2.5.5. Personal Consumption Expenditures by Function: Annual

Related Data and Content

Data Suggestions Based On Your Search

Content Suggestions

Other Formats

Households; Owner-Occupied Real Estate Including Vacant Land and Mobile Homes at Market Value, Market Value Levels

Annual, Not Seasonally AdjustedMarket Yield on U.S. Treasury Securities at 30-Year Constant Maturity, Quoted on an Investment Basis, Inflation-Indexed

Annual, Not Seasonally Adjusted Monthly, Not Seasonally Adjusted Weekly, Not Seasonally AdjustedS&P Cotality Case-Shiller U.S. National Home Price Index

Monthly, Seasonally AdjustedConsumer Price Index for All Urban Consumers: Owners' Equivalent Rent of Residences in U.S. City Average

Monthly, Not Seasonally Adjusted Semiannual, Not Seasonally AdjustedRelated Categories

Releases

Tags

Permalink/Embed

modal open, choose link customization options

Select automatic updates to the data or a static time frame. All data are subject to revision.